Uranium focused Lotus Resources (ASX: LOT) has sold off its non-core asset the Hylea cobalt project in New South Wales to Sunrise Energy Metals (ASX: SRL) for $2.5 million in cash and shares.

Lotus has been concentrating on the advanced Kayelekera uranium project since acquiring it in 2019.

Commenting on the decision to offload Hylea, Lotus managing director Keith Bowes said the company was “firmly focused” on positioning Kayelekera for a production restart in an “improving uranium price environment”.

As a result, he said the Hylea project has become a non-core asset for the company. Although, Mr Bowes noted Hylea’s “excellent long-term potential” remained.

Keeping this in mind, the sale of Hylea includes a $1 million cash payment and a further $1.5 million in Sunrise shares.

Mr Bowes said the transaction allows Lotus to “immediately realise value” for Hylea while also retaining exposure to Hylea and Sunrise’s portfolio of other electric vehicle metals through the share consideration.

Uranium focus

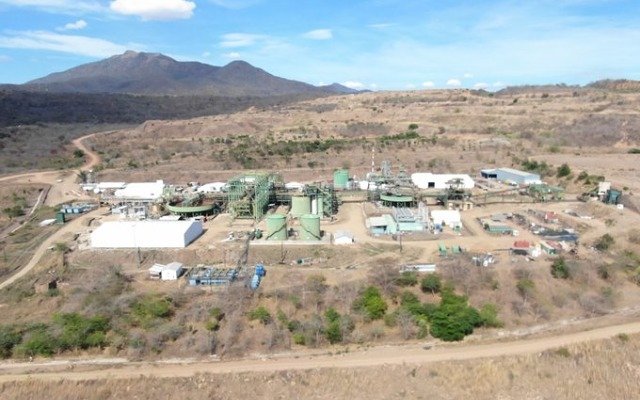

The advanced Kayelekera uranium project has a proven production history after generating 11 million pounds of uranium over five years before closing in 2014 due to low prices.

Lotus has multiple work programs at Kayelekera underway with the strategy of positioning Kayelekera for a “quick and economical” restart.

The project has an existing high-grade resource of 37.5Mlb of uranium oxide at 630 parts per million.

A scoping study based on previous production and technology indicates capital expenditure would be in the area of US$50 million with initial capital intensity of US$21/lb.

It is expected the 1.4Mtpa processing plant would generate 2.5Mlbpa of uranium.

Mr Bowes said if the current work programs are successful, they could cut the scoping study costs by as much as 20%.

“Since [Kayelekera’s] closure in 2014, there has been a number of proven technological advancements not available at the time, as well as other relevant initiatives the company is considering,” he added.