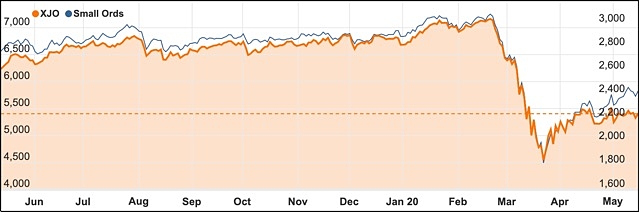

Australia’s share market continued to ebb and flow with every bit of good news, ending the week up 76 points for the session with the ASX 200 on 5408.8 points.

It was banks and the big miners that pushed the market higher on Friday – the very same stocks that had pushed it lower on Thursday but investors were happy to take their gains where they could get them.

Bullish iron ore prices saw BHP (ASX: BHP) up an impressive 3.5% while the more concentrated iron ore play Fortescue (ASX: FMG) was up 4.3%.

Rio Tinto (ASX: RIO) was up 2.5% or $2.10 to $85.36.

All of the big four banks were also up with the financials sector adding 1.56% with Westpac (ASX: WBC) the pick of the big four, adding a whisker above 2% or 31c to close at $15.26.

NAB (ASX: NAB) wasn’t far behind after adding 1.4% or 22c to $15.46 and ANZ (ASX: ANZ) was up 1.9% or 29c to $15.44.

Commonwealth (ASX: CBA) added 1.2% or 70c to $59.60 while the more internationally focussed Macquarie (ASX: MQG) was up almost 1.9% or $1.92 to $105.08.

Tiny gain for the week masks plenty of volatility

For the week the share market was up a tiny 0.3%, although that inconsequential change masked plenty of volatility as the index was daily alternately buoyed with hopes and crunched with disappointment.

Chief among those moves was Thursday’s 1.7% fall – the worst session for more than two weeks.

One of the interesting developments on Friday happened in the information technology sector which was the only spot of red in an otherwise unanimous sea of green.

Xero suffers a rare stumble

The culprit was small business accounting operator Xero (ASX: XRO) which was down after posting a maiden profit that was marred by coronavirus slowdowns.

Some analysts were critical of the result, saying the company had chased a profit rather than investing to ramp up its subscriber growth rate while others predicted average revenue per user could be set to fall in coming months.

By the close Xero had lost 5.6% or $4.45 a share to $75.32, although the information technology sector has been rising strongly as investors look for companies that are less impacted by coronavirus slowdowns.

Xero has been an impressive performer with its shares adding 90% last year.

Energy stocks such as Origin (ASX: ORG), Woodside (ASX: WPL) and Santos (ASX: STO) were helped by a 9% lift in the oil price.

In an interesting move, Kogan.com (ASX: KGN) announced it had bought furniture retailer Matt Blatt for $4.4 million, with the online retailer set to take the furniture retailer exclusively online.

There will be another change next week when Caltex shares (ASX: CTX) will be renamed Ampol with a new ASX code of ALD from Tuesday following shareholder approval for the change.

Small cap stock action

The Small Ords index closed up a narrow 0.13% for the week to close on 2432.6 points.

Small cap companies making headlines this week were:

Talga Resources (ASX: TLG)

Battery anode and graphene developer Talga Resources will work with luxury car maker Bentley to develop a new e-axle made of graphene and aluminium to out-perform traditional copper windings.

The graphene-based aluminium e-axle aims to reduce vehicle weight and improve performance for electric and hybrid vehicles.

As part of the initiative, Britain’s innovation agency Innovate UK has approved Talga for co-funding – giving it £224,000 ($429,940) of the £3.6 million.

Talga managing director Mark Thomson said combining the company’s graphene material with aluminium will give it the properties required to outperform copper in electric motors.

“For automotive manufacturers this could reduce vehicle weight and increase performance, safety and driving range while retaining sustainability and economics,” he said.

Apollo Consolidated (ASX: AOP)

A new zone of gold mineralisation has been identified at Apollo Consolidated’s Lake Rebecca gold project in WA.

The zone was discovered during resource expansion drilling an is located to the north-east of the Duchess deposit.

Drilling comprised 25 reverse circulation holes for 3,480m and targeted around the Rebecca, Duke and Duchess areas.

Apollo stated significant new gold intercepts had been returned in several locations.

At the new prospect 1.2km north-east of Duchess, better results were 25m at 1.23g/t gold and 15m at 1.4g/t gold.

Apollo noted the new prospect was open for more than 1km to the north and 200m to the south.

Follow up drill targets have been prepared, with drilling to continue in the area.

