The collapsing iron ore price has continued to push the Australian share market lower.

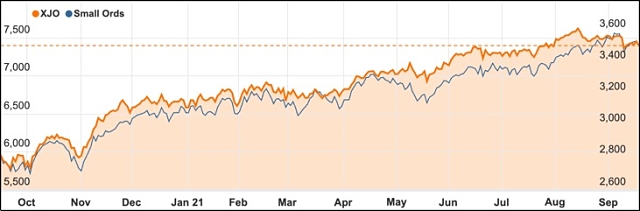

On Friday the ASX 200 fell another 0.76% to 7403.7 points, although things could have been worse with the market only down 2.9 points for the week.

There was nowhere to hide for the big miners though, as the iron ore price continued to slide to below US$110 a tonne, settling at US$107.21.

Andrew “Twiggy” Forrest’s Fortescue Metals (ASX: FMG) was the most notable casualty, with shares falling 11.5% to $15.27 as brokers including UBS downgraded the company.

Rio Tinto (ASX: RIO) shareholders were not spared the pain, with the stock falling 4.7% lower to $98.8 while the more diversified BHP (ASX: BHP) lost 3.4% to finish at $39.06.

Analysts have been surprised by the speed of the weakness in the iron ore price, which back in May was sitting above US$220 a tonne.

Iron ore market may be heading for a surplus

However, no-one is expecting much of a price recovery from here after the price has more than halved with weaker steel production in China potentially sending the market into a supply surplus.

Bearish UBS research predicted that China’s steel production will plateau by 2023 due partly to pollution concerns, with the iron ore price set to fall below US$100 a tonne by the end of this year and average just US$89 a tonne in 2022.

Gold stocks feel the pain too

It wasn’t just the iron ore miners that were suffering with the falling gold price sending down the prices of gold miners.

Northern Star (ASX: NST) shares were down 2.8% to $9.27 while Newcrest (ASX: NCM) shares were down 3.1% to $23.78 – leading the sector lower.

There was some positive news to offset the gloom in the mining and gold sectors with pharmaceuticals wholesaler API (ASX: API) adding an impressive 10.1% for the week to $1.46 after it decided to allow suitor Wesfarmers (ASX: WES) to do due diligence on its books.

Our biggest telco Telstra (ASX: TLS) also added 1.3% to $3.92 for the week after chief executive Andy Penn revealed a promising corporate strategy for the coming four years.

Myer jumps but AMP keeps falling

Even perennially troubled department store Myer (ASX: MYR) jumped 11.7% to 58c a share after it unexpectedly returned to profit but did not declare a dividend.

Some things never change though, with shares in fund manager AMP (ASX: AMP) falling to a fresh low below $1 at just 99c – a fall of 5.7% for the week and 36.5% this year.

The perennial disappointer has now fallen more than 81% over the past five years.

In other stock specific news, shares in financial software provider IRESS (ASX: IRE) fell 11% after suitor EQT Funds Management pulled out of its potential takeover.

EQT had offered as much as $15.91 per share for the acquisition but both parties were unable to agree to a transaction, with IRESS repeating its profit guidance of $164-$168 million for 2021.

Small cap stock action

The Small Ords index managed a slight 0.31% gain for the week to close on 3519.6 points.

Small cap companies making headlines this week were:

ioneer (ASX: INR)

North America’s only lithium-boron project is about to be developed after owner ioneer announced on Thursday it is joining forces with Sibanye-Stillwater.

Under the agreement, Sibanye-Stillwater will pay ioneer US$490 million for a 50% stake in the project with both parties to jointly progress Rhyolite-Ridge to production.

Once in production, Rhyolite-Ridge will be the largest lithium mine in the United States.

Argenica Therapeutics (ASX: AGN)

Argenica Therapeutics is gearing up for clinical trials of its neuroprotective peptide candidate ARG-007 in treating tissue death in stroke patients.

