Perth-based Lotus Resources (ASX: LOT) will boost its interest in the Kayelekera uranium project in Malawi to a maximum 85% after reaching an agreement with project owner Kayelekera Resources Pty Ltd.

Lotus will exercise its right to acquire the additional 20% on top of its current 65% equity via the acquisition of Kayelekera’s shares in Lily Resources Pty Ltd, which is the incorporated joint venture between the two companies.

As consideration for the buy-out, Lotus will issue approximately 226 million shares to Kayelekera in an scrip-only transaction which will maintain the company’s cash reserves.

The remaining 15% interest in the project will continue to be held by Malawi Government.

Previous ownership

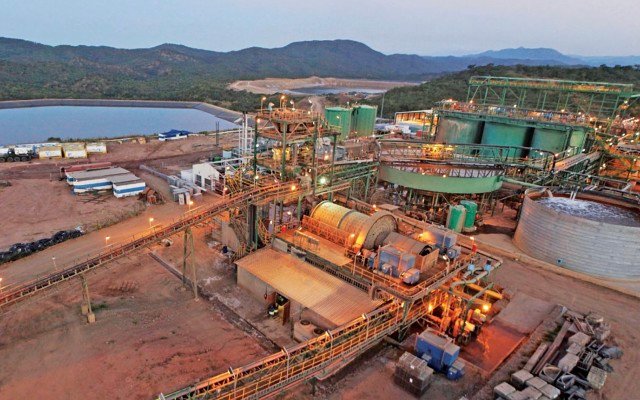

The Kayelekera project was previously owned by Paladin Energy (ASX: PDN) from 2009 to 2014, producing approximately 11 million pounds of uranium.

Low uranium spot prices forced the mine to be put on care and maintenance, with Paladin offloading the project to Lotus in March last year.

A recent study showed a $64.3 million investment by Lotus could support the re-start of Kayelekera to make it a viable long-term operation using existing infrastructure.

With a current resource of 376.5Mlbs uranium oxide, Lotus expects annual production from the project to be around 3Mlbs.

Track record

Lotus chairman Michael Bowen said Kayelekera was one of only a small number of uranium projects worldwide with a demonstrated track record of operation.

“Consolidating the ownership is an important milestone for [Lotus] as it positions us for a recommencement of operations in an improving uranium price environment,” he said.

“With work progressing on the re-start feasibility study, [our] increase in ownership comes at a time when the uranium price and sentiment in the industry is improving due to an impending supply deficit.”

Capital banked

Last month, Lotus staged a $12.5 million capital raising through the placement of 100 million shares at $0.125 each to help fund the Kayelekera acquisition and support pre-feasibility study work.

“The strong demand was testament to Kayelekera’s potential as one of only two uranium assets on the Australian Stock Exchange to have proven, commercial production,” Mr Bowen said.

“We can now accelerate work on the re-start feasibility study and ramp-up exploration on a number of near-mine, high-priority uranium targets, which will help support an extension of Kayelekera’s life beyond the current 14 years of estimated production.”