Valmec (ASX: VMX)

Valmec has added $23 million to its order book after securing new infrastructure projects in Western Australia and the Northern Territory.

The agreements include an infrastructure service contract with WA’s Water Corporation, with the work to be undertaken on its Perth Metro Main Renewals program.

Another project will include infrastructure work for US gold miner Newmont Corporation’s subsidiary Newmont Mining Services.

The work will be carried out on Newmont’s Tanami Expansion 2 project, which is an underground gold mine in the Tanami Desert about 540km north-west of Alice Springs.

Valmec has also secured $5.9 million-worth of compression equipment overhaul and maintenance service contracts for Queensland and Victorian onshore gas customers.

THC Global (ASX: THC)

Medicinal cannabis company THC Global has expanded its footprint with the acquisition of Tetra Health for $3 million in cash and shares.

Tetra has a network of more than 630 referring and prescribing physicians in addition to dispensing pharmacies across Australia.

Its revenue is generated mostly from consultation fees that are charged to more than 1,100 active and 10,000 prospective patients, as well as from the supply of de-identified data and real-world evidence gathered during patient on-boarding.

THC claims this data can assist with clinical trials and studies to advance the availability of medicinal cannabis in Australia.

Additionally, the acquisition will enable THC to “rapidly increase” the number of Australian patients who can access medicinal cannabis including the company’s own products.

Liontown Resources (ASX: LTR)

Advanced lithium explorer Liontown Resources has debuted its third successive mineral resource upgrade for its flagship Kathleen Valley project in WA, with the latest resource representing a 636% increase on the maiden resource that was revealed in September 2018.

The new resource stands at 156Mt at 1.4% lithium, as well as tantalum at an average grade of 130ppm.

According to Liontown, the latest upgrade confirms Kathleen Valley as a “world class” lithium deposit.

Commenting on the results Liontown managing director David Richards said the continued growth in the Kathleen Valley resource reflected the deposit’s quality and scale.

“This latest resource update clearly establishes Kathleen Valley as one of the world’s premier hard-rock lithium deposits, with clear potential to underpin a long-life mining operation,” he added.

Liontown followed the positive resource news with an announcement it had identified a strong gold, platinum group element, nickel and copper anomaly during fieldwork at the wholly-owned Moora project, which is also in WA.

Kyckr (ASX: KYK)

Kyckr has secured Germany’s second largest bank as its new client.

The bank Commerzbank has signed a $100,000 contract to use the company’s Kyckr for Business portal in the UK.

Commerzbank had previously been using Kyckr’s customer verification platform on a pay-as-you-go basis.

This new $100,000 contract is for an initial 12 months, with Kyckr’s technology to be used to provide automatic access to primary source data and documents during the critical customer verification stage.

“We are extremely pleased that we have extended our relationship with Commerzbank through a longer-term contract,” Kyckr chief executive officer Ian Henderson said.

Kyckr followed up the positive contract news by revealing April had generated the company’s highest monthly revenue to-date.

At $260,000 for the month, the revenue was up 39% on the prior year.

TNT Mines (ASX: TIN)

The latest junior to jump back into the uranium space is TNT Mines, which revealed it had executed a binding agreement to acquire the East Canyon uranium and vanadium project in Utah.

Located within Utah’s Dry Valley/East Canyon mining district, TNT believes the project is in a highly prospective region due to a strong history of uranium and vanadium mining.

The district has historically produced uranium at 0.13-0.15% and vanadium at 1.3%.

East Canyon is also on the Uravan Mineral Belt which has produced more than 85Mlb uranium and 660Mlb vanadium.

The project covers 16sq km and hosts numerous historic workings including the None Such Mine.

During 2018 and 2019 limited field work was carried out and returned peak grades of 0.47% uranium and 9.21% vanadium.

In consideration for the asset, TNT paid the vendor $25,000 and issued 500,000 shares. If TNT elects to proceed with the acquisition following due diligence, it will issue 2.5 million shares and a further 2.75 million performance rights.

The week ahead

We are in for another interesting week with the continuing news on COVID-19 still a major factor and some potential influence from central banks.

Locally a mix of data around consumer confidence, the job market and consumer spending are sure to add to the bleak picture that is emerging from the shutdown period of fighting the virus.

Reserve Bank governor Dr Philip Lowe will be making a virtual panel appearance with FINSIA on Thursday, which could throw some further light on the extraordinary support the bank is using to keep short term interest rates low.

Internationally, US Federal Reserve chair Jerome Powell is providing testimony on Tuesday and the Fed’s minutes will be out on Wednesday and there are also US housing figures and jobless claims.

Chinese data on house prices and loan rates could also provide some further information on how that country is emerging from its prolonged coronavirus hibernation.