A restart definitive feasibility study for Lotus Resources’ (ASX: LOT) Kayelekera uranium project in Malawi has ranked it as one of the lowest capital cost projects of its kind in the world.

It also confirmed the project has the ability to recommence production within 15 months once a final investment decision has been made.

The study is underpinned by an ore reserve estimate of 15.9 million tonnes at 660 parts per million for 23 million pounds of uranium oxide.

Uranium produced in the mine plan is based on 96% reserves and 4% inferred resources.

A short road to restart will result in an average production of 2.4Mlbs uranium oxide per year for the first seven years of a 10-year mine life.

Lotus is now focused on accelerating engagement with nuclear energy utilities, arranging financing options and securing offtake agreements to support the restart.

Investor appeal

Managing director Keith Bowes expected the study’s findings would appeal to investors.

“Having an asset with low technical risk and low restart capital which can quickly commence production are key characteristics that investors look for in a mining project,” he said.

“The results of the restart study clearly put Kayelekera in this category and provides an opportunity for us to leverage off some of the strongest fundamentals for the uranium industry in many years.”

Stand-out features

Stand-out features of the study include attractive capital and operating costs, which take into consideration the current high inflation environment, while ensuring Lotus can significantly reduce its carbon footprint.

Initial upfront capital costs remain one of the lowest in the industry, from a headline (US$88 million) and a capital intensity perspective (US$37 per pound annual production).

This includes US$35.8 million for plant and infrastructure which were not previously considered in the scoping study but have been incorporated to improve project economics and processing reliability.

The new items are an acid plant and steam turbine upgrade (costing US$15.3 million), a nanofiltration upgrade (US$1.5 million), connection to the national grid (US$13 million) and an upgrade to the front-end processing circuit to incorporate ore sorting (US$6 million).

“This is an excellent achievement given current inflationary pressures,” Mr Bowes said.

“The numbers are higher than in the scoping study, but includes items which are critical for lowering our operating costs.”

Operating costs during steady state in the initial mining phase before stockpile treatment commences now sit at US$29.1/lb uranium oxide, which Mr Bowes said was within second quartile costs for current and planned uranium producers.

Timing of restart

The timing of Kayelekera’s restart is dependent on the uranium price and the economic terms relating to Lotus’ long-term offtake agreements.

The uranium spot price has increased by 100% in the past year, peaking at US$64/lb in April.

Research shows momentum in the market is positive, with strong underlying fundamentals which indicate continuing price increases that could see the project’s necessary pricing levels quickly achieved.

A final investment decision will be dependent on the completion of project work, offtake negotiations, a mine development agreement and financing.

Mr Bowes said a decision could be made as early as December, with first production by early 2024 and a maiden shipment in the months to follow.

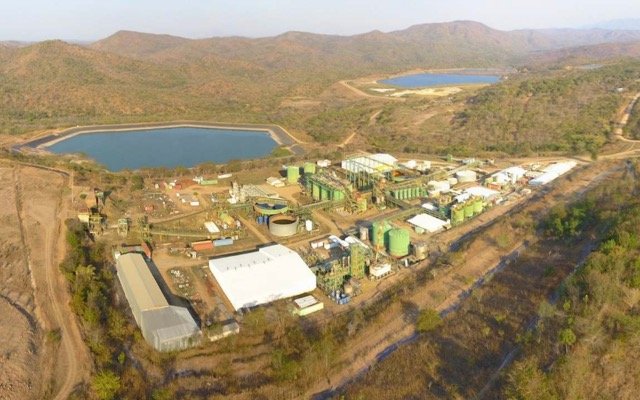

Kayelekera is currently on care and maintenance and has been a strong past producer of uranium, having delivered 11Mlbs to the market between 2009 and 2014.