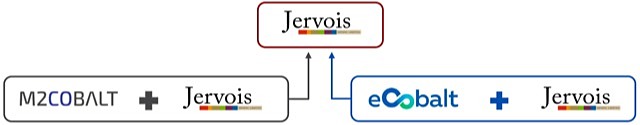

Jervois merges with eCobalt to create world’s third largest cobalt miner

Via the mergers with eCobalt and M2 Cobalt, Jervois will become the third largest cobalt company in the world by market capitalisation.

Australian developer Jervois Mining (ASX: JRV) today announced it will acquire 100% of Canadian advanced-stage development company eCobalt Solutions Inc in a friendly at-market merger which will create one of the world’s largest cobalt companies.

The move will provide Jervois with exposure to capital markets in Australia and Canada and see it inherit a global asset pipeline which includes North America’s highest grade cobalt project located in the historic Idaho cobalt belt.

Under the terms of the merger agreement, Jervois will acquire all of the issued and outstanding common shares of TSX-listed eCobalt that Jervois does not already own.

Each common share of eCobalt will be exchanged for 1.65 common shares of Jervois, representing an implied offer price of C$0.36 per eCobalt share, based on the closing price of Jervois’ common shares on 29 March.

In mid-2018, Jervois secured 7,249,800 common shares in the capital of eCobalt, constituting approximately 4.54% of outstanding common shares in the company on an undiluted basis.

Once approved, the new entity – expected to be worth around $100 million – will rank as the world’s third largest cobalt company after Canada’s Cobalt27 and Australian company Clean TeQ Holdings (ASX: CLQ).

M2 Cobalt acquisition

The proposed merger is the second of its kind for Jervois this year and further enhances its geographic spread.

In January, the company announced plans to join forces with US-based M2 Cobalt in a separate and unrelated transaction, giving it a valuable foot in the door of the east African market with the historic Kilembe copper-cobalt mine and the Kasese cobalt refinery.

M2 is an exploration-stage business with an established operating presence in Uganda, strong government links and existing relationships with local stakeholders.

The company’s Kilembe properties comprise five exploration licences covering 710 square kilometres of highly prospective land in the Kasese and Bunyangabu districts which border the Democratic Republic of Congo.

They are along strike of the historic Falconbridge mine previously owned by Canadian base metals operator Falconbridge Limited and include the now-closed Kilembe mine which produced over 16 million tonnes of ore in its heyday, grading 1.98% copper and 0.17% cobalt.

Last month, Jervois announced the merger with M2 was progressing well, with the partners due to kick-off an exploration program to pursue the re-start of Kilembe and Kasese.

Main attraction

The main attraction for Jervois in its latest merger is eCobalt’s flagship Idaho cobalt project – believed to be the only near-term, environmentally-permitted primary cobalt deposit in the US.

The project hosts the nation’s largest cobalt resource at 45.7 million pounds grading 0.59% cobalt in measured and indicated resources and sits within the famed Idaho cobalt belt which is a northwest-trending zone of cobalt-copper-gold occurrences approximately 64km long and up to 10km wide.

Idaho is currently the subject of a new feasibility study focusing on a potential increase in targeted production rate to 1200 tonnes per day from 800tpd – an increase of 50% on the previous mine plan.

In January, eCobalt said the new production rate with improved economies of scale should create a more resilient economic plan which can withstand the volatility of the cobalt market.

Current assets

Jervois’ is finalising a pre-feasibility study on a 3 million tonnes per annum heap leach facility based on an inferred mineral resource of 167.8 million tonnes at 0.59% nickel and 0.06% cobalt at the company’s Nico Young laterite nickel-cobalt deposit in New South Wales.

After construction, the facility will be one of Australia’s largest cobalt-nickel operations.

Jervois said it had commenced discussions to bring a partner into the project as it moves towards definitive feasibility study stage later this year.

The company has also applied for a prospecting licence over the Kabanga sulphide nickel-cobalt project in Tanzania as a complementary addition to its east Africa ambitions via M2.