IMF expects worst economic fallout since The Great Depression

The International Monetary Fund expects 170 countries to experience negative per capita income growth in 2020.

International Monetary Fund (IMF) managing director Kristalina Georgieva has delivered a sombre message about the impact of the COVID-19 pandemic, warning that the IMF is expecting the worst economic fallout since The Great Depression.

However, Ms Georgieva in her video address stressed the positive, indicating the resolution with which the fund is confronting the pandemic’s effects.

“These are the times for which the IMF was created — we are here to deploy the strength of the global community, so we can help shield the most vulnerable people and revitalise the economy,” she said.

But she did not underplay the gravity of the threat facing the global economy.

“We are still faced with extraordinary uncertainty about the depth and duration of this crisis.”

Just three months earlier, the IMF had expected positive per capita income growth in 2020 from more than 160 member countries.

“Today, that number has been turned on its head: we now project that over 170 countries will experience negative per capita income growth this year,” Ms Georgieva said.

This week, the 189 members of the IMF will link by video to determine the actions that need to be taken.

Everybody to get hurt

Ms Georgieva said the “bleak outlook” regarding the negative impact of COVID-19 applies to advanced and developing economies alike.

“This crisis knows no boundaries. Everybody hurts,” she said.

The IMF recognised that among the worst hit will be those working in retail, hospitality, transport and tourism.

In most countries, the majority of workers in these sectors are either self-employed or employed by small and medium-sized companies.

Vulnerable countries to be hit hardest

In the past two months, more than US$100 billion (A$156.5 billion) in portfolio money has been pulled out of emerging markets.

The amount is three times larger than the money that fled emerging markets in the first two months of the 2008-09 global financial crisis.

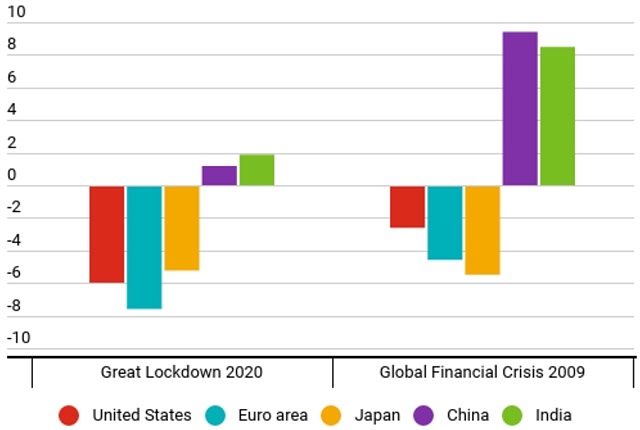

Real GDP growth by year-on-year percentage change.

Commodity exporters are taking a double blow from the collapse in commodity prices.

“And remittances — the lifeblood of so many poor people — are expected to dwindle,” Ms Georgieva said.

Gross external funding needs for emerging markets and developing countries will need to be in the trillions of dollars, she added.

Governments spring into action

The IMF will this week release figures showing that countries around the world have taken fiscal actions totalling about US$8 trillion (A$12.5 trillion).

Ms Georgieva said it is encouraging that countries are coordinating their actions.

“Many of the poorer nations are also taking bold fiscal and monetary action … and with far less firepower than their rich country counterparts,” she said.

IMF’s four-point plan

The IMF has set four priorities for dealing with this looming economic crisis.

The first is to continue with essential containment measures and support for health systems, as Ms Georgieva said defeating the virus and defending people’s health is necessary for economic recovery.

The IMF believes the second priority should be shielding affected people and companies with large, timely and targeted fiscal and financial measures, including tax deferrals, wage subsidies and cash transfers.

The third consideration is to reduce stress to the financial system and avoid contagion. Ms Georgieva noted banks have built up more capital and liquidity over the past decade and said their resilience will be tested.

The fourth priority outlined by the IMF involves a plan for recovery. According to Ms Georgieva, this requires careful consideration of when to ease restrictions on a gradual basis, with the world needing to move quickly to build demand as the global economy stabilises.