Weekly review: iron ore rescues Australian share market from vaccine failure

每周市场报告

Australia still rides on iron ore’s back and the treasured bulk commodity once again helped the share market to record its sixth week of gains.

Despite the disappointing failure of our local vaccine candidate which weighed heavily on CSL’s share price and two days of market losses, none of it was enough to prevent a skinny 0.6% rise for the week.

The benchmark ASX 200 fell 40.5 points or 0.6% on Friday to 6642.6 points but there was still just enough fizz remaining from Wednesday’s nine-month high to eke out the weekly win.

Small weekly rise solely due to iron ore

That would definitely not have been the case without iron ore, with the soaring price hitting an amazing seven year high of US$156 a tonne as China’s steel mills continued their voracious appetite with no sign of Beijing wanting to interrupt this particular Australian export.

Also pushing up the iron ore price were continuing supply issues from Brazil’s Vale, which helped to turbocharge the prices of the big local miners.

Fortescue (ASX: FMG) shares added an effortless 2% to hit a new record close of $22.95, adding an impressive 11% for the week and pouring another $2.6 billion into the vault for founding chairman Andrew ‘Twiggy’ Forrest.

The more diversified BHP (ASX: BHP) still impressed, closing up 0.8% at $42.82 while shares in rival Rio Tinto (ASX: RIO) jumped 0.5% to $116.

Back to the future for the mining giants

BHP and Rio are now trading at the best prices since 2011 and 2008 respectively, showing the extent of the iron ore boost, which has transported the mining giants right back into the heady days of the original China commodities boom.

In addition, the Australian dollar has continued its rise against a weakening US dollar, back as high as US75.6c.

Vaccine failure dampens healthcare sector

CSL (ASX: CSL) was hit hard by the trial failure of the COVID-19 vaccine it was developing with the University of Queensland, with shares falling 3.2% to $291.53 after it was revealed that some trial participants were recording HIV false positive results.

While there is no danger of the trial members actually contracting HIV and indeed indications that the molecular clamp vaccine might successfully produce successful COVID antibodies, the news that vaccine development would be halted due to the false readings still took investors by surprise.

The gloom from that news seemed to spread across many of the healthcare stocks, with ResMed (ASX: RMD), Sonic Healthcare (ASX: SHL), Ramsay Health Care (ASX: RHC) and Cochlear (ASX: COH) all falling.

Industrial, consumer and property stocks were also broadly weaker although energy and technology stocks were largely positive as oil prices continued to recover.

It was a good day for lithium bulls with shares in Independence Group (ASX: IGO) adding 25% after coming out of a trading halt after it completed its institutional entitlement offer, raising about $446 million to help fund its acquisition of a 49% stake in Tianqi Lithium Energy Australia.

Buy now pay later entity ZipCo (ASX: Z1P) saw its shares rise 2% after it announced a partnership with Facebook so that small and medium-sized Australian businesses can use Zip Business to pay for advertising on the social platform.

Small cap stock action

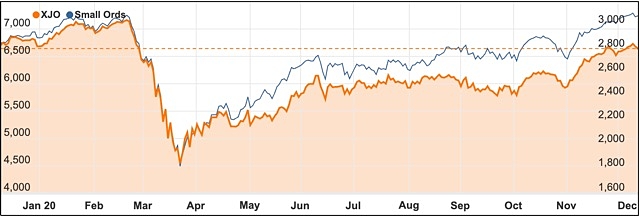

The Small Ords index was steady this week increasing a fractional 0.07% to close on 3081.1 points.

ASX 200 vs Small Ords

Small cap companies making headlines this week were:

Incannex Healthcare (ASX: IHL)

Incannex Healthcare embarked on a world first US FDA-compliant trial this week to evaluate the use of psilocybin mushrooms and psychotherapy in treating generalised anxiety disorder.

The company will use psilocybin, which is found naturally in several mushrooms, and psychotherapy to treat more than 70 patients under a collaboration with Monash University, with Dr Paul Liknaitzky to head up the research.

Incannex will retain any intellectual property from the trial, and will continue working with Monash to share data and advance research to create a new “promising treatment approach”.

Meteoric Resources (ASX: MEI)

Gold explorer Meteoric Resources has identified a large anomaly at its Juruena gold project in Brazil.

