Emerging tungsten developer King Island Scheelite (ASX: KIS) has locked in its first offtake partner as it looks to restart tungsten production from its wholly-owned Dolphin mine on King Island off Tasmania.

The company today announced it had signed an offtake agreement with leading European tungsten powder supplier Wolfram Bergbau und Hutten AG, which will see Wolfram take almost 20% of the proposed annual production of tungsten concentrate from the mine over a four-year period.

Wolfram is a wholly-owned subsidiary of Swedish engineering and technology giant Sandvik Group (STO: SAND). The Austria-based company supplies tungsten powders for the manufacture of high-tech components in the tooling, automotive, aerospace, energy, infrastructure, electronics and mining industries.

Speaking with Small Caps, King Island chairman Johann Jacobs said he was “extremely pleased” to have attracted such an internationally renowned company as the first customer in what is a “highly competitive market”.

In addition, he said offtake negotiations with other international tungsten producers for the remaining 80% of annual production were at an “advanced stage”.

“We certainly anticipate finalising these by the end of April,” Mr Jacobs added_._

Offtake deal

Under the terms of the agreement, King Island will deliver 140,000 metric tonne units or 1,400t of tungsten oxide to Wolfram over a four-year period.

This equates to the export of about 2,200t of concentrate produced by the redeveloped Dolphin mine over that period or about 550t per year, which accounts for close to one-fifth of the mine’s proposed annual concentrate production of 3,100t.

The contract is based on take-or-pay principles, with the price referenced to the ammonium paratungstate (APT) price reported by global pricing platform Fastmarkets MB.

Mr Jacobs said based on APT price forecasts, this puts a total value on the contract of around A$42 million.

APT is the internationally accepted benchmark price for tungsten products. It is an intermediate product containing 88.5% tungsten oxide, whereas the concentrate that King Island intends to sell will be 65% tungsten oxide.

The agreement is also subject to King Island achieving certain financial and operational milestones before 31 March 2021.

According to Mr Jacobs, this includes the project reaching nameplate production capacity by this final deadline.

Dolphin mine redevelopment

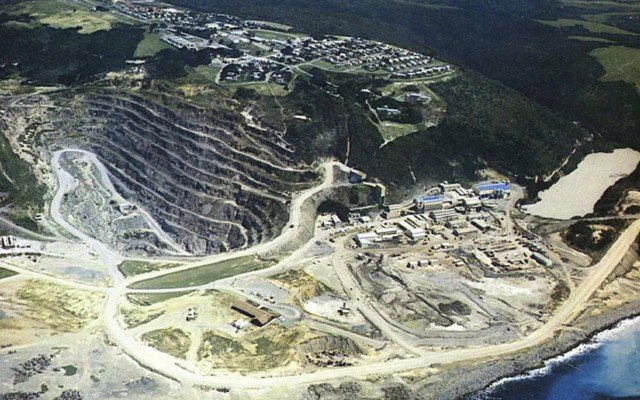

The company’s 100%-owned Dolphin project is located near the south-east town of Grassy on King Island, a large island in the Bass Strait between Victoria and Tasmania.

It is currently one of the world’s richest tungsten deposits, hosting a total indicated mineral resource estimate of 9.6Mt at 0.9% tungsten oxide, including mineral reserves of 3.14Mt grading at 0.73% tungsten oxide.

The Dolphin mine historically produced tungsten concentrate between 1917 to 1990 before it was closed due to extremely low tungsten prices.

As the tungsten market began to recover in the mid-2010s, Dolphin’s current owner King Island began to evaluate the potential of redeveloping the mine.

The company’s current redevelopment plan proposes an open cut mining operation with an initial mine life of eight years before potentially going underground.

“All up, we potentially have about a 20-year mine life,” Mr Jacobs said.

The proposed processing flowsheet is based on a gravity circuit, backed up by a small flotation circuit, with the plant having an annual ore capacity of 400,000t.

With the Grassy port located only 1km from the proposed open pit operations, the company aims to ship about 2,000t of pure tungsten (about 3,500t of concentrate) from the island each year in sea containers to refining facilities around the world.

According to Mr Jacobs, the Dolphin project is technically pre-approved, having already obtained the mining lease and environmental approval.

“We are going through the final testing of our flotation circuit, but our primary methodology will be through gravity and then with flotation at the back end of it, so that isn’t critical to the development of the project,” he said.

“The next steps are to finalise the offtake agreements and in parallel with that, start looking at financing the mine.”

According to Mr Jacobs, the company anticipates it will take between three and five months to finalise funding.

“Redevelopment from the time of financial close to actual final commissioning is 12 months, so, potentially we’ll be in production in the last quarter of 2020,” he said.

Tungsten market

Tungsten is hard and steel-grey with the highest melting point of any metal. Interestingly, a temperature of about 5,700 degrees Celsius is needed to bring tungsten to boil, which is equivalent to the surface temperature of the sun.

The metal is a key component in the manufacture of steel tools and has many other applications including lighting filaments and electronics, power engineering, coating and joining technologies. It is also used in microchip technology and liquid crystal displays.

It has been categorised by the US Department of Defence, the British Geological Survey and the European Commission as a “critical” and “strategic” raw material due to its economic importance and supply risk.

Most of the world’s tungsten reserves are in China, with the country supplying about 80% of the world’s demand.

However, in recent years the Chinese Government began cracking down on local miners to clean up their operations and adhere to strict environmental regulations, which has effectively curtailed supply and pushed tungsten’s price upwards.

According to market data from research firm Roskill, the price is predicted to rebound in the coming years.

“Tungsten market fundamentals have changed as demand from defence, industrial, and oil and gas applications has picked up, just as environmental policies in China have curbed supply and added cost pressures for producers,” the firm stated.

In October last year, the Drakelands tungsten-tin mine in the UK closed, taking about 1,200t of material off the market.

Two upcoming mines in Portugal and Spain are expected to take care of this shortfall, with King Island hoping to scoop up additional demand in the market, driven by GDP growth.

“There’s very little else in the western world that’s coming online in the near-term, so we’ll be picking up the growth of 2-3% per year moving forward,” Mr Jacobs said.

Over the last few months, the APT price has stabilised and is currently in the range of US$265-285 per mtu.

“Our price forecast is that tungsten will be sitting at US$275-300/mtu, certainly for the foreseeable future,” Mr Jacobs said.