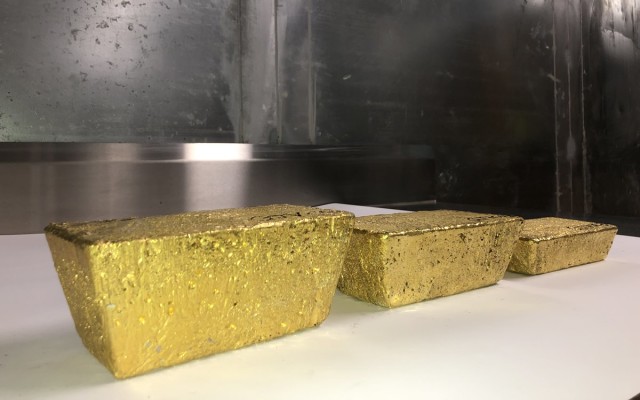

Gold Road Resources (ASX: GOR) and Gold Fields’ subsidiary have poured the first three gold bars from the Gruyere gold project in Western Australia in time to take advantage of the gold price which is at record highs.

The milestone marks Gold Road’s transition to ASX-listed gold producer, with three dore gold bars produced from the carbon-in-leach circuit and totalling 1,139 ounces of gold.

“This weekend’s gold pour is a tremendous milestone given that the Gold Road team discovered the world class Gruyere orebody less than six years ago,” Gold Road managing director and chief executive officer Duncan Gibbs said.

“Importantly, Gold Road joins the ranks of ASX-listed gold producers as owner of a 50% stake in the world class Gruyere gold mine.”

“Our work is far from done – we remain committed to exploring the highly prospective Yamarna Greenstone Belt to unlock the potential through the discovery of more resource ounces for Gruyere and new discoveries that cold be developed as stand-alone gold mines,” Mr Gibbs added.

Gold Fields executive vice president Stuart Mathews said the joint venture would now focus on ramping up the operation to nameplate capacity over the next six-to-seven months.

While ramp up is underway, lower grade stockpiled ore will be processed to reduce any potential gold losses that may occur as the plant is stabilised and the ball mill and gravity circuit are fully commissioned.

The joint venture anticipates it will produce between 75,000oz and 100,000oz of gold during 2019. This guidance has been revised down from the previous estimate of 100,000oz to 120,000oz.

Gold Road noted the downward revision was a result of delays in completion and commissioning of the ball mill and the overall plant.

Despite the plant delays, mining has tracked ahead of scheduled with 2 million tonnes of ore mined and stockpiled in readiness for processing before the end of June.

Gruyere gold mine

When fully operational, the Gruyere gold mine is expected to generate 300,000oz per annum of gold over 12 years from a 8.2Mt per annum plant.

The joint venture’s capital outlay for the operation was $621 million and in line with final forecast estimates.

Gold production is expected to attract all-in-sustaining costs of $1,025/oz.

Underpinning the operation is a 3.92Moz gold reserve, which has an average gold grade of 1.25g/t.

Lake Grace project

At the same time as its maiden gold pour from Gruyere, Gold Road revealed it had secured a 51% stake in the Lake Grace project in WA’s wheatbelt region after spending $700,000 under the initial earn-in agreement.

Cygnus Gold (ASX: CY5) owns the other 49%; however, this will be reduced to 25% with Gold Road electing to boost its stake to 75% by spending a further $500,000 on advancing the project over the next 18 months.

Assays are pending from a recent 462m aircore drilling program at the project’s Hammerhead prospect. Gold Road plans to kick-off another round of aircore drilling at Lake Grace later this month.

By mid-morning trade, Gold Road’s share price was up 3.52% to $1.03.