Weekly review: hot US inflation takes shine off good week for Australian shares

WEEKLY MARKET REPORT

A hot inflation number out of the United States was the only excuse required to sell down Australian shares on Friday, although that still left us with a winning week.

While Wall Street was sharply lower with the S&P 500 down 1.8% on Thursday as US consumer prices rose at an annual 7.5% – the fastest since 1982 – the reaction in Australia was a little more muted with the ASX 200 down 1% or 71.2 points to 7217.3 points.

Particularly hard hit in Australia were technology stocks, with the tech index down 3.8% as the inflated valuation of their US cousins were sliced on the back of fast rising 10-year bond yields, which rose above 2% for the first time since 2019.

Local tech index down but still up for the week

However, even that backwards step still left the local tech index up more than 2% for the week, failing to undo a positive streak in the middle of the week.

The standout sector in Australia after a long time on the sidelines was the banks, with the index up 4% on the back of some really strong numbers out of the Commonwealth Bank (ASX: CBA) and NAB (ASX: NAB) during the week.

It was a great week for travel stocks with the re-opening of international borders sending shares in Flight Centre (ASX: FLT) up 18.6% with Webjet (ASX: WEB) shares also up 17.5% and Corporate Travel Management (ASX: CTM) shares up 12.9%.

Iron ore miners end the week strongly

Also notable performers for the week were the big iron ore miners, with a 5% rise in the price of iron ore on Thursday night pushing the materials sector to be the only one to close in positive territory on Friday.

Rio Tinto (ASX: RIO) and Fortescue (ASX: FMG) both added more than 2% while the more diversified BHP (ASX: BHP) was still up 1.2%.

Growth in premiums pushed IAG higher

Company specific news was also enough to overcome the downdraft from US markets, with insurer IAG (ASX: IAG) having a fantastic day, with shares closing up more than 4% higher at $4.74.

That was natural consequence of strong half year earnings with a 6.2% rise in gross written premiums, which led to an upgraded growth forecast.

A 4.4% fall in revenues and 58% drop in insurance profits and 10.8 basis point slump in insurance margins failed to take the shine off the strong growth.

Magellan still losing funds to manage

There were some negative impacts from company specific news with shares in fund manager Magellan Financial Group (ASX: MFG) down 4.9% to $18.11 after it announced funds-under-management had fallen to $87.1 billion – down 6.8% since the end of January and by 8.8% since the start of the year after net outflows and the termination of St James’s Place mandate.

Shares in Baby Bunting Group (ASX: BBN) slipped 3% to $5.27 despite posting a 10% increase in revenue, an 11% increase in net profit and a 13.8% increase in their interim dividend to 6.6 cents a share.

Online sales grew by 32.6% and now make up 23.8% of total sales but increased investments and other Covid-19 related costs saw the retailer increase its costs of doing business by 1.25% to 30.2%.

Small cap stock action

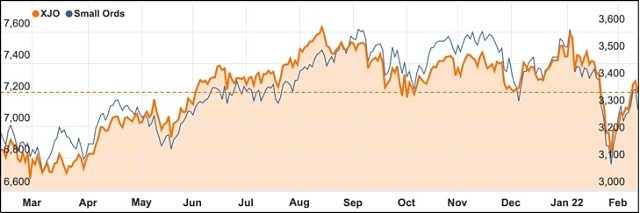

The Small Ords index rose 0.85% for the week to close on 3298.9 points.

ASX 200 vs Small Ords

Small cap companies making headlines this week were:

Rectifier Technologies (ASX: RFT)

Impressing investors in the small cap space this week was Rectifier Technologies with news it had received purchase orders, which, combined, were worth US$20 million (A$27.9 million).

Tritium Pty Ltd issued the binding purchase orders for Rectifier’s 35kW high-voltage and high-efficiency modular power supply units for DC electric vehicle charging.

The power supply units will be delivered to Tritium by the end of the year.

Rectifier says the substantial order is a “significant milestone” for the companies that have worked together since 2017.

Odin Metals (ASX: ODM)

Maiden drilling at Odin Metals’ Cymbric Vale prospect within its flagship Koonenberry project in New South Wales has intercepted high-grade copper.

The company received assays from the first 12 scout reverse circulation holes drilled at the prospect.

Notable results were 11m at 1.9% copper from 35m, including 6m at 3.2% copper from 37m; 7m at 1.08% copper from 48m; and 10m at 0.88% copper from 11m.

