Weekly review: market applauds Santos and Oil Search merger despite carbon risks

WEEKLY MARKET REPORT

In a decade’s time either BHP (ASX: BHP) and Woodside Petroleum (ASX: WPL) will look like genius winners or Santos (ASX: STO) and Oil Search (ASX: OSH) will.

Both groups have taken radically different approaches to the risks of having a carbon heavy balance sheet.

In the case of BHP and Woodside, BHP decided to roll its oil and gas assets into Woodside in exchange for shares that its holders can then choose to sell or hold.

That was a really big decision given that oil and gas have long been important profit contributors to BHP.

In the end, the worry that oil and gas assets might go the way of coal and become a burden on the balance sheet rather than a positive led to the decision to continue to radically decarbonise its portfolio and concentrate on “forward facing” metals such as copper, nickel, potash and iron ore, all of which have a place in an electrified energy future.

Santos and Oil Search will become a top 20 global giant

Santos and Oil Search went in the other direction, combining their oil and gas assets in a $21 billion energy giant that will be in the top 20 energy companies in the world and has a lot of defensive, low-cost production and plenty of blue-sky projects as well.

Certainly, there was nothing except a warm embrace from the share market for the new energy giant with Santos shares up 0.5% to $6.06 and Oil Search shares 2.2% higher to $3.73 as analysts generally warmed to the long-anticipated deal.

BHP shares were also up 0.81% to $41.25 while Woodside’s shares gained 0.36% to $19.27 as energy and mining stocks recovered a little.

The long-term ramifications of the shuffling of assets between the four companies will be interesting to watch but, in general, analysts liked the Santos and Oil Search tie up because it combined Santos’ low-cost operating model which throws off free cash flow at around US$28 a barrel combined with the growth potential within Oil Search through assets like the Alaska Pikka oil project and the Papua LNG project.

Cost savings of up to US$115 million a year before tax didn’t hurt investor sentiment either.

With a big balance sheet that is flexible enough to fund growth and also manage capital efficiently, the immediate reaction from investors and brokers was bullish.

Market up on Friday but down for the week

In the end, the deal helped to push the Australian share market up 0.5% to 7406.6 points on Friday, although this was not enough to overturn weekly losses that closed at 1.55%.

Sharp falls in the price of iron ore depressed the prices of the big miners such as BHP, Rio Tinto (ASX: RIO) and Fortescue Metals (ASX: FMG) during the week and unpredictability around the continuing burden of the Delta strain of COVID-19 on global economic growth drove share price weakness in the US market and in Australia.

Downgrades to Chinese property giant Evergrande led to uncertainty around Chinese steel demand while news of a weakening in US economic growth in July and August due to a rise in COVID-19 infections that hit consumer spending helped to push market lower.

One beneficiary of the uncertainty was the price of gold which also helped to set a more positive tone in the Australian market on Friday as local gold mining shares rose.

A 1% fall in the price of giant blood products and biotech stock giant CSL (ASX: CSL) pulled in the opposite direction.

In market specific news, Iress (ASX: IRE) shares fell 1.9% after the company extended the due diligence period for EQT Fund Management by 10 days after having initially granted 30 days for a proposed takeover, with EQT most recently offering $15.91 per share for IRE in August.

Small cap stock action

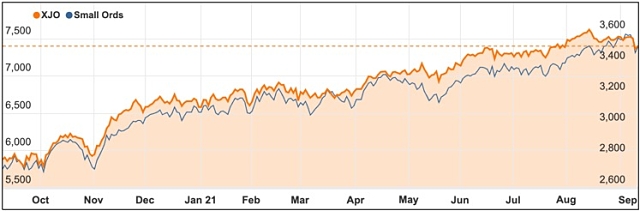

The Small Ords index dropped 2.38% for the week to close at 3508.7 points.

ASX 200 vs Small Ords

Small cap companies making headlines this week were:

Tambourah Metals (ASX: TMB)

Recent ASX debutant Tambourah Metals has gained another battery metals project in Western Australia’s east Pilbara.

The company has acquired 100% of the Russian Jack project in the region with the asset believed prospective for tin, tantalum and lithium.

Securing Russian Jack follows field work kicking off at Tambourah’s namesake gold project where historic mining generated 5,247oz of gold.

Previous explorers have unearthed numerous gold intercepts at Tambourah, with a peak of 21.54g/t gold returned during a small 2019 drilling campaign.

AssetOwl (ASX: AO1)

After rebranding its flagship inspector360 SaaS platform to Pirsee late last month, AssetOwl has secured its first Victorian customer, marking the company’s first step in its nation-wide expansion.

AssetOwl chief executive officer Geoff Goldsmith said securing its first Victorian customer was a “hugely significant” milestone, with the state home to Australia’s second largest rental market.

The company believes Pirsee is the only product of its kind commercially available that enables property managers to direct inspections remotely through a video call while also capturing high-resolution photos and reviewing them in real-time.

