Leigh Creek Energy (ASX: LCK) is gearing up for a catalyst event expected to add “significant commercial value” to its namesake in situ gasification (ISG) project in South Australia – targeting the upgrade of its current resource to reserve status before the end of this year.

Earlier this month, the company announced the maiden production of synthesis gas from its pre-commercial demonstration at the Leigh Creek coalfields in the state’s north.

Though this was no easy task for the junior gas developer, having overcome obstacles including opposition by cultural groups and market scepticism and negativity surrounding ISG technology.

Despite the setbacks, the South Australian government is very encouraging of the project and Leigh Creek Energy is ready to move forward and prove the capabilities of both the company and its technology.

The Leigh Creek Energy Project is currently estimated to hold a 2C resource of 2964 petajoules, which makes up about 7.8% (per Energy Quest Report, December 2017) of Australia’s east coast gas resources.

2P reserve upgrade within weeks

Speaking with Small Caps, Leigh Creek Energy head of investor relations Tony Lawry said the company expects to have enough information to send to the certifier to upgrade this (at least partially) to 2P reserves “within weeks”. It then aims to achieve this conversion by the end of 2018.

Lawry said when the independent assessors MHA Petroleum Consultants categorised the resource in 2016, “they were very clear in their report and during their assessment that once we’ve made syngas, they’d be able to upgrade the resource to a reserve. Under the PRMS system, it cannot be categorised a Reserve until production testing has been completed and suitable results obtained.”

“We’re now making gas and the process is effectively an analytical and mathematical process to look at the gas results and then use all of the previous data that the resource was based on to upgrade to reserve status,” he explained.

What is ISG?

Synthesis gas, or “syngas”, is generated through in situ gasification (ISG), which is a chemical process that converts coal from its solid state into a gaseous form.

ISG is the term used in South Australian legislation, although it is often referred to as ‘underground coal gasification’ in other jurisdictions around the world.

Leigh Creek Energy’s ISG demonstration involves two wells drilled into a coal seam – one inlet and one outlet connected more than 500m below the surface. Air and water is pumped through the inlet well and an initiation device heats the coal to start a chemical reaction in the coal seam.

While this air and water is introduced through the inlet well, syngas flows through the outlet well where it is analysed. Following analysis, the syngas is destroyed through a thermal oxidiser as part of the demonstration phase of the project.

This process differs from the coal seam gas extraction method of hydraulic fracturing or “fracking”, which involves injecting water and additives under pressure into the rock formation to fracture the rock to allow gas to escape.

Syngas uses

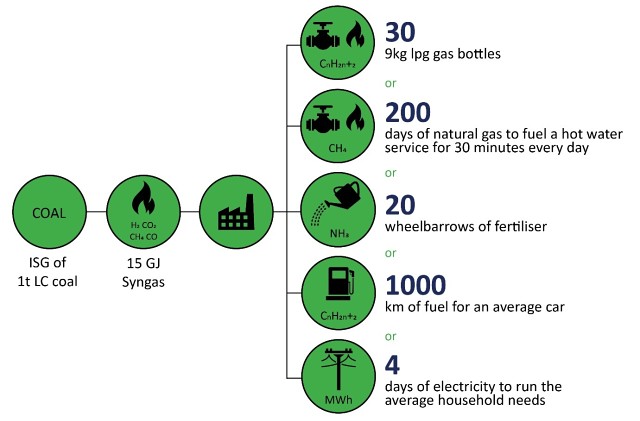

Syngas contains methane, hydrogen and other valuable components and can be used to produce electricity directly, or further refined into a variety of products including natural gas and ammonium nitrate to be used in fertiliser and industrial explosives.

Leigh Creek Energy is currently working with its partners to decide which of these three product options it should target in the first instance.

It is no secret that the forecasted future supply for Australia’s domestic gas market, particularly in the east coast, has been falling significantly short.

To counteract this, the government has enacted laws including limiting exports of liquified natural gas to improve local supply.

However, Lawry said each of the product options – electricity, natural gas or petrochemical products – have great commercial potential. In particular, Australia currently imports about 95% of urea fertilisers.

“Urea and methanol have very strong market demand,” Lawry said.

Prime location for the demonstration

Leigh Creek Energy believes the coalfields of Leigh Creek, in the Telford Basin of northern SA, are an ideal location for an ISG demonstration, due to the depths of the coal and the fact that the region has already been heavily impacted by historic coal mining.

The company received environmental approval in April and was approved by the state government in September to commence a three-month pre-commercial demonstration (PCD), enabling the first production of syngas earlier this month.

The PCD is aiming the demonstrate that the ISG gasifier can be operated safely and in an environmentally responsible manner, with a production target of 1 million cubic feet per day of syngas.

