Life sciences group Invion Group (ASX: IVX) has progressed the development of its next-generation photodynamic therapy for the treatment of various illnesses, boosted by part proceeds of a $4.5 million capital raising.

In June, the company signed an agreement with RMW Cho Group to co-develop the latter’s Photosoft technology for the treatment of atherosclerosis and infectious diseases (including viral, bacterial, fungal and parasitic).

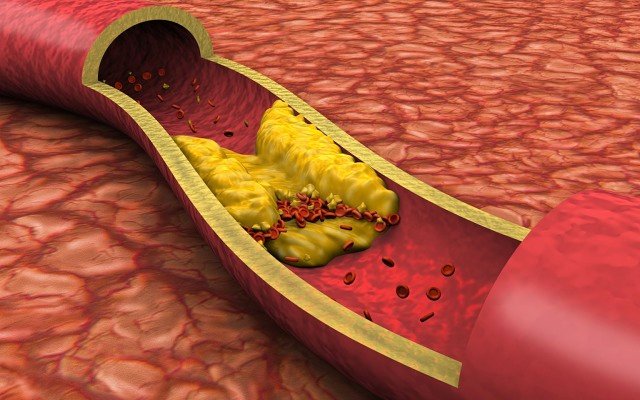

Atherosclerosis refers to the build-up of cholesterol, fat and other substances in arteries, and is a major cause of fatal heart diseases around the world.

Photosoft has to-date, been tested for its ability to treat a range of cancers but the new agreement extends that application.

Under the terms of the partnership, Invion undertook a $4.5 million capital raise via a share placement and paid RMW a $2.25 million one-time fee for the licence.

Invion agreed to issue 321 million fully paid shares to the new professional and sophisticated investors at an issue price of $0.014 each to raise the money (before costs).

Photodynamic therapies

While the new indications represent a significant opportunity for Invion, the company’s primary activity in the quarter continued to be focused on developing the next generation of photodynamic therapies for treating cancers.

Invion’s research partner Hudson Institute of Medical Research is undertaking additional proof-of-concept work on Invion’s improved active pharmaceutical ingredient (API) known as INV043 to study its effect on immune responses, as well as exploring its potential to work alongside other therapies.

The study follows promising findings from initial proof-of-concept results released in May where significant regression was observed in vivo in T-cell lymphoma, triple negative breast and pancreatic cancer models when a photoactive INV043 was applied.

Quarterly financials

Invion held a $2.9 million cash reserve at the end of the quarter, representing an increase of approximately $1.9 million on the previous period.

Its cancer program remains fully funded through a research and development agreement with RMW whereby Invion invoices RMW on a monthly basis.

The company recorded a cash outflow of $350,000 from operating activities, while primary areas of expenditure were research and development at $800,000 and administration and corporate costs at $370,000.

Proceeds from the share placement contributed $4.5 million to Invion’s cashflow and was followed by a $2.25 million outflow related to the one-off development payment to RMW.