With the silver price soaring, Investigator Resources (ASX: IVR) is offering investors an advanced project and thus leveraging to that robust metal price.

While much of the gold action at present involves project acquisition and early exploration, in the much smaller primary silver sector, there are projects that have advanced work and JORC resources but, until recently, have been stalled by a low metal price.

One instance is Investigator’s Paris silver project, Australia’s highest grade silver project, located 60km northwest of the town of Kimba in pastoral country on South Australia’s Eyre Peninsula.

Investigator has a resource of 9.3 million tonnes at an average 139 grams per tonne of silver and 0.6% lead for a contained 42 million ounces of silver and 55,000t of lead.

The indicated component stands at 4.3Mt at 163g/t silver and 0.6% for a contained 23Moz of silver and 26,000t of lead.

The silver cut-off grade is 50g/t. Investigator has said the silver grade emphasises the “high-grade and quality ounces of Paris compared with Australian peer silver deposits”.

New institutions join the register

Last week, the company raised $8 million through a share placement with its largest shareholder, London-based Merian Gold and Silver Fund, taking half of the total. Once the second tranche of shares are issued, Merian will hold around 15% of the stock.

Investigator said recent appreciation in the silver price saw significant demand from existing shareholders and institutional investors. A number of new institutions have now joined the Investigator register.

The new shares were issued a $0.03 per share and have already returned to their pre-issue price of over $0.04.

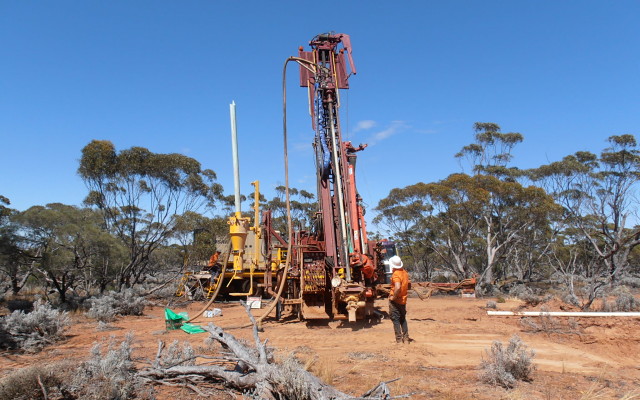

The money is to be used for resource drilling, development studies and further exploration around Paris, which the company describes as “possibly the best undeveloped silver deposit in Australia”.

With so much interest in silver at present, and so few primary silver plays on the ASX, Investigator is a company that now has the capacity and will to proceed to pre-feasibility studies (PFS).

Drilling program to add more silver to resource

Investigator managing director Andrew McIlwain said the company has been impressed by the demand for the silver story from investors.

“The Investigator team now have the capacity to complete the Paris PFS, where we will be seeking to enhance the outcome through drilling to add more silver to the project,” he said.

Drilling is expected to begin in early September. Infill drilling is included to advance the existing inferred segment of the resource to indicated status. Notably, each time Investigator has drilled at Paris the resource grade has improved.

The Paris resource is described as a shallow, high-grade silver deposit amenable to bulk open pit mining. The depth of mineralisation ranges from 5m to 160m below a flat terrain.

In its most recent presentation, Investigator said work on design of the open pit, capital and operating cost estimates and economic evaluation could be completed within nine months.

There are also numerous satellite targets near Paris, including the undrilled Xanthos with potential to host additional Paris style mineralisation.