This phase should provide information for the development of the commercial project.

As Leigh Creek Energy aims to convert its current 2C resource to 2P reserves (at least partially) by the end of this year, it also hopes the PCD will contribute information required for this review. Another benefit of the Leigh Creek location is its avoidance of culturally-sensitive areas, making recent opposition a little puzzling.

Earlier this month, the company concluded legal proceedings with the Adnyamathanha Traditional Lands Association, with the latter’s application being dismissed on all accounts.

Leigh Creek Energy believes it has a good relationship with the traditional landowners in the region and had previously received two heritage clearances from the group.

“We respect the traditional owners and will continue to work with them to achieve mutually beneficial outcomes that would benefit them in areas of employment, business development, cultural recognition and enhancements and education opportunities” Lawry said.

The crucial difference

ISG has been a topic of controversy in recent times, particularly relating to safety concerns and damage to the environment.

In April this year, failed gas company Linc Energy was found guilty by a Queensland district court and fined $4.5 million for causing serious environmental harm at its underground coal gasification plant near Chincilla in the state’s Western Downs region during 2007 and 2013.

According to the court findings, Linc mismanaged the underground burning of coal seams, causing rock to fracture and allow the escape of toxic gases which contaminated the air, soil and water on site. As Linc has been in liquidation since 2016, it did not defend itself during the trial.

An assessment report published by the South Australian government’s energy and resources division has outlined the differences between the Leigh Creek project and Linc’s Chincilla operations.

Firstly, the coal at Leigh Creek is much deeper – at 540m below surface, it is more than four times deeper than Chincilla’s shallow 125m depth.

The Leigh Creek coal also has very low permeability, meaning that water does not pass through it as easily, and the risk of fractures and fissures is deemed low due to the density of the geology.

Another important difference is that the Leigh Creek coal sits in a basin with a confined hydrology.

“All the water that flows into the underground system sits in that basin and it doesn’t go anywhere and that basin is not connected to any other regional groundwater resources,” Lawry explained.

He also noted that the surface environment has been heavily impacted by 70 years of open cut coal mining, with “not a lot of environmental value left”.

“Having said that, we’ve done an enormous amount of work, and at an enormous cost in the millions of dollars, characterising the baseline of our environmental resource because we always need to be able to measure our impact relative to what we started with.”

Lawry said another advantage of Leigh Creek’s project is the fact that the person who designed all of its equipment is regarded as “one of the few, if not the only person in the world that’s now managed two successful in situ gasification operations in two different locations and more importantly, two different geologies”.

This is Leigh Creek Energy’s General Manager, Technical, Justin Haines, who was Carbon Energy’s (ASX: CNX) General Manager, Technical when it successfully produced syngas from its Bloodwood Creek demonstration facility in Queensland from 2011 to 2015.

Haines was Technical Manager through the operation and successful decommissioning of the CNX Panel 2 operations with a glowing report from the Queensland government regulator.

“The last significant factor that’s different between South Australia and other projects is the level of regulatory oversight and the transparency that we have had with the regulator in developing the design of our project and how we’re going to operate it,” Lawry added.

Undervalued in a sceptical market

Recent controversy aside, Leigh Creek Energy believes it has been significantly undervalued because the market doesn’t really understand the past successes of ISG or the relative simplicity of the technology.

However, two main de-risking milestones were achieved this year – environmental approval and first syngas production.

“We’ve got the hardest approval to get. The market always said you’ll never get approval to make gas at Leigh Creek because of what’s happening in Queensland, but we achieved that,” Lawry said.

“The market then said, ‘come back to us when you make gas – we don’t believe you will deploy the technology’. Well, we’ve done that.”

The next risk to overcome is the conversion of contingent resources to reserves, which Lawry described as “largely administrative and analytical from here on”.

Leigh Creek Energy has a research and development working capital facility with the Commonwealth Bank of Australia (ASX: CBA), which allows it to progress the operational phase of the PCD without needing to wait for its expected tax rebate.

This week, the company announced it has received its rebate from the Australian Taxation Office for the 2017/18 year and successfully repaid the loan. It also reduced the facility’s limit from $10.5 million to $3.6 million to reflect next year’s anticipated rebates.

Leigh Creek Energy is also backed by two major offshore investors, China New Energy Group, which holds a 28.9% shareholding in Leigh Creek Energy, and CITIC which holds 3.7%.

According to Lawry, it is also being watched by companies across the world including in South Africa, India, America and other parts of Australia.

“The world is looking at this project because this is one of the few [ISG] projects that will be commercially successful or have a commercial overlay to it – and we’re very proud of that,” he said.