After COVID-19 lockdowns delayed its Australian Stock Exchange debut, New Zealand Buy Now Pay Later (BNPL) outfit Laybuy Group has re-launched an initial public offering (IPO) with a view to hitting the ASX boards next month.

The company is hoping to raise $40 million through the issue of approximately 28.4 million new shares at $1.41 each; and another $40 million through a sell-down by existing shareholders, namely managing director Gary Rohloff and his wife Robyn (with 50% equity), and Kiwi investment vehicle Pioneer Capital (50%).

There will also be an employee gift offer, under which eligible employees will be able to apply for $1,000 worth of shares (or approximately 700 shares) at no cost.

Laybuy had originally targeted the first half of the year for its ASX listing but the brewing pandemic and eventual retail lockdown put those plans on the backburner.

According to Retail New Zealand, retailers made “almost no sales” during COVID-19’s first wave of disruptions except for those considered to be essential services.

Laybuy’s offer closes on 25 August and the company anticipates commencement of trading on the ASX on 7 September under the ticker code ‘LBY’.

Growth aspirations

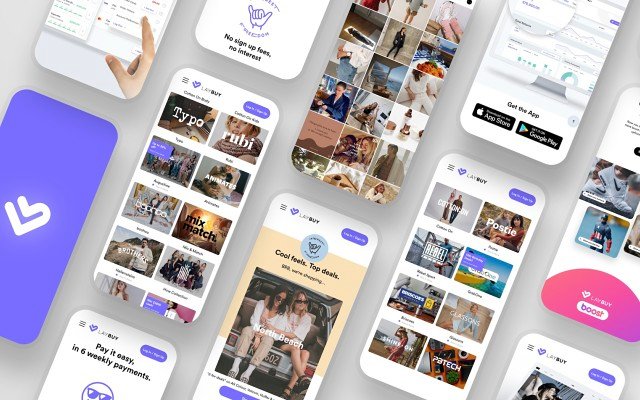

Funds raised through the IPO will be used primarily to support Laybuy’s United Kingdom growth aspirations, where it is positioning itself as a leading weekly-payment BNPL provider, instore and online.

Laybuy officially expanded into the UK market last year when it partnered with fashion retailer Foot Asylum to provide online customers with an interest-free and risk-free purchasing option and to stimulate sales in a turbulent retail environment.

“Gaining traction in this new market was a major challenge for us as the BNPL [concept] is not as ubiquitous [in the UK] as it is in Australasia,” Mr Rohloff said at the time.

“A large amount of our focus has been dedicated to educating the market on the Buy Now Pay Later model, led by the success we are experiencing back home.”

Mr Rohloff said the UK holds the most “blue sky” opportunity for Laybuy, with the size of its retail market being more than double that of Australia’s (based on total retail market expenditure in 2019).

On average, Laybuy’s partnering retailers enjoy an increase in order value of approximately 60%, an increase in online and instore conversion rates of 50%, and a 30% rise in new customer acquisitions.

Retail boost

Proceeds from the IPO will also be used to boost the number of retail merchants and customers on Laybuy’s books.

For the year ending June 2020, the company had more than 5,600 active merchants in the areas of fast fashion, health, beauty and footwear, and over 470,000 customers across New Zealand, Australia and the UK – representing an increase of 50% and 110% respectively on the previous corresponding period.

According to Laybuy, the adoption of BNPL solutions has occurred rapidly in New Zealand, with an estimated 20% of all online clothing and footwear spend in 2018 made through BNPL providers.

Laybuy considers itself a dominant BNPL provider in the New Zealand market, and views its key competitors as Afterpay (ASX: APT) and Zip Co (ASX: Z1P).

Australian market

Australia, by contrast, has had a historically-strong appetite for BNPL payment schemes, with the number of providers and transactions growing rapidly since 2015.

In the year ending June 2016, it was estimated that 400,000 Australian consumers had used at least one BNPL arrangement from a provider within a 12-month period.

Two years later, this figure had increased to more than 2 million consumers.

Laybuy considers the Australian market to be more competitive than New Zealand, with Afterpay, Zip, and Swedish platform Klarna competing for a share.

Mastercard partnership

In February, Laybuy entered into a partnership with global payments giant Mastercard to enable the issue of digital cards to Laybuy customers in all markets by the end of 2020.

The card will allow for a fully-functional ‘tap and go’ service at any of Laybuy’s listed merchants that offer contactless payment.

“Customers will be able to bypass a number of steps currently required for in-store transactions [and] their purchase experience will be near instantaneous, improving customer engagement and encouraging repeat purchasing behaviour,” the company said.

“Reducing friction or barriers to buying – such as additional steps, waiting time or complexity – from the payment process benefits merchants in a similar way… reducing the time staff spend processing transactions enables them to focus their resources elsewhere.”

The Mastercard deal is expected to broaden Laybuy’s revenue streams and “deepen customer loyalty”.

“This partnership provides us with access to most retailers in Australia – consumers will be able to use a Laybuy debit card to purchase at any Mastercard retailer offering contactless payments,” Mr Rohloff said.

“As you can imagine, this is a massive opportunity and we are excited to see this come to fruition,” he added.