How to value Afterpay shares?

Block completed its $39 billion acquisition of Afterpay earlier this year.

How much is buy now, pay later stock Afterpay worth?

It is an intriguing question but a very difficult one to answer after the stock was sold off after payments giant PayPal entered the field with a “pay in 4” instalment product released in the United States.

It is also a very important question to answer after Afterpay (ASX: APT) literally came from nowhere to install itself in the top 20 companies in Australia.

When you suddenly have a share price as volatile as Afterpay’s which is capable of moving the entire Australian market down – which happened with the PayPal announcement which saw Afterpay shares fall 8% – all investors need to pay attention and not just those millennials clever enough to have jumped on the Afterpay bandwagon early.

It is also a live question for Australia’s sharebroking community, which at this stage seem to be split into two main camps – those on the buy side that automatically upgrade their price forecasts to somewhere above the current share price to stay ahead of the game or those who are highly sceptical about Afterpay’s valuations, future growth projections and hype.

Similarly, Australian institutions have not been big early investors in Afterpay, although index funds would have been big buyers as the stock soared up the charts.

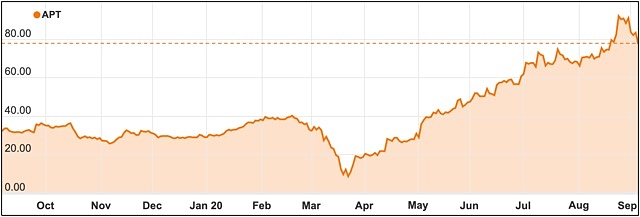

Afterpay share price chart.

That situation should now change, given that at the very least the PayPal intervention will bring to a head the arguments over the durability and remaining growth behind Afterpay and its crew of listed “mini-me’’ buy now, pay later companies such as Sezzle (ASX: SZL), Zip (ASX: Z1P) and Splitit (ASX: SPT).

Afterpay has boosted the ASX 200

Since the start of the year, Afterpay has on its own added an amazing 44 points to the S&P/ASX 200 Index, effectively going against the tide as the index lost hundreds of points.

According to the sceptics, the arrival of PayPal takes away the unlimited growth potential for Afterpay in the US, given that PayPal already has a massive customer base or around 26 million merchants and 324 million users.

If PayPal finds success with its defensive “pay in 4’’ product, that mass of existing customers and data will become a formidable obstacle given that Afterpay needs to grow its base of customers and merchants to support its current valuations.

It could also mean that Afterpay’s merchant fees will come under pressure – something that hasn’t happened so far because retailers desperate for sales are happy to pay for access to Afterpay’s younger customer base.

Afterpay not concerned about new competitors

Afterpay chief executive Anthony Eisen insists that the two platforms are very different, with PayPal offering a “transaction solution’’ while Afterpay offers a much more customised and dedicated platform that its customers love to use.

“Competition from traditional and newer players has been present throughout our journey – we expect this to continue but it will not change our strategy or diminish our global opportunity,” he said.

He has a point given that since its inception, Afterpay has overcome the many doubters and grown like topsy, with younger users loving the simple idea of paying by instalments over time and ditching what they see as rapacious, high interest credit cards.

Afterpay’s financial results were also encouraging, with expected net transaction losses (NTL) to come in lower for the full-year, while pre-tax earnings were expected to come in significantly higher.

Afterpay now expects its FY20 Net Transaction Losses (NTL) – represented as a percentage of underlying sales – to hit 0.38% for fiscal 2020, representing an improvement of 17 basis points on prior guidance.

Quite simply, Afterpay’s predominantly younger users love the flexibility of the system and would do anything to keep access to it – which is why bad debts are so low and critics who talked about credit risk have so far been proved wrong.

By missing a payment, users can no longer use Afterpay so there is a strong incentive to pay up on time.

Afterpay shows why buying shares is so important

In a broader sense, Afterpay’s success so far shows the importance of using the Australian share market as a means to generate wealth.

Only founded in 2015 by Anthony Eisen and Nicholas Molnar and listed on the ASX in April 2016, Afterpay originally offered 25 million shares at $1 each for a total market capitalisation of $165 million soon after listing, with the money raised being used to finance the company’s stellar growth.

