The Australian share market enjoyed a strong end to the week, with the ASX 200 jumping 0.6% on Friday as health stocks, technology and the gold sector all had gains.

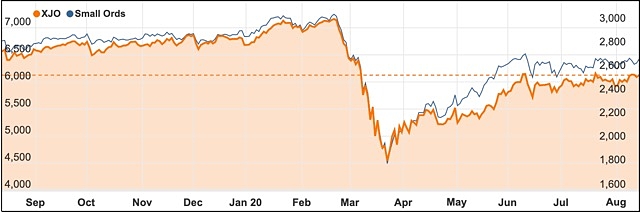

That brought the weekly gain to 2% – not a bad term deposit rate for a year if you can get it – and the ASX 200 to a 6126.2 point finish as investors continued to find more positive surprises than negative among company profit reports.

The solid week rested on good performances by consumer stocks, financials and a recovering property sector as the market enjoyed its best week for a month and a half.

A lot of the action on Friday was in the technology stocks with Computershare (ASX: CPU) up an impressive 7.8%, Afterpay (ASX: APT) up 6.3% and accounting software provider Xero (ASX: XRO) up 5.4%.

Performances were also variable due to profit confessions rather than sectors, with Commonwealth Bank (ASX: CBA) losing 0.9% on Friday for its third daily fall after a mixed profit while National Bank (ASX: NAB) outperformed its banking peers with a 1% share price rise after releasing its third quarter numbers.

For NAB, revenue was 10% up on stronger markets & treasury income but cash profit fell 7% to $1.55 billion. Investors seemed to like the fact that margins had held up well despite around $55 billion of residential and business loan deferrals.

Mesoblast blasts off

The most impressive rise of the day was enjoyed by Mesoblast (ASX: MSB) shareholders who watched the stock leap 39% after a US FDA advisory committee supported the approval of its drug remestemcel-L for children suffering from rare blood diseases.

The drug may also prove useful in treating COVID-19 and the FDA will now decide on formal approval on September 30.

Other health stocks were also broadly higher, with CSL (ASX: CSL) up 0.6% to $279.34, ResMed (ASX: RMD) up 2% to $25, Ramsay Healthcare (ASX: RHC) up 1% to $67.67 and Cochlear (ASX: COH) up 0.95% at $199.77.

Gold shines – for those who produce

Gold stocks also showed some results-based variability with Newcrest shares (ASX: NCM) down 0.9% as higher gold prices helped lift profits but production fell 13%.

It was the outlook for 2020-21 that left investors unimpressed, with Newcrest’s costs rising and gold production remaining soft.

For the other gold miners it was a great day with Perseus (ASX: PRU) up 6% to $1.50, Evolution (ASX: EVN) rising 6.5% to $6.09, Northern Star (ASX: NST) up 0.8% at $14.24 and Saracen (ASX: SAR) rising 3.5% to $5.61.

Shares in maternity and baby supplies merchant Baby Bunting (ASX: BBN) gained 10.4% to $4.15 as the retailer released results showing it had boosted sales revenue by 10% to $405 million, even though net profit fell 14%.

Companies such as Telstra, AGL, Transurban and Newcrest that reported weak future outlooks during the week were punished by investors but investors were prepared to overlook current weakness for a strong vision.

Treasury Wines (ASX: TWE) was a good example, with the share price up 18% for the week despite a struggling current performance after management flagged strong growth in Chinese sales.

It continued to be a strong week for consumer discretionary companies with Wesfarmers (ASX: WES) and ARB Corp (ASX: ATB) both touching record highs and Collins Foods (ASX: CKF) up 3.1%, Dominos Pizza (ASX: DMP) up 1.9%, Harvey Norman (ASX: HVN) up 2.2% , JB Hi-Fi (ASX: JBH) up 2% and Super Retail Group (ASX: SUL) up 1.7%.

Gambling firms also had a strong day with the Star, Crown, Tabcorp, and Aristocrat Leisure all rising by between 1 and 1.5%.

Small cap stock action

The Small Ords index recovered 1.25% on Friday to close the week up 0.79% on 2707.9 points.

Small cap companies making headlines this week were:

Trigg Mining (ASX: TMG)

Recent drilling at Trigg Mining’s Lake Throssell sulphate of potash project in WA has returned a high-grade SOP product.

Assays returned up to 14,500mg/L – equivalent to 14.5kg per square metre. All-up, 77 brine samples were collected and assayed on average 11,300mg/L, with 90% of the holes drilled to date returning grades exceeding 10,000mg/L.

Trigg claims the results place Lake Throssell among the highest-grade SOP projects in Australia.

Managing director Keren Paterson described the results as “exciting”.

These results combined with those in an upcoming aircore drilling program will underpin a maiden resource, which is scheduled for release in the December quarter.

Wide Open Agriculture (ASX: WOA)

In its strategy to become a global “first mover” with its lupin-based protein products, Wide Open Agriculture revealed it has now secured 200kg of lupin from a regenerative farmer in WA.

The company is preparing the batch in readiness for shipping to the CSIRO where it will be processed into a food grade protein isolate for incorporation in a variety of plant-based products including “meat”, milk, “egg” and gluten free.

“Our goal of bringing a regenerative, lupin-based protein to the multi-billion-dollar market is developing at a rapid pace,” Wide Open managing director Dr Ben Cole said.

“We have identified a multi-skilled team that offers Wide Open expertise to accelerate this exciting technology from the laboratory into pilot scale production and into the commercial realm,” he added.

In readiness for anticipated demand, Wide Open said it was also negotiating with other lupin growers in WA to secure future supply.

