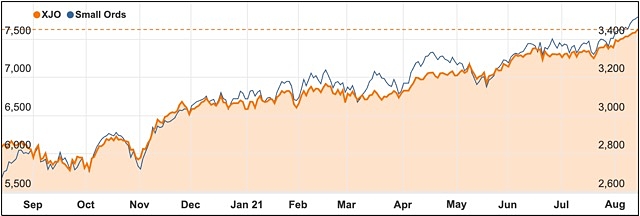

Like the little engine that could, Australia’s barnstorming share market has continued to push to record highs, with a strong surge on Friday pushing it up 0.5% to 7628.9 points.

Driving the engine much faster on Friday were the big banks – apart from Commonwealth – and big biotechnology and blood products group CSL (ASX: CSL).

Amid a broad rally of healthcare and technology stocks there were a string of record prices with retail giant Wesfarmers (ASX: WES) and investment Bank Macquarie (ASX: MQG) just two of the bigger names rising to record highs.

Records are made to be broken

Records are now constantly being broken with the unveiling of increasingly positive and at times unexpected profit results pushing the market to record highs in seven of the past eight trading days.

The rally is even more impressive given that one of the early forces stoking the rises – rising iron ore prices – has spectacularly reversed and has been pushing down the share prices of the big iron ore miners such as BHP (ASX: BHP), Rio Tinto (ASX: RIO) and Fortescue Metals (ASX: FMG).

Similarly, gold stocks suffered from a lack of interest with investors looking for growth.

NSW lockdowns and infections keep rising

A terrible run of fresh COVID-19 infections, regional spread and new lockdowns within New South Wales didn’t even seem to give the market pause as investors looked through the current problems to a time when vaccinations will finally allow for restrictions to be eased.

CSL was particularly impressive with a 2.4% gain to $297.53 on Friday seeing it zero in on the $300 mark as investors bet it will hit the ball out of the park when it releases its profit result next Wednesday.

Investors have been generally buoyant as profit results were generally better than expected with buybacks and lush dividends the order of the day.

Strong profits buoy shares

Commonwealth Bank (ASX: CBA) shares fell back after reporting an excellent result, strong dividend of $2 a share and a $6 billion share buyback but broker downgrades based on the fact the result could be hard to improve on caused some profit taking.

Strong results from Telstra and AMP and a surprise return to profit from Myer during the week were other ingredients for the bullish tone for the market as a raft of new results are released in the coming week.

The rush of dividends and share buybacks has also increased investor confidence that companies are looking forward to stronger trading conditions once vaccination coverage rises high enough, with banks, telcos, utilities and retail stocks all helping to push the market higher.

Merger and acquisition activity is also anticipated to hot up with generous fiscal and monetary support, rising profits and cheap borrowings making shares appear cheap compared to the alternatives.

Baby Bunting profits improves but shares fall back

In company specific news, Baby Bunting (ASX: BBN) shares dropped by 4.5% after delivering a lift in annual sales, online growth, margins, profits and its dividend.

Sales rose by 15.6% to $468.4 million, margins were strong at 37.1% and statutory profit was up 76% to $17.5 million and the dividend improved from 6.4c a share to 8.3c a share but perhaps the stock had been priced for even more.

GrainCorp (ASX: GNC) shares added an impressive 14% after strong demand for grain saw a hefty lift in forecast underlying profit from the previous guidance of $80 million to $105 million to a range of $125 million to $140 million.

Small cap stock action

The Small Ords index soared 1.54% this week to close at 3518.0 points.

Small cap companies making headlines this week were:

Plenti (ASX: PLT)

Fintech lender Plenti has achieved one of key goals on its path to building a $1 billion loan book.

The company has launched its first asset-backed securities deal (ABS). An ABS is collateralised by an underlying pool of assets in the form of a bond or note that pays income at a fixed rate until it reaches maturity.

Plenti revealed this week it was issuing $306.3 million notes to investors with these backed by secured automotive receivables.

The importance of the deal is it reduces Plenti’s funding costs with almost 90% of the notes receiving a AAA credit rating.

Vintage Energy (ASX: VEN) and Metgasco (ASX: MEL)

Partners Vintage Energy and Metgasco have revealed net gas pay from the Vali-3 well in the Cooper Basin ATP 2021 project had “exceeded expectations”.

Vintage says Vali-3 has delivered the largest net pay out of any of the wells drilled at the project to-date including Vali-1 ST1 and Vali-2.

The Vali-3 well has a total depth of 3,186m, with 178m of gas pay identified in the Patchawarra and Tirrawarra formations.

Work is also underway to evaluate potential further pay from the Epsilon and Toolachee formations.

Classic Minerals (ASX: CLZ)

Mining of a bulk sample is underway at Classic Minerals’ Kat Gap gold project, which is near Southern Cross in WA.

The company is targeting 3,000-5,000t of ore grading between 4-6g/t gold to produce up to 1,000oz, which is a small portion of the project’s current 93,000oz resource.

Classic’s strategy is to gather more essential data and calibrate mining and metallurgical parameters prior to full-scale mining in the first quarter of next year.

The trial mining will help Classic test its 30tph hour Gekko processing plant and make any requisite adjustments.

Global Energy Ventures (ASX: GEV) and Province Resources (ASX: PRL)

A feasibility study into exporting green hydrogen will be carried out after Global Energy Ventures, Province Resources and French independent power producer Total Erin inked a MoU.

Under the MoU, Global Energy Ventures will evaluate the technical feasibility and costs associated with delivering green hydrogen to specific markets in the Asia Pacific.

The study will be based on Global Energy Ventures compressed hydrogen shipping and supply chain technology.

This will involve looking at transporting the hydrogen from an onshore production facility known as Province and Total’s HyEnergy project in WA’s Gascoyne and then exporting it to the nominated markets.

Province and Total revealed the zero carbon HyEnergy scoping study was “forging” ahead and was expected to be completed within 12 months along with executing definitive agreements and advancing ongoing feasibility work.

Envirosuite (ASX: EVS)

Envirosuite is riding the tailwinds of the global push to comply with ESG regulations with companies increasingly adopting its environmental technology solutions.

During a global pandemic, Envirosuite has seen its annual recurring revenue for its Omnis product in the Americas region jump 34% to $13.9 million in FY 2021 ending June.

Envirosuite expects this growth trajectory to continue and pick up further in the North American market following the passing of the US$1 trillion infrastructure bill in the US this week.

The company noted US$97 billion of this will be funnelled into key sectors that require its solutions including water, ports and airports.

The week ahead

Continuing profit reports will be the driving force for the week with about a third of the ASX reporting profits in the coming week, including many influential companies such as JB HiFi, BHP, Woodside, Coles and CSL.

Backing up the mass of around 90 company reports will be the July jobs data and June wage increases which will be a major measure of how much pain the series of lockdowns has inflicted on the jobs market and the economy in general.

Central bank action will also be vital in the coming week with the Reserve Bank releasing its August 3 board minutes which will give some indication on the thinking about winding back bond purchases.

The RBA has said it will taper its bond buying from $5 billion a week to $4 billion a week from September but there may be more clues as to the reasoning for their wind back on Quantitative Easing (QE).

The very next day the New Zealand Reserve Bank is expected to raise interest rates by 0.25%, becoming one of the world’s first central banks to reverse course after the pandemic pushed interest rates down.

US Federal Reserve minutes complete the picture from central banks.

Other things to watch out for include US retail sales and housing figures and Chinese retail sales and investment which are expected to slow down a little.