The rise of the green energy market has brought Poseidon Nickel (ASX: POS) to the brink of restarting its West Australian nickel mining and processing activities.

Presenting a bullish quarterly report, Poseidon Nickel chief operating officer Michael Rodriguez said the nickel market is in the middle of a very major change.

He said that class one, high quality nickel sulphide producers would be sought after to provide increasing quantities of battery quality metals to feed the clean energy revolution and the remaining class two ferro-nickel and nickel pig iron producers would service more traditional industrial uses such as manufacturing low grade stainless steels.

Getting closer to restarting Silver Swan

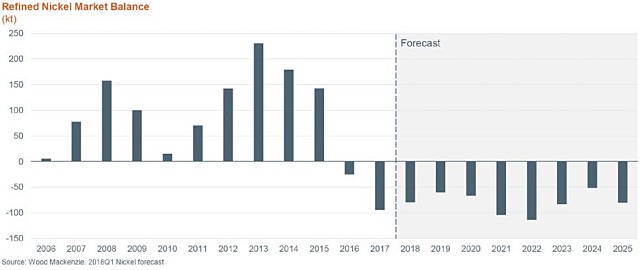

“As a consequence of the clean energy revolution, there are forecast nickel supply deficits for as far as the eye can see,’’ said Mr Rodriguez.

“Simply put, there is no pipeline of nickel projects ready to deliver nickel into the market,” he added.

Mr Rodriguez welcomed the changing sentiment in the nickel market which was providing the impetus needed to restart its operations in the medium term, which contain around 400,000 tonnes of class one nickel.

Poseidon also owns two of the largest nickel processing facilities, second only to BHP.

He said the immediate focus was on the initial restart of direct shipping ore from the Silver Swan underground mining operations.

An independent technical review of the Silver Swan bankable feasibility study was completed by Behre Dolbear Australia (BDA) and a project execution plan was also prepared.

Poseidon has progressed a competitive underground mining contractor tender process for the restart of Silver Swan and expressions of interest for the production offtake from traders and refiners.

Mr Rodriguez said the recent improvements in the nickel price were welcome after a prolonged period of historically depressed nickel pricing but that prices would need to hold even higher if they were to stimulate new nickel projects which were complex, capital intensive and required up to seven years to bring into production.

Black Swan also coming into focus

While the main priority for the quarter was on developing Silver Swan direct shipping ore, Poseidon also completed an engineering study for the refurbishment of the processing facility at Black Swan.

Any restart of Black Swan would need to be conducted at a banking feasibility level to prepare for a future integrated restart of the combined Black Swan concentrator, the Black Swan open pit mine and the Silver Swan high-grade underground mine if market conditions continued to improve.

During the quarter, Poseidon also progressed discussions with a third party for the downstream processing of nickel and cobalt sulphide concentrates through to battery grade chemicals, although the discussions are at an early stage and the business model is still developing.

Disruptive technologies driving commodities prices

Mr Rodriguez said he expected disruptive technology to be the driving force behind the next global commodities cycle, with exponential growth as the energy transformation and electric vehicle markets drove demand for battery metals such as graphite, copper, lithium, cobalt and nickel.

“Unthinkable less than five years ago, renewable energy investment made up over two thirds of the power plants installed across the planet in 2016 and 2017,’’ said Mr Rodriguez.

“The way power is being generated, distributed and stored is transforming the power industry.’’

He said the adoption of electric vehicles also promised to be exponential rather than linear, leaving Poseidon in a great place to meet forecast supply shortages that could develop faster than the current market is predicting.

Across its project suite, Poseidon has almost 400,000t in contained nickel resources, with a contained cobalt credit of 7,450t, plus 183,000 ounces of gold and 670,000oz of silver.

Trading in Poseidon shares is currently voluntarily suspended due to problems with a cleansing prospectus covering previous share issues.