Heavy Rare Earths (ASX: HRE) is set to acquire an initial 80% interest in Prospect Hill, South Australia’s largest known and most advanced tin project.

The move will broaden the company’s exposure to clean energy and strategic and critical minerals and complement the scandium and rare earth opportunities at its flagship Radium Hill uranium project.

The earn-in comes via an agreement with major shareholder Havilah Resources (ASX: HAV) that will see an expansion of Heavy Rare Earths’ previous uranium-only entitlement and encompass the rights to all minerals including tin.

Historical Data

Located in the Northern Flinders Ranges, HRE views Prospect Hill as an “exceptional opportunity” based on extensive historical exploration data confirming tin mineralisation over 500 metres of strike and to a depth of 120m at the South Ridge prospect.

The data comprised 51 drill holes, with best intercepts of 3m at 4.85% tin from 44m, 5m at 3.32% tin from 84m, and 6m at 2.33% tin from 14m.

Previous petrological and metallurgical studies indicate the tin is mostly present as cassiterite, 80% of which is recoverable using gravity processing methods.

Agreement Terms

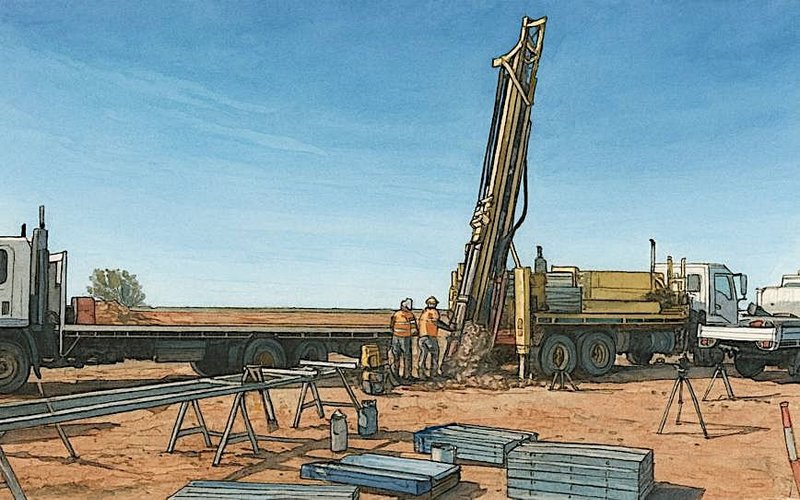

Under the terms of the earn-in at Prospect Hill, Heavy Rare Earths must spend a minimum $1.5 million on 3,750m of drilling for non-uranium minerals within three years, starting with a $350,000 spend in the first 12 months.

Once HRE has met these requirements, the companies will form a joint venture that will free-carry Havilah until the completion of a bankable feasibility study on any non-uranium discovery.

Havilah will then have the right to contribute a 20% pro-rata share to future JV expenditure or dilute its equity to below 10% interest in return for a 1.5% net smelter return royalty on production.

On completion of the earn-in, Heavy Rare Earths will pay Havilah up to $1.8m as reimbursement for historical exploration expenditure at Prospect Hill.

Mutually Beneficial Deal

Heavy Rare Earths non-executive chair John Byrne said the earn-in deal would be mutually beneficial.

“We appreciate Havilah’s ongoing support in considering and agreeing to our proposal to expand our mineral interests during the initial year of our commercial engagement,” he said.

“We are excited about the advanced opportunity now on offer at the South Ridge prospect and the potential for us to move quickly to advanced studies relating to the small-scale extraction of tin.”

Mr Byrne said the company planned to fast-track drilling at South Ridge to estimate a maiden mineral resource and acquire material for metallurgical testwork.

Critical Minerals Portfolio

Heavy Rare Earths closed out a deal with Havilah during the June quarter to acquire a uranium and critical minerals portfolio in SA’s Curnamona province.

The purchase includes prospective targets on the Radium Hill, Lake Namba-Billeroo and Prospect Hill projects, encompassing potential palaeochannels and extensions targeting sedimentary uranium discoveries similar to the Honeymoon deposit owned by Boss Energy, ASX: BOE.

Heavy Rare Earths also received assays from limited reconnaissance rock sampling to better understand the distribution of critical minerals along strike from the Radium Hill mine, where 2.6 million pounds at 1,200 parts per million uranium oxide were mined between 1954 and 1961.

Scandium Values

A total of 18 samples confirmed that the high-grade mineralisation continues northeast along strike from the mine to the Bristowe’s, Radium Hill North and Bonython prospects, with 13 returning scandium oxide values greater than 100ppm, and seven recording greater than 500ppm.

Importantly, the second-highest scandium assay of 890ppm was from a sample collected at the Bonython North prospect, located 4.3km north-east of the Radium Hill mine.

Eight of the samples also returned rare earths grades of more than 10,000ppm TREO (total rare earth oxides) and featured material concentrations of high-value heavy rare earth elements which remain at heightened risk of global supply disruption.

Extension Potential

Mr Byrne said there was “considerable potential” for extensions to mineralisation along the main lode system north-east of the Radium Hill mine.

Over the coming period, the company will fast-track field checking of radiometric target areas highlighted by a recent geophysical survey and by structural analysis of magnetic data.

The work will involve hand-held scintillometer and pXRF (portable xray fluorescence) investigations of outcropping target areas and in-situ soils for anomalous uranium and critical mineral values.