LatAm Autos looks to boost cash flow by modernising car sales in Latin America

LatAm Autos (ASX: LAA) has said it is on course to reach cashflow break even by the end of 2018 following strong growth in unit sales volumes as part of a broader shift from a pure online auto classifieds platform to a “car transaction marketplace” that provides similar services as CarSales in Australia and AutoTrader in the UK.

Based in Ecuador, LatAm Autos remains an ASX-listed entity that is the leading online classifieds and content platform in the Latin American automobile industry, with operations in 6 countries across the American continent that employs around 150 people.

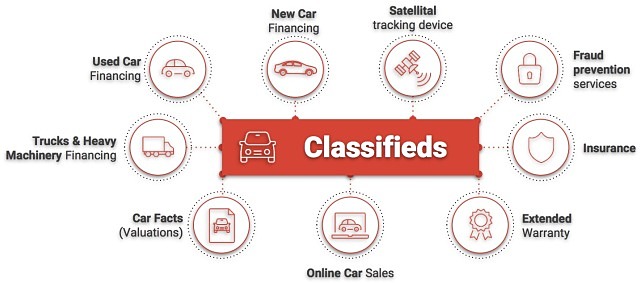

LatAm Autos wants to integrate the auto sales industry in the region by facilitating the contact between buyers and sellers and providing key information for the auto acquisition process.

At the Global Online Classifieds conference in Miami on Friday 22 June 2018, LatAm CEO CEO Jorge Mejia Ribadeneira said that the company is on course to reach a record month of cross-sell unit sales in June 2018 while reaffirming his expectation that LatAm will reach cashflow break even later this year.

From old to new

Traditional online classifieds have not undergone substantial changes since the mid-1990s but LatAm says it has developed strategies to monetise its dominant market position and business model to create a successful brand that continues to thrive despite challenging market conditions.

As a higher volume of lower quality leads from general classifieds increased, lead generation from auto classifieds has focused on higher conversion rates.

One of its flagship products that is growing strongly in Latin America is Motorfy, a service that simplifies buying a car for Latin American consumers while enabling LatAm to cross-sell a range of new products.

The initial range of sold products is auto finance, insurance and GPS tracking but LatAm says it expects to expand Motorfy’s capabilities and revenue lines by integrating it with credit management systems in real-time and automating the credit assessment process that can significantly reduce the time taken from quotation to approval – thereby increasing the potential for higher sales.

A key caveat for LatAm is that it only receives a portion of the loan value as commission and does not take any underwriting risk that’s attached to the loan.

Today’s news helped LatAm shares to a 17% gain in this morning’s trading session. With shares currently trading at $0.17 per share, LatAm is valued at around A$62 million by market capitalisation.