Data analytics and software solutions company InFocus Group (ASX: IFG) has formed a new business unit to house its digital ventures activities within its broader data intelligence and software solutions operations.

InFocus Digital Ventures will build upon the company’s core capabilities in frontier technologies such as digital assets, AI, and big data, while seeking next-generation concepts in regulated digital asset markets and blockchain ecosystems across the Asia-Pacific region and beyond.

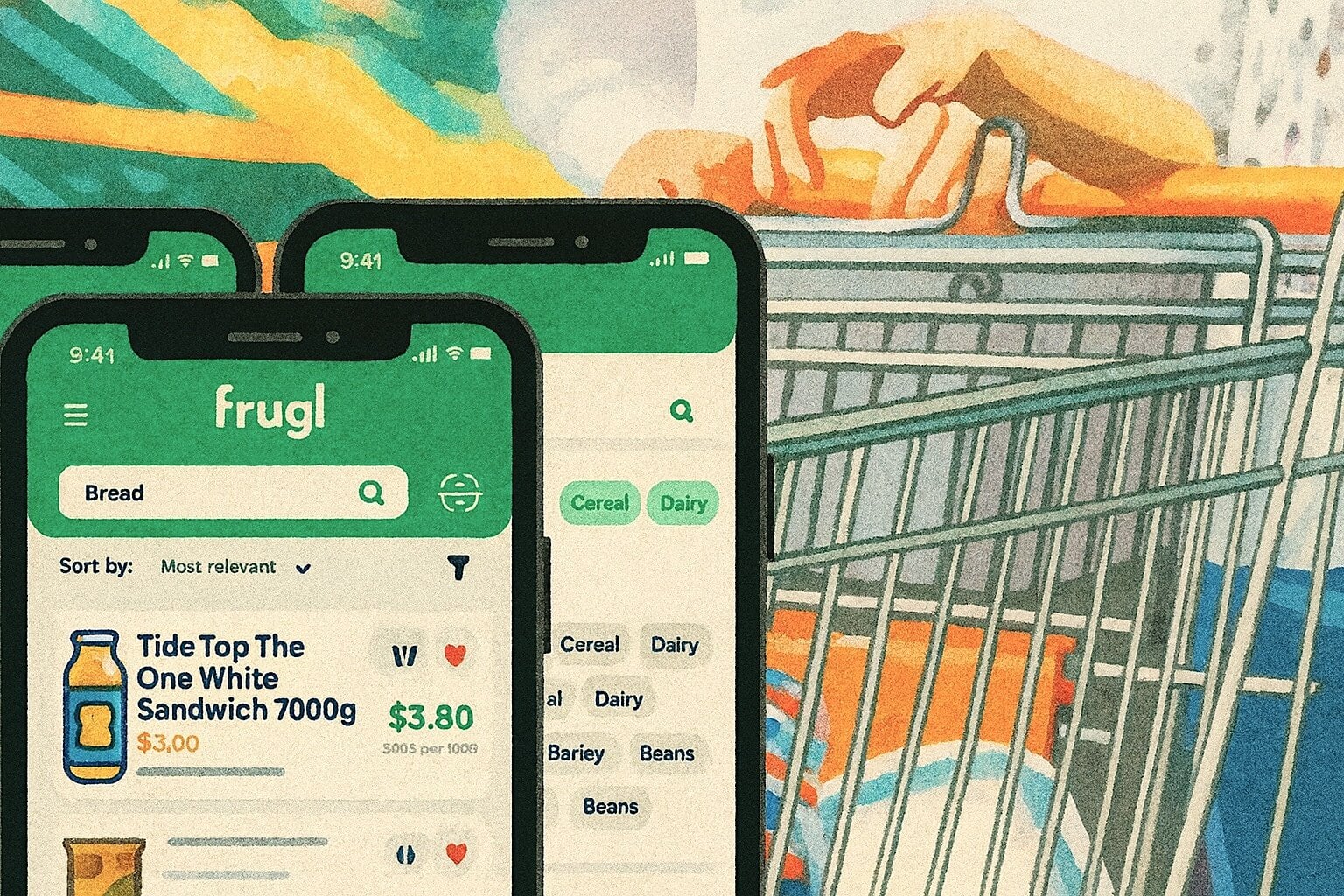

Current projects under consideration include a gamification element to the Frugl grocery app, which may introduce rewards points and other incentives for future users, while the new unit will also manage further developments to the US$3.25 million iGaming project with Taiwanese company TG Solutions, and the US$1.5m stablecoin-based payments platform projects for social gaming company GBO Assets.

Mythos Group Engagement

InFocus has engaged digital asset holding company Mythos Group to advise on blockchain integration strategies tailored to its digital ventures objectives, as well as guide tokenisation initiatives, provide expertise in digital asset governance, regulatory compliance and risk management, and evaluate partnership and investment opportunities.

Mythos will also deliver insights on emerging trends, market dynamics and technological innovation in the cryptocurrency space, assist with the development of digital asset product offerings, go-to-market strategies, and customer engagement models, and facilitate education and upskilling for InFocus’ leadership team in the areas of blockchain, cryptocurrency and digital asset best practices.

Mythos has provided InFocus with up to $10 million in conditional funding for future projects, structured as convertible notes with a face value of $1,000 each and a fixed conversion price of $0.015 per share.

Bitcoin ETF Investment

Mythos will advance an initial $2.5m that InFocus will temporarily invest in the Monochrome Bitcoin ETF, providing the company with indirect bitcoin exposure, along with a $2.5m loan (at 10% interest per annum) to help develop InFocus Digital Ventures.

InFocus will divest this investment for cash as soon as it requires working capital and funding for new business ventures, and may retain some of the holding for customer and supplier agreements that enable payment in bitcoin.

Chief executive officer Ken Tovich said the Digital Ventures business unit would benefit from Mythos Group’s leadership.

“Mythos is the expert in digital assets, cryptocurrency and digital ventures and accepting this financing facility provides us with the tools, capabilities, strategic team, and funding to develop next-generation digital ventures concepts built upon our existing platform,” he said.