“Pirsee is perfectly placed as the only software that can help property managers and their clients to carry out fully remote routine inspections in a safe, compliant and efficient fashion,” Mr Goldsmith said.

Norwest Energy (ASX: NWE)

Oil and gas explorer Norwest Energy has uncovered what it considers to be a “significant conventional gas discovery” while drilling the Lockyer Deep-1 well in WA’s Perth Basin.

The well was drilled to a total depth of 4,274m and intersected the top of the Kingia Sandstone at 4,041m.

Elevated gas levels were noted from 4,041m to 4,067m with logging resistivity separation indicating good inferred porosities throughout a reservoir interval of about 26m. Elevated readings continued throughout Kingia to the top of the Bit Basher Shale at 4,109m.

Norwest noted no gas-water contact was evident – supporting the company’s case for “significant resource potential” across the Lockyer Deep/North Erregulla Deep structure.

Additionally, a 42m interval had elevated gas reading in the High Cliff Sandstone from 4,172m and 4,214m.

Hydrocarbon potential was also encountered within the shallower Dongara/Wagina formations.

A comprehensive wireline logging program is underway to fully-appraised the gas oil deliverability across the intervals.

Boss Energy (ASX: BOE)

Boss Energy is making good on its plans to become Australia’s next uranium producer at the former Honeymoon mine in South Australia, after revealing its front-end engineering and design for the mine was progressing “well ahead of schedule”.

The FEED process is now anticipated to wind up early next year and will be followed by a final investment decision and detailed design work.

Boss will also start ordering long-lead items and is already engaging with preferred vendors.

“We have a plant on care and maintenance, other significant production and storage infrastructure in place, we have formed an Owner’s Team to restart Honeymoon and we are moving through the FEED stage rapidly,” Boss managing director Duncan Craib said.

Venus Metals Corporation (ASX: VMC)

Youanmi continued to generate positive drill results this week for Venus Metals Corporation and joint venture partner Rox Resources.

On Monday, it was revealed drilling had interested 4m at 45.5g/t gold from 341m in a newly-defined position in the hanging wall between the Bunker pit and Youanmi main lode.

At the Junction target, high-grade gold was uncovered with best results of 16m at 4.22g/t gold from 56m, including 3m at 16.4g/t from 66m and 3m at 4.1g/t from 203m; 3m at 15.17g/t gold from 108m; and 3m at 3.35g/t gold from 204m.

A few days later, it was reported a step-out hole at the Link prospect had returned 7.25m at 15.02g/t gold, including 2.9m at 22.37g/t.

Venus expects the results at Link would add to the global Youanmi resource which totals 1.7Moz of gold.

Over at Venus’ Henderson gold-nickel project in WA’s eastern goldfields phase one drilling produced encouraging results.

The phase one program comprised 61 holes for 2,006m and intercepted 7m at 1.13g/t gold from 45m, including 1m at 4.57g/t gold; and 2m at 2.2g/t gold, including 1m at 4.09g/t gold.

Lotus Resources (ASX: LOT)

Another aspiring uranium miner fast-tracking a project to development is Lotus Resources, which has started the definitive feasibility study for its Kayelekera asset in Malawi.

The study is scheduled for completion mid-next year.

Starting the DFS follows recent technical studies which have yielded positive results including improved production rates and lower operating costs.

Technical work has evaluated power supply, ore sorting, acid recovery and tailings storage and identified potential for significantly better outputs and returns compared to last October’s mine restart scoping study.

Lotus managing director Keith Bowes said the most “notable technical study” had been the ore sorting work, which is based on technology that was not previously available when Kayelekera was last in production.

Ore sorting test work showed Kayelekera ore could be upgraded resulting in increased annual production.

“This means for example that a 400 parts per million uranium oxide marginal ore could be upgraded to around 800ppm uranium oxide in feed for the main plant,” Mr Bowes said.

The week ahead

One of the highlights of the coming week will be a speech on Tuesday by Reserve Bank Governor Dr Philip Lowe.

Until now, Dr Lowe has been fairly bullish on the chances of the Australian economy bouncing back after it finally emerges from the latest wave of COVID-19 lockdowns so the main interest will be on whether he has moderated those views somewhat given the stubborn pace of infections and hospitalisations.

The other thing to watch out for will be the August jobs data which is out on Thursday and is set to show a kick up in unemployment as lockdowns in Sydney and Melbourne drive working hours down.

Other things to look for locally include data on petrol prices, the used car market, overseas arrivals and departures and population data.

Overseas, the big things to watch out for are a swag of Chinese data including retail sales, production which will be interesting to compare to similar measures out in the US.

The US CPI numbers will also be keenly awaited to see if the rush of inflation has endured or is more of a flash in the pan.

Rounding out a busy week in data releases will be New Zealand June quarter economic (GDP) growth and US consumer sentiment numbers.