Odin is planning multiple more drilling programs at Koonenberry over the course of 2022, with assays pending from RC drilling at the Grasmere prospect, which has a historic resource of 5.75Mt at 1.03% copper, 0.35% zinc, 2.3g/t silver and 0.05g/t gold.

Kalamazoo Resources (ASX: KZR)

Kalamazoo Resources is the first gold-lithium explorer in Australia to secure certified carbon neutral status under the Federal Government’s Climate Active program.

Carbon neutral certification is granted to companies that have reached net zero emission. Securing certification requires businesses to calculate the greenhouse gas emissions it generates then work to reduce these as much as possible.

Any remaining emissions can be mitigated by purchasing carbon offset units, which in Kalamazoo’s case involves participating in the Western Farm Trees reforestation program in WA’s wheatbelt.

Chairman and chief executive officer Luke Reinehr said the company was focused on minimising the impact of its exploration activities both in WA and Victoria.

iCandy Interactive (ASX: ICI)

Gaming investment company iCandy Interactive has acquired a 51% interest in South East Asia-based Digital Games International that trades under the name Storms.

Storms was acquired in exchange for $8 million iCandy shares.

Founded two years ago by Singtel, Advanced Info Service (AIS) and SK Telecom, Storms has rapidly grown with 2021 revenues amounting to $4.3 million, which was a 1,400% increase on 2020.

iCandy’s rationale for the acquisition is to leverage Storms’ extensive games publishing network, and expand its metaverse ambitions.

The week closed out with iCandy announcing it had officially completed its acquisition of Lemon Sky Studios, which is known for developing AAA games and working on titles such as Call of Duty Infinite Warfare, Need for Speed Hot Pursuit, Spider-Man and Marvel’s Avengers.

Combined, iCandy and Lemon Sky are already building a new pipeline of three generative arts NFT projects and nine NFT and metaverse-based game titles.

Mako Gold (ASX: MKG)

West African-focused gold explorer Mako Gold has rigs on the ground at its flagship Napié and nearby Korhogo projects in Cote d’Ivoire.

The company launched a scout aircore drilling program this week at Napié that will total 15,000m and target regional discoveries outside of the main Tchaga and Gogbala prospects.

Over at Korhogo, a 7,000m auger drilling campaign is underway, with two rigs working together to refine targets for a follow up 10,000m aircore program.

Mako is confident that Korhogo hosts large gold deposits.

K-TIG (ASX: KTG)

It was a big week for welding technology developer K-TIG with the announcement of two new research and development projects.

On Tuesday, K-TIG revealed it was building a new R&D facility within BAE Systems Australia’s Factory of the Future. This factory is located within South Australia’s Tonsley Innovation District.

K-TIG’s R&D facility will seek to demonstrate its technology across a number of industrial applications.

This news was followed up with K-TIG announcing a partnership with UK-based Nuclear Advanced Manufacturing Research Centre to create turnkey robotic welding cell to produce stainless steel nuclear storage containers.

The cell will be developed within a nuclear industry technology demonstration facility, with the aim of supplying containers for waste during decommissioning of the Sellafield nuclear site near Cumbria.

The week ahead

The biggest thing to look forward to in the coming week is the January labour force estimates, which are expected to show employment increased by about 45,000 jobs in January, with the participation rate expected to be nudging a near record at 66.2%.

The strong jobs market is coaxing plenty of new entrants to dip a toe in the water and the unemployment rate could drop towards 4%, which would be a 14-year low.

Other releases to watch out for include consumer sentiment figures, which may be on the mend as lockdowns give way to more freedom, debit and credit card spending, land and housing supply, skilled job vacancies and overseas arrivals and departures, which should be rising off the floor.

On the share market, reporting season moves into top gear with around half of the ASX 200 set to report.

Some of the bigger names to report profits include JB Hi-Fi, BHP, Seven West Media, Ansell, Fortescue Metals, CSL, Santos, Wesfarmers, Transurban, Telstra and QBE, to name just a few.

Internationally, some of the big indicators to watch include minutes from the US Federal Reserve, which should act to confirm the chances for a March rise in official interest rates, US chain store sales, mortgage applications, jobless claims, housing starts and existing home sales.

Another one to watch is the Chinese inflation numbers for January which may show a bit of a slow-down to 9.5% annual growth as COVID-19 supply chain problems start to ease.