The company engaged two manufacturers to produce batches of the candidate drug, with both demonstrating they could generate the drug at scale while maintaining GMP quality and grade.

Argenica chief executive officer Dr Liz Dallimore said the manufacturers’ (AusPep and AmbioPharm) achievements allow development of the drug to progress to clinical trials with increased confidence in manufacturing and safety.

Legacy Minerals (ASX: LGM)

This week’s ASX gold debutant Legacy Minerals has been busy – reporting visible gold in drill core within days of listing during maiden drilling at its Harden project in New South Wales’ Lachlan Fold Belt.

Harden is the most advanced of Legacy’s projects which hosts numerous historical gold mines.

The exploration news follows the company’s ASX listing on Monday after a “strongly supported” $5.8 million IPO.

At the time of listing, Legacy managing director and chief executive officer Chris Byrne said the company had “numerous opportunities for discovery” across its “exciting portfolio”.

Metal Hawk (ASX: MHK)

Drilling at Metal Hawk’s Berehaven project in WA has unearthed massive nickel sulphides, which the company has likened to Kambalda komatiite-hosted nickel deposits in the region.

A portable XRF was used to analyse drill core from the first pass reverse circulation program at the project.

Assays from the program are anticipated within four weeks and Metal Hawk plans to complete downhole electromagnetics surveys to identify the strongest conductive zones for follow up drilling.

Toro Energy (ASX: TOE)

Toro Energy is current integrating the vanadium resource with the uranium resource block model in the first phase of a re-engineering study for its Lake Maitland deposit, which is part of its Wiluna project in WA.

The company plans to re-optimise the design for the deposit so it can be economically mined for uranium and vanadium while lowering the cut-offs.

Toro will then use the data to refine the processing stream for the project and ultimately increase the Wiluna’s project value.

Vintage Energy (ASX: VEN)

Gas explorer Vintage Energy has booked an “outstanding” 190% increase to the material gas resource for its Odin field in Queensland’s Cooper Basin.

ERCE undertook the independent estimate resulting in 2C contingent resources of 36.4Bcf, with 16Bcf net to Vintage.

“We were confident that Odin would over-deliver once extensive gas shows through a number of target zones were observed, but to have this confirmed and independently certified by ERCE is a massive boost for all concerned,” Vintage managing director Neil Gibbins said.

A resource calculation is underway for Vintage’s nearby Vali field.

The week ahead

Once again central banks will be the focus of investor attention with our own Reserve Bank board minutes from the September 7 meeting the main event,

We already know that the Board held official interest rates steady at 0.1% and that it will taper bond purchases from $5 billion to $4 billion a week to reflect the “delay in economic recovery’’ due to continuing lockdowns in Sydney and Melbourne for the Delta outbreak of COVID-19.

However, market watchers will be keen to see any more detail on that decision, given the fact that bond purchases could taper at a faster rate if the economy starts to snap back when lockdowns are loosened as vaccine coverage increases.

It is a similar situation in the US with the Federal Reserve Open Market Committee beginning a two-day policy meeting.

The surge in US COVID-19 Delta infections has caused a slower recovery in the jobs market and the Fed could choose to delay the tapering of its asset purchases until the November meeting.

Even the People’s Bank of China is getting in on the act but is widely expected to keep one and five-year prime rates steady at 3.85% and 4.65%.

Other local releases to watch out for include consumer confidence surveys, purchasing managers indexes, payroll jobs, skilled jobs and wealth figures which should deliver a gauge on how the Australian economy is coping with the lockdown pressures.

That picture is quite complex to read, with Commonwealth Bank data showing that Australians are actually saving money during the pandemic, due to government support payments and the inability to spend freely during lockdowns.

That has boosted overall Australian savings to a stellar $230 billion, although there are obviously some groups of people who are taking a financial beating while others are prospering.

Such a high level of savings could lead to a rush of spending once lockdowns finally begin to ease.