Weekly review: investors reap half a trillion dollars in memorable year

WEEKLY MARKET REPORT

The Australian share market managed to rally on Friday to close virtually flat for the week but it is worth remembering what an amazing financial year we have just enjoyed.

The value of Australian shares jumped an amazing $560 billion for the year as the ASX 200 leapt 24% to record one of the best investment performances ever seen.

That followed on from a 11.3% fall in the previous financial year as the pandemic and lockdowns caused a serious dose of uncertainty which was finally overcome in March as record amounts of monetary and fiscal stimulus finally got things moving.

Rapid bull market brings home great returns

That performance makes it one of the best years on record as a rapid bull market built up speed and went through various sectors in waves – making it a great year for passive investors who follow the index but a more challenging one for active investors who had to keep up with some quick changes in fashions.

It was a broad-based rally with all sectors except utilities ending up higher and a rising index recorded in all but one month.

Technology stocks were flying in the first half as tiny interest rates and the growth of people working from home sped up growth themes and made online shopping, gaming and streaming much more appealing.

Fashions changed rapidly during the year

In the second half, price growth switched to the financials, consumer discretionary and communications sectors, although after falling during most of the second half, technology stocks once again rose in the last couple of months.

The market also cycled a little between growth themes and value as investors switched from the prospect of glowing future earnings and the certainty of a current cheap price.

Surging prices helped mining investors

Mining investors had plenty to cheer about with surging commodity prices such as iron ore and copper pushing to record highs and even coal prices rose bravely in the face of Chinese import bans.

Real estate also had a bumper year which helped to buoy the banks, which rode a wave of refinancing and happily recycled cheap Reserve Bank money for a cut which saw bank shares take off.

It is a trend that might have further to run with bad debt provisions on the wane, increasing the chances of some share buybacks and with higher dividends providing some tailwinds.

Energy points higher

On Friday is was a late surge in the energy sector which pushed the ASX 200 up by 0.6% to a close of 7308.6 points, just 0.6 points higher for the week.

Telstra (ASX: TLS) finished off a strong week with a 0.8% rise to $3.79.

Investors liked the idea that Telstra would be returning a big chunk of its $2.8 billion tower sale to shareholders.

Conflict at the OPEC+ meeting on Thursday night helped to nudge oil prices higher, which helped push Woodside Petroleum (ASX: WPL) up 3% on Friday to $22.95, while Santos (ASX: STO) gained 1.1% to $7.13 and Oil Search (ASX: OSH) rose 1.3% to $3.86.

Small cap stock action

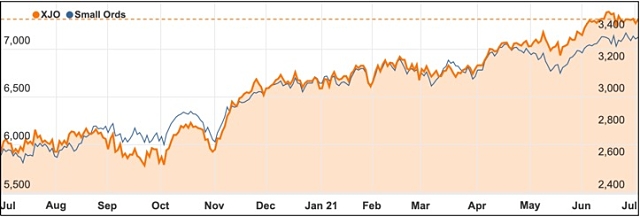

The Small Ords index slipped 0.79% this week to close on 3376.4 points.

ASX 200 vs Small Ords

Small cap companies making headlines this week were:

AML3D (ASX: AL3)

Leading global aerospace company Boeing has contracted AML3D to manufacture a 3D printed mandrel tool from Invar-36 material.

AML3D will manufacture the tool using its proprietary wire additive manufacturing technology.

This initial contract is for one tool, which will be assessed for its mechanical properties, internal soundness and vacuum integrity, along with how well it meets Boeing’s specifications.

Although the deal is valued at under $50,000, AML3D anticipates it will lead to future collaborations and commercial benefits.

Amplia Therapeutics (ASX: ATX)

Melbourne-based Amplia Therapeutics will advance its AMP945 drug for treating pancreatic cancer sufferers in a new collaboration with Sydney’s Garvan Institute of Medical Research.

The collaboration paves the way for Amplia to access Garvan’s extensive clinical research network and benefit from its research in focal adhesion kinase biology, which AMP945 is based on.

Amplia will fund studies using AMP945 in combination with gemcitabine for treating cancer, with pancreatic cancer the initial focus.

As part of the agreement, Amplia will have first rights to any new IP arising from the collaboration.

Investigator Resources (ASX: IVR)

Aspiring silver producer Investigator Resources has debuted an updated mineral resource for its flagship Paris project in South Australia’s Eyre Peninsula.

The new resource totals 18.8Mt at 88g/t silver and 0.52% lead for 53.1Moz silver and 97,600t lead at a cut-off grade of 30g/t silver.

Within this resource is an indicated component of 12.7Mt at 95g/t silver and 0.6% lead.

The new estimate will feed into a pre-feasibility study which is due for completion in the September quarter.

Sayona Mining (ASX: SYA) and Piedmont Lithium (ASX: PLL)

Sayona Mining and Piedmont are step closer to their downstream lithium processing plans in Quebec after the Superior Court of the Canadian Province approved the companies’ joint bid to acquire North American Lithium (NAL) and its La Corne processing facility.

“It has been a long journey, yet we have now reached a major milestone towards our evolution into a leading integrated producer in North America,” Sayona managing director Brett Lynch said.

The companies have offered a total of C$196.2 million for NAL, with a cash component of C$94.4 million.

Sayona and Piedmont plan to build a lithium hub in Quebec, with a commitment to developing downstream processing capability within five years if production at NAL is a success.

In addition, Piedmont is taking a staged stake in London-listed IronRidge Resources (IRR) and its portfolio of lithium projects in the West African state of Ghana.

It has agreed to acquire a stake in IRR itself and also has options to earn into 50% ownership of the project and, importantly, its output.

The week ahead

Yet again the Reserve Bank will set the tone for investors with the Board meeting to discuss its monetary policy settings – not just interest rates but its yield curve target and bond purchases as well.

While rates are likely to remain on hold, analysts are expecting a bond buying package of around $50 billion to be announced over a six-month period.

There is a swag of local statistical releases as well, including retail sales for May which have been crimped by lockdowns, new house approvals, new motor car sales, inflation, job advertisements, consumer confidence, weekly payroll jobs and wages figures and underemployment

Overseas, the Independence Day holiday in the US will reduce the number of releases and will see their markets closed on Monday.

Minutes from the US Federal Reserve Open Market Committee’s June 15-16 meeting will be released, as will Chinese inflation figures.