Weekly review: invasion worries send ASX 200 down for the day but not the week

WEEKLY MARKET REPORT

Global worries about a potential Russian invasion of Ukraine and a disappointing result from global insurance giant QBE managed to send the Australian share market down by 1% on Friday.

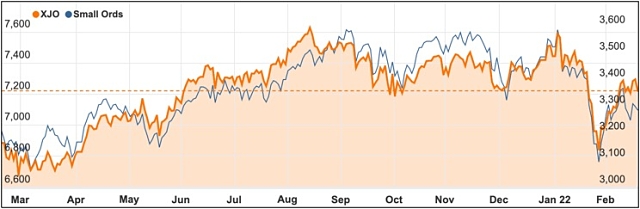

By the end of trade the ASX 200 had shed 1% or 74.5 points to 7221.7 points with all sectors closing lower, however the market still managed to record its third straight week of gains – although just 0.1% – as a reasonably positive profit reporting season acted as a buffer against greater falls.

Health stocks were some of the strongest for the week, buoyed by industry goliath CSL’s excellent profit performance.

Tech sector very weak as Nasdaq plunges

On the other side of the coin the tech sector continued to be a source of weakness as the tech-laden Nasdaq continued to plunge, down 2.9%.

Seek (ASX: SEK) shares closed down 4.9% lower while Afterpay owner Block (ASX: SQ2) was down 3.7% while accounting software company Xero (ASX: XRO) shares fell by more than 2%.

There was little respite for miners, with shares continuing to slide after China’s benchmark iron ore futures extended losses for a fourth straight session on the back of fears about government intervention.

QBE disappoints as disaster claims rise

QBE (ASX: QBE) shares were down by up to 11% before closing down 8.7% at $11.55, as investors remained disappointed that the profit turnaround was not much larger.

After last year’s loss of US$1.5 billion, QBE produced a $US750 million profit but that was lower than most forecasts and came with a disappointing dividend and a muted dividend forecast.

Natural disaster claims were higher than expected and were continuing to feed into higher insurance premiums and QBE took a conservative stance on increasing reserves as claims continued to come in above expectations.

Shares in chicken processor Ingham (ASX: ING) fell as much as 5% after it warned that mounting costs as a result of the Omicron wave would be felt in the second half.

Ingham reported an 8.8% rise in net profit to $38.4 million in the first half.

Origin woes on closing power stations early

Also in the wars was power company Origin (ASX: ORG) with shares falling a further 8.3% as investors digested news that it was going to close Australia’s biggest coal power plant, Eraring, many years earlier than planned.

One of the few good news stories of the day was beleaguered fund manager Magellan Financial ASX: MFG) with its shares rising an impressive 18.5% after it reported a 24% rise in its interim net profit of $251.6 million and a dividend of $1.10 per share.

A 12% rise in average Funds under management (FUM), a 23% increase in total revenues and a 13.4% hike in its dividend plus plans for an on-market share buyback helped to restore some lost confidence.

It was also a good day for gold miners after the price if the yellow metal rose above US$1,900 for the first time since June as the threat of a potential Ukraine invasion caused investors to flock to the safety of gold.

Small cap stock action

The Small Ords index fell a marginal 0.2% for the week to close at 3292.2 points.

ASX 200 vs Small Ords

Small cap companies making headlines this week were:

Simble Solutions (ASX: SIS)

Well known executive and investor Dr Daniel Tillett has joined Simble Solutions to help propel growth of its ESG SaaS technologies – CarbonView and SimbleSense.

Dr Tillett is executive director and chief scientific officer of Race Oncology where he has helped build the company from a $5 million market cap in 2019 to its current value of around $500 million.

He also founded private Australian company Nucleics, which sells SaaS DNA sequencing software to companies and institutions around the world.

iTech Minerals (ASX: ITM)

Shallow drilling at iTech Minerals’ Eyre Peninsular landholding is making rapid headway, with the company reporting it has completed more than 130 holes for 2,300m.

The company has completed 62 holes at the Ethiopia prospect in search of kaolin and REE in ionic adsorption clay (IAC REE). At the Bartels prospect 49 holes have been finished, while at Burtons 18 out of a planned 50 have been undertaken.

Bartels and Burton are both believed prospective for IAC REE. A rig will then move to Caralue Bluff where it will complete 194 holes and target kaolin mineralisation.

Initial assays are expected in about four weeks.

Navarre Minerals (ASX: NML)

More high-grade gold has been intercepted from 2021 drilling at Navarre Minerals Crush Creek project in Queensland’s north.

Crush Creek is part of Navarre’s recently acquired Mt Carlton operation, with drilling aiming to build new deposits to extend the mine life.

Drilling at the BV7 prospect generated notable results of 3.1m at 211.6g/t gold from 94.8m; 5m at 9.2g/t gold from 96m; 4m at 5.1g/t gold from 101m; and 14.3m at 3.5g/t gold from 121m.

Lotus Resources (ASX: LOT)

With a definitive feasibility study targeted for mid-year, Lotus Resources unveiled a 23% upgrade to resources for its Kayelekera uranium project in Malawi this week.

The mineral resource for Kayelekera now totals 46.3Mlb of uranium grading 500ppm. Within this, 81% is classified as measured and indicated – amounting 37.4Mlb of contained uranium.

Underpinning the resource upgrade was continuing positive drill results, along with a lowering of the cut-off grade form 300ppm uranium to 200ppm. The cut-off grade has been reduced due to positive ore sorting test work and a strengthening uranium market.

ioneer (ASX: INR)

Offtake partner EcoPro Group has increased its lithium carbonate purchase commitment from ioneer’s proposed Rhyolite Ridge lithium boron mine in Nevada.

EcoPro will now procure 7,000tpa of lithium carbonate from Rhyolite Ridge over an initial three years – up from the previous 2,000tpa commitment.

This accounts for about 34% of the 22,000t proposed annual lithium carbonate production from Rhyolite Ridge.

Wellnex Life (ASX: WNX) and Australian Dairy Nutritionals (ASX: AHF)

A joint venture has been made official between Wellnex Life and Australian Dairy Nutritionals that will see the duo launch Australia’s first organic A2 infant formula.

The A2 milk will be sourced from Australian Dairy Nutritionals’ farms and distributed through Wellnex’s retail and pharmacy network.

Sold under the Ocean Road Dairies brand, it is expected the infant formula will be available throughout 500 stores nationally by the end of the current financial year ending June 2022.

The week ahead

Military action or otherwise in Ukraine will obviously be a driving force for markets in the coming week with news on inflation, jobs and wages also a clear focus.

On Wednesday, the release of the Wage Price Index by the Australian Bureau of Statistics is expected to show wages rose by about 2.5% for the year – still short of the 3% target eyed by the Reserve Bank but at least a bit higher than in recent years.

One of the more important releases for the week will be the US estimates of economic growth and inflation, which are out on Thursday and Friday respectively.

Other figures to watch out for include local measures of conditions in the manufacturing and services sectors, with potential commentary on supply-chains and labour market issues.

Consumer sentiment, credit and debit card spending and household spending will all be an indication of whether consumers are starting to make a dent in their pandemic savings while figures on construction, business investment, average weekly earnings and the job market will round out the economic picture.

The continuing profit reporting season will also play a big role in the direction of the share market with reports from Super retail group, BlueScope Steel, Coles, Seven Group, Cochlear, Rio Tinto, Woolworths, Nine Entertainment, Qantas and Medibank amongst a host of other household names.