Even after being crunched by PayPal, Afterpay shares were trading at $83.79 on Thursday for a market capitalisation of $23.39 billion – a stunning growth rate which in the old parlance would be an 83 bagger.

The two founders this year passed $1 billion each from their stakes in Afterpay – Nick Molnar at the tender age of 30, making him the youngest self-made billionaire in Australia.

Under a current plan to sell down their stakes they will each collect around $135 million but their remaining stakes in the company are still worth north of $1.5 billion.

For investors who took part in that original float, a $10,000 stake would now be worth $837,900 – a staggeringly fast rise.

So how did all of this wealth suddenly appear?

The answer is a combination of a relatively simple idea, spectacular local and international growth and good management that stayed focussed through some very tough times.

Wealth born out of simplicity

The idea behind Afterpay is simplicity itself – it is the old “buy now, pay later’’ concept that has been around in retailing for a very long time indeed.

Those who are old enough might even remember Waltons, a retailer that controversially sold a lot of their products to poorer customers using a series of lay-by payments.

However, rather than link that concept to a single store or chain of stores, Afterpay took the model of paying by instalments without interest and applied it to any online or physical store that joined their network.

Customers only pay fees when they miss a payment.

Retailers and customers all happy

Merchants loved the idea because it lifted sales at a time when retailing was struggling and shoppers – particularly but not only millennials – also loved the increase to their purchasing power and the simplicity and built in discipline of Afterpay compared to credit cards and other means of purchase.

Afterpay gets paid merchant and transaction fees by retailers that use its service but many of them view these fees as a reasonable cost to get higher sales.

Copycats and critics galore

There have been plenty of critics all the way through the Afterpay story – some thought it was effectively lending without credit checks and others called for much stricter regulation to bring Afterpay into line with banks and other credit card issuers.

And of course, there have been a plethora of companies copying the Afterpay model – many of which have also been highly successful, although Afterpay continues to enjoy a first mover advantage and rapid international growth in the US and UK.

COVID-19 provided great opportunity to buy Afterpay shares

The toughest time for Afterpay was when the share price crunched during the earlier stages of the COVID-19 pandemic this year, although that period also offered investors a great second chance to jump on board the Afterpay growth train.

Amid doubts about how the untested instalment payment model would work in a recession when unemployment rose rapidly and was concentrated on Afterpay’s millennial customer base, Afterpay shares quickly sank by 68% to just $12.44 on March 20 – at one stage falling 33% on one day.

That slashed the value of shares owned by Afterpay’s founders, Nick Molnar and Anthony Eisen, to just $261 million each – a far cry from their current worth of $1.54 billion just a few months and a share sell down later.

That downturn was short lived though, with US expansion and a major deal with Chinese giant Tencent, turbocharging Afterpay’s shares into their current lofty heights.

Afterpay hits back at critics

Afterpay has been countering critics of its instalment payment system too, describing it as a budget management tool and pointing out that the service can’t continue to be used by customers with just one overdue payment.

More than 90% of the group’s monthly underlying sales are generated by repeat customers and around 75% of its sales are through online channels.

Where the Afterpay share price goes from here is an open question but with a business model that is embraced by customers and retailers alike, significant room for offshore expansion, pandemic-driven growth in online sales and ready access to capital through its share market listing, the main impediments to continued growth would appear to be regulatory and competitive.

So far, Afterpay has managed to convince regulators that it is not offering unregulated credit but it remains susceptible to unfavourable regulatory outcomes that could reduce the attractiveness of its business model.

The entry into the buy now, pay later space of massive companies with established customer bases like PayPal is certainly a challenge but Afterpay has been successfully staring down much bigger rivals such as the bog banks since its inception.

Valuation question remains unanswered

All of which leaves the question of how to value a company like Afterpay.

There are all sorts of models that could be used but, in the end, it will be the fight between buyers and sellers on the share market that arrives at what the company is worth.

That means the share price for Afterpay will continue to be volatile – certainly compared to the big banks, miners and CSL that accompany it in the ASX 20.

That volatility could propel it all the way to the top of those 20 companies or much further down the index outside the top 20.

We’ll just have to wait and see which future the market – and Afterpay’s international growth – decides on.

However, it would be a brave investor who wrote off Afterpay’s chances – and a brave investor who bought in at these prices for a volatile ride.