Blackstone Minerals (ASX: BSX)

Following more high-grade nickel results at Ta Khoa this week, Blackstone Minerals has doubled down on its fast-track exploration strategy at the project with the addition of more rigs and a another geophysics crew.

On Tuesday, Blackstone reported it had received assays from the fourth and final hole of a maiden drilling program at the Ban Chang prospect.

Assays for the final hole were 13.4m at 1.01% nickel, 0.96% copper, 0.05% cobalt and 1.14g/t PGE from 76m, including 2.1m at 2.53% nickel, 1.36% copper, 0.11% cobalt and 0.76g/t PGE from 77.6m.

With these latest results, Blackstone noted that all four holes had intersected high-grade massive sulphide nickel.

With encouraging results continuing to flow in, Blackstone plans to use the additional geophysics team to firm up more targets for drilling, with six diamond core rigs now in operation.

BPH Energy (ASX: BPH)

BPH Energy’s claims PEP 11 remains one of the most significant untested gas projects in Australia have been shored up via a report released in late June.

The report was published after years of review work on the gas field, which lies in the offshore Sydney Basin.

Past work had identified structural leads that could contain 5 trillion cubic feet (5 TCF) of gas.

The report identified strong parallels between PEP 11 and similarly aged gas producing structures in Queensland’s Bowen Basin, which hosts the 40 billion cubic feet Churchie/Myall Creek gas field.

Meanwhile, a geochemical review has shored up the company’s plans with a report indicating the area surrounding the proposed drilling site at the Baleen prospect was best for hydrocarbon influence.

Part of PEP 11’s appeal is its proximity to the east coast domestic gas market.

BHP owns 23% of Advent Energy, which in turn holds an 85% interest in PEP 11.

The company is raising almost $2.5 million to increase its stake in Advent, with the rights issue scheduled to close on 24 August.

Navarre Minerals (ASX: NML)

Advanced gold explorer Navarre Minerals has secured priority status from the Victorian Government for an exploration licence application it submitted to expand the St Arnaud gold project.

After a competitive application process, Navarre was deemed the preferred owner for licence ELA 6819 which includes the Bristol, New Chum and Nelson lines of reef.

These reefs extend into Navarre’s granted licence where drilling has uncovered silver and gold.

In addition to ELA 6819, Navarre has applied for two other licences, which, if granted, will boost Navarre’s St Arnaud project to 1,364sq km.

Once Navarre secures the licences, it will launch exploration including mapping, soil and rock chip sampling, and computer modelling of historical mine workings including geology and structure.

Prescient Therapeutics (ASX: PTX)

Prescient Therapeutics has entered a research collaboration for its proprietary CAR-T cancer technology with Melbourne’s Peter MacCallum Cancer Centre (Peter Mac).

Under the collaboration, Peter Mac’s Professor Phil Darcy will lead the research which will use Prescient’s CAR-T cancer therapy.

The technology is a type of cellular therapy that reprograms a cancer patient’s immune cells to destroy the cancer.

CAR-T has been shown to be effective in haematological malignancies, with the research collaboration to work on boosting the therapy’s impact on solid tumours.

This work is expected to complement Prescient’s other cell therapy enhancement programs.

Upcoming listings

Planning to make their way onto the ASX bourse in the coming weeks is:

North Stawell Minerals

Gold explorer North Stawell Minerals is aiming to be this year’s fifth new mining float with its $20 million IPO.

The company is issuing 40 million shares at $0.50 each to raise the funds to advance the Stawell gold mine which has previously produced more than 5Moz gold.

In its prospectus, North Stawell describes the Stawell project as the “corner point” of Victoria’s Golden Triangle, which has produced more than 66Moz.

The Stawell tenements cover 261.9sq km with North Stawell chairman claiming there is potential for discovery of a large mineral system under cover.

Once the IPO closes on 28 August, North Stawell’s shares are scheduled to begin trading on 16 September.

Proceeds will fund exploration with the company already identifying 43 gold targets including a tenement with a JORC resource of 875,000t at 2g/t gold for 55,000oz.

Laybuy Group

The latest to take advantage of the buy now pay later investor frenzy is Laybuy Group which has launched an $80 million offer.

The New Zealand-based company plans to list next month after issuing 28.4 million shares at $1.41 each. Another $40 million will be raised through a sell-down by existing shareholders, namely managing director Gary Rohloff and his wife Robyn (with 50% equity), and Kiwi investment vehicle Pioneer Capital (50%).

These shares will be sold at $1.41 each also.

Once listed, it is expected the company will have a market cap of $246 million and trade under LBY.

Offer proceeds will be used toward boosting Laybuy’s retail merchants and customers as well as UK expansion plans.

Laybuy is a BNPL provider that enables customers to split purchases into interest free instalments are paid weekly for six weeks.

The week ahead

Once again company profit results will play a big part in driving individual stocks and the market as a whole this week.

Some of the more notable stocks expected to report in the coming week include Argo, JB Hi-Fi, Bendigo Bank, BlueScope Steel, BHP Group, Coles, Cochlear, Vicinity Centres, A2 Milk, CSL, Brambles, Tabcorp, Crown Resorts, Domino’s Pizza, Oz Minerals, South 32, ASX Ltd, Wesfarmers, Webjet, Mirvac, Coca-Cola Amatil, Qantas, Medibank Private, Perpetual, Origin Energy and TPG Telecom,

Other than the company reports, there are a few statistics to watch out for with the new preliminary retail trade figures for July, consumer confidence and the minutes of the latest RBA board meeting.

Overseas there is a forest of housing data in the US, along with the latest meeting minutes from the US Fed.

Otherwise there are the usual watching briefs on the continuing progress of the COVID-19 virus, vaccines and treatments and the increasing combativeness of the US election.