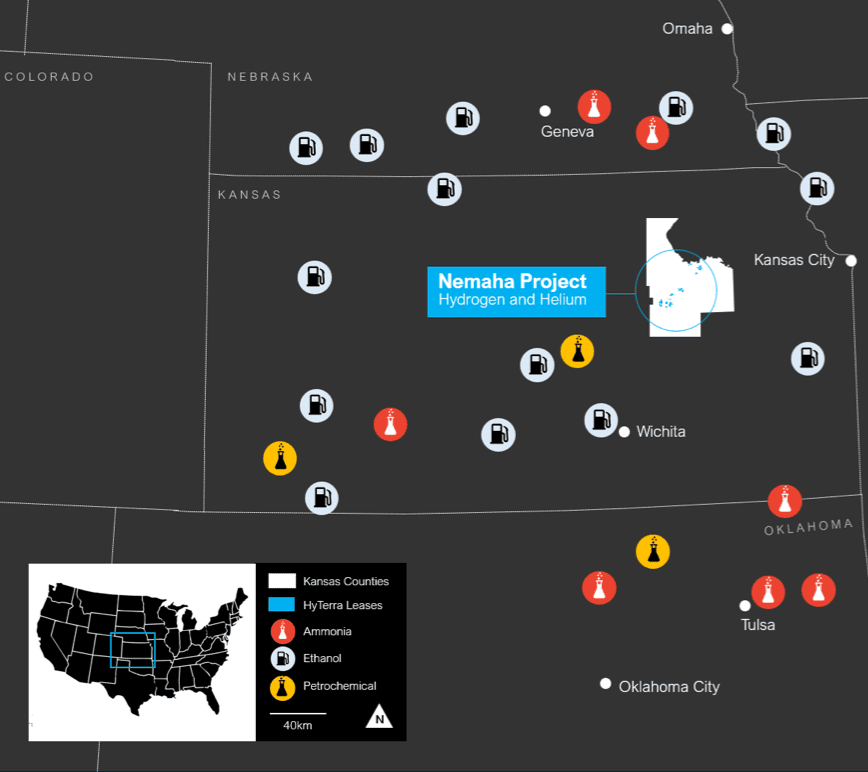

HyTerra (ASX: HYT), the first “white” hydrogen-focused company to list on the ASX, is exploring for natural hydrogen and helium resources near major industrial hubs in the Mid-West USA.

HyTerra has added momentum to its hunt for a low-carbon feedstock with the acquisition of additional exploration leases at its Nemaha Project in Kansas.

The company has increased its 100%-owned exploration position in the area by 30%, with Nemaha expanding from 9,607 to 12,720 acres.

Datasets have linked the new leases with the existing leases to deliver a prized tenement package with contiguous subsurface geology and promising white hydrogen and helium prospectivity.

Nemaha is one of HyTerra’s key assets in its strategy to develop a high-value, white hydrogen business in the US.

Demand for natural white hydrogen, which offers lower costs and a cleaner alternative than hydrogen created from gas or water, is expected increase from around 90 million tons (Mt) to as much as 585Mt by 2050 according to McKinsey.

Middle America the centre of hydrogen

Kansas has been the focal point for natural hydrogen exploration activity globally because of its favourable geology, first and foremost, as well as its location in the heart of an American industrial precinct where hydrogen can be put to good use – such as ammonia production to create green fertiliser.

HyTerra has already identified the potential for Nemaha to be connected via railways, roads and/or pipelines to multiple nearby off-takers.

The private US hydrogen sector in the USA is also starting to flex some muscle with white hydrogen explorer Koloma recently raising US$245 million from several heavyweight investors including Amazon and Bill Gates.

The US Government is also throwing billions in incentives at hydrogen development to investigate its potential as a new energy source and low carbon molecule.

Drilling ahead

The company is currently working on the design of two exploration wells it plans to spud in the third quarter of 2024.

Its north-western leases are geologically contiguous with the Sue Duroche 2 well, which intersected up to 92% hydrogen and 3% helium in 2009.

Planning for the wells has included matching information from an airborne geophysical survey HyTerra acquired over the leases in 2023 with existing seismic data – any crossovers will be in the company’s drilling crosshairs.

Leading the exploration campaign are HyTerra executives Ben Mee and Avon McIntyre. Both are former Shell petroleum geologists with significant discoveries under their belt.

Capital raising

To help fund the upcoming drilling programme at Nemaha, HyTerra announced in late March it was undertaking a placement and fully underwritten pro-rata non-renounceable rights issue to raise up to approximately $6.1 million.

Hydrogen heating up

Positive drilling results for hydrogen and helium have had a huge impact on other listed plays over the past half year or so.

Since elevated hydrogen and helium were detected in its Ramsay 1 Well in October last year, Gold Hydrogen (ASX: GHY) has bounced from around A$0.22c to A$1.82.

Meanwhile, Pulsar Helium (TSXV: PLSR) has jumped from C$0.50 to around C$1.17 since February when the company announced it had encountered helium in the Jetstream appraisal well at its Topaz Project, Minnesota, USA.