Renewed optimism in the uranium sector has seen Lotus Resources (ASX: LOT) proceed with a review of operational costs at the Kayelekera project in Malawi, in preparation for a restart of the mine.

A host of possible cost reduction initiatives were identified in an October scoping study and will now be assessed in separate technical reviews which will form part of a restart feasibility study for the project, in which Lotus holds 85% equity.

The reviews will focus on power generation, ore sorting, acid recovery and tailings storage requirements and are either underway or due to commence shortly.

A 5,000 metre reverse circulation drilling program will also kick-off next month to test uranium targets up to 4km from the Kayelekera processing facility.

A smaller infill program will follow at the high-grade Milenje Hills rare earths discovery, 2km from Kayelekera, to gauge the depth profile of the mineralisation.

Increasing global demand

Lotus managing director Keith Bowes said the mine is being positioned as first in line to respond to increasing global demand for uranium.

“There is a growing supply-demand gap in the uranium sector and brownfield projects with proven production history such as Kayelekera could be well placed to respond and meet this demand,” he said.

“Our key short-term focus will be to test the cost reduction initiatives identified in last year’s scoping study – if they prove successful, there is potential for savings of up to 20% on previous estimates.”

Original cost assumptions for the Kayelekera restart were based on actual operational data gathered over the project’s previous production life from 2009 to 2014.

Since its closure, technology has progressed considerably and Lotus is now looking to incorporate these advancements into the restart.

Ore Sorting

Lotus believes changes in ore sorting technology over the years could possibly have the largest impact on Kayelekera costs, with potential to increase uranium grades and reject acid-consuming gangue minerals such as calcites from plant feed.

Ore upgrading is considered particularly important for lower-grade stockpiles which would be treated at the end of mine life, while the rejection of gangue minerals could be implemented from the start of operations.

“A number of companies have developed this technology to a point now where it is well established in the recycling industry and is making significant advances in mining with multiple applications installed at various gold and base metal mines,” Mr Bowes said.

“Ore sorting is most effective with coarser materials and any fines generated from crushing and screening must be processed separately, therefore the strategy in our current assessment is to include more traditional upgrading concepts such as desliming, gravity and density classification for these fine materials.”

Power assessment

The Kayelekera site is currently powered by diesel generators and Lotus anticipates significant cost reductions could be achieved by connecting the site to Malawi’s national grid.

Initial discussions with ESCOM (Electricity Supply Commission of Malawi) have indicated that sufficient power is currently available at the town of Karonga, which is 50km from site.

Mr Bowes said a solar-battery alternative is also being considered for the camp facilities, as well as the option to recover up to 2 megawatts of power from an onsite acid plant by retrofitting a steam turbine.

Acid recovery

The onsite sulphuric acid plant produces approximately 235 tonnes per day, which Lotus said may not be enough for the restart operation.

Using an acid recovery process, the company could potentially reduce the production of fresh acid (and decrease costs) or increase plant throughput to consume the additional acid.

Mr Bowes said the optimal solution would be investigated as part of the feasibility study work.

Tailings storage

The original schedule for Kayelekera indicated a second tailings storage facility would be required after five years of production. However, Lotus now believes deferring the timing of the new build by optimising the existing facility could be beneficial for project cash flow.

“A more attractive option would be to look at using the depleted pit as a disposal area for tailings as this could eliminate the need for the second tailings facility completely,” Mr Bowes explained.

“Both of these options have the potential to reduce our all-in-sustaining-costs.”

Project history

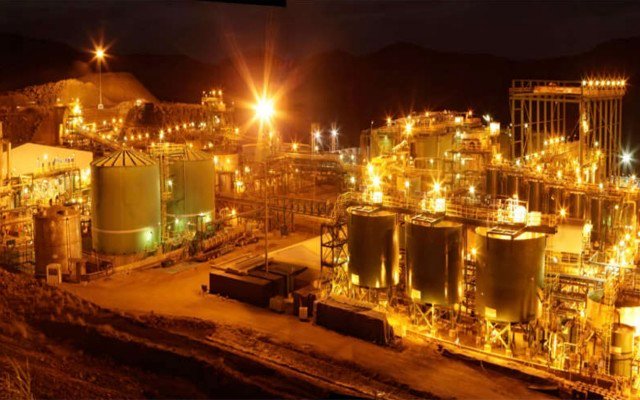

The Kayelekera project was previously owned by Paladin Energy (ASX: PDN) and produced approximately 11 million pounds of uranium in the five years to 2014.

Low uranium spot prices forced the mine to be put on care and maintenance, with Paladin offloading the project to Lotus in March last year.

The mine hosts a current resource of 37.5Mlb uranium oxide, with the planned restart potentially supporting annual production of 3Mlb.

Lotus’ scoping study demonstrated that Kayelekera could become a viable long-term operation and one of the first uranium projects worldwide to recommence production in the near future.