The anomaly was discovered via deep induced polarisation survey, which confirmed it is 2km long, 1.5km wide and less than 500m below surface.

Meteoric suspects the anomaly represents disseminated sulphides at depth and could lead to a “significant” porphyry copper-gold discovery.

A magnetotelluric survey was also completed with interpretation of that due to be released in the new year.

Immutep (ASX: IMM)

Biotechnology company Immutep’s Chinese partner EOC Pharma will begin a phase II clinical trial into using Immutep’s lead drug eftilagimod alpha for treating metastatic breast cancer.

Up to 152 patients will be enrolled in the trial across 20 clinical sites.

The study will evaluate eftilagimod alpha in combination with paclitaxel chemotherapy in HER2-negative/HR-positive metastatic breast cancer patients with disease progression after endocrine therapy.

This study will build on encouraging data from an Active Immunotherapy Paclitaxel phase IIb study that begun earlier this year.

Esports Mogul (ASX: ESH)

Gaming company Esports Mogul has branched into the mobile market with the beta testing of its Mogul app in South East Asia.

The company’s strategy is to become a first mover in the rapidly growing mobile gaming segment.

“At mogul.gg we are now poised to bring our best-in-class eSports experience to the 2.6 billion mobile gamers around the world. Players will be able to effortlessly create, host, and compete in all of the best branded mobile eSports tournaments available anywhere,” Mogul chief executive officer Michael Rubinelli said.

Wide Open Agriculture (ASX: WOA)

Regeneratively farmed and sustainable food company Wide Open Agriculture is closer to commercialising its lupin protein after successful production of the food-grade plant protein using industrial-grade equipment.

“This marks an important milestone in the scale-up process, as it increases the potential commercial viability of the process and demonstrates the capability of producing commercial quantities of lupin protein that can be sent to ingredient and food companies in Australia and globally,” Wide Open Agriculture managing director Dr Ben Cole said.

Initial taste-testing of the product has found it to be neutral which is a key requirement for food companies when incorporating the ingredient.

iCandy Interactive (ASX: ICI)

Another stock to easily raise funds in the current environment was iCandy Interactive which secured $10.5 million in a heavily oversubscribed placement, with proceeds to be used to boost production capabilities and enhance product quality.

iCandy followed the raising with news its Masketeers: Idle Has Fallen game had generated $1 million in revenue in 63 days – making it the fastest revenue generator of any other iCandy game.

The company expects the strong revenues from Masketeers will contribute “significantly” to its performance in the current and subsequent financial years.

Creso Pharma (ASX: CPH)

Medicinal cannabis company Creso Pharma has been riding a wave of positive news following the loosening of EU and UN regulations for cannabis.

Creso has expanded into Canada’s largest recreational cannabis market Ontario via its subsidiary Mernova Medicinal.

Mernova received a notice to purchase from the Province of Ontario for its HPG13, Lemon Haze and Mimosa strains which will be sold under Ritual Green products brand throughout Ontario Cannabis Stores and online.

The company also secured a heads of agreement on Friday for Creso to supply cannabidiol products which will be sold under Martin & Pleasance brands across Australia and New Zealand.

The week ahead

We might be entering the silly season around Christmas and the New Year but there are still a few statistical releases to watch out for both here and overseas.

One that is expected on Monday or perhaps later in the week is the release of the mid-year budget update which will put some numbers around the expected budget damage from the pandemic.

The other thing to watch out for in a similar vein is the November labour force report which will document the extent of the employment damage cause by the various pandemic shutdowns as Federal Government employment schemes begin to wind down.

Still, the unemployment numbers are expected to improve based on Australia’s largely successful fight against COVID-19.

Other domestic numbers to watch out for include overseas arrivals, household impacts of COVID-19, card spending, consumer sentiment and spending intentions.

There are a couple of Reserve Bank items to watch for with Head of Financial Stability Jonathan Kearns speaking at the Australasian Finance & Banking Conference on Tuesday with the RBA’s December board meeting minutes out on the same day.

Internationally, the highlights will be a range of activity data out of China and also the US economic growth numbers, which will be a useful check on how the trade war participants are travelling.

The US Federal Reserve Open Market Committee begins its two-day policy meeting on Tuesday.