Koba Resources (ASX: KOB) is moving quickly to take advantage of a hot global tin market with the acquisition of two historical projects in North Queensland.

The company has signed a binding agreement with EV Resources (ASX: EVR) to acquire a 100% interest in the high-grade projects covering 432 square kilometres located approximately 100km southwest of Cairns.

Koba has paid a $100,000 deposit and will outlay a further $600,000 in cash on completion of the acquisition, with EV Resources also entitled to a1% net smelter return royalty.

Tin-Producing Region

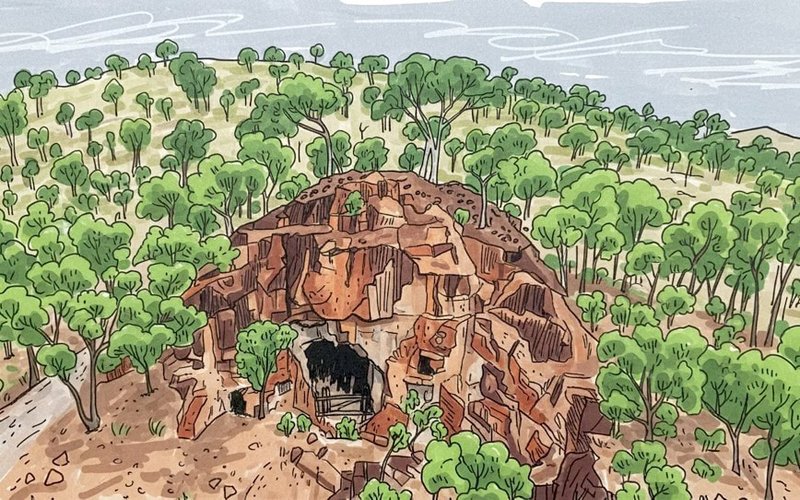

The two tin-tungsten projects are located in the historical Herberton field—the second largest tin production district in Australia, with more than 75,000 tonnes of tin metal recovered from more than 2,400 mines.

Numerous very high-grade historical mines lie within Koba’s project areas along a 1.3km section of the Kitchener trend.

Seven of these produced approximately 120,000 tonnes of ore at an average grade of 2.3% tin.

Separately, the Gilmore mine located 40km to the southwest produced 26,169 tonnes grading at 7.6% tin.

Immediate Drill-Ready Targets

Chief executive officer Ben Vallerine said the Stannary Hills and Mt Garnet tin-tungsten projects would provide the company with immediate drill-ready targets at a time of historically high tin prices.

“The limited drilling completed since mining ceased in the 1980s clearly demonstrates that considerable mineralisation remains unmined,” Mr Vallerine said.

“Targeted drilling offers opportunity to discover new high-grade zones around these historical mines, while there is also substantial potential to define lower-grade, bulk-tonnage resources.”

Phase 1 Exploration Plans

Koba’s first phase of exploration at the new projects will include geological mapping, rock chip sampling and ranking of the highest priority targets in preparation for drilling.

It is also looking to trial induced polarisation (IP) to prioritise drill targets and define new targets along strike, as well as additional project-wide geological mapping, rock chip and soil sampling to develop a pipeline of targets.

The company is aiming to commence drilling of the highest priority targets in early 2026, following the northern wet season.

$4.35m Share Placement

To help fund the purchase of the two projects, Koba has received firm commitments for its share placement to raise up to $4.35 million.

Members of the company’s board have subscribed for $70,000 of the placement, subject to shareholder approval.

EV Resources said the transaction is a significant step in its ongoing strategy to streamline its portfolio.

The company plans to use proceeds of the sale to explore and develop the company’s antimony assets and to advance its US-focused critical minerals strategies.