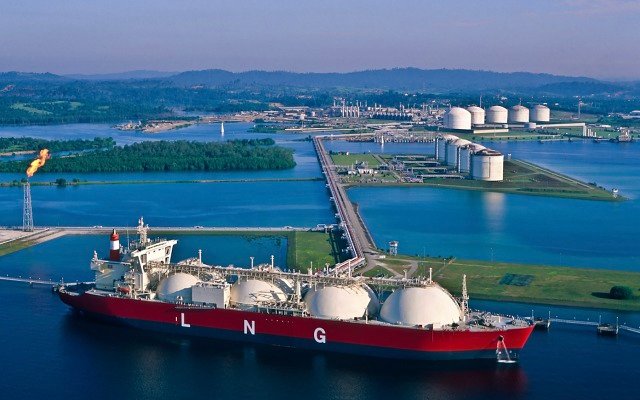

Australia’s shipments of liquefied natural gas (LNG) are beginning to be impacted by the COVID-19 pandemic combined with the global oversupply of gas.

Adelaide-based advisory firm EnergyQuest reported that Australian shipments in May were eight cargoes lower than in April.

Australian producers shipped 6.9 million tonnes in 101 cargoes in April but, in May, the comparative figures were 6.4Mt and 93 cargoes.

This left the Gladstone LNG producers with a substantial surplus on hand.

The degree of oversupply is indicated by the large number of vessels being delayed from unloading at their intended destinations.

“EnergyQuest estimates 41 Australian cargoes have anchored offshore or are steaming slowly awaiting final destination orders during May and early June,” the report noted.

Deliveries to China are still holding up although with a small decline in May to 37 cargoes, against 40 in April — but close to the 38 in May 2019.

In April, though, China imported 2.8Mt of LNG from Australia, the highest imports from this country on record.

Worst yet to come with no effort to resolve glut

Latest figures show that between 40 and 45 cargoes due to leave US ports in July have been cancelled, up from the 30 cancelled for this month.

“More than a month after oil was seen to briefly hit negative territory, the global gas market is still extraordinarily oversupplied,” EnergyQuest stated.

“Traders and analysts believe the worst may be yet to come with demand falling and storage nearing capacity, creating ideal conditions for negative spot gas prices in Europe and the United Kingdom.”

LNG was already oversupplied due to a mild winter and extra supply starting up, but the coronavirus pandemic reduced demand even further.

EnergyQuest argued that the global energy industry is still far from recovered from falling demand as a result of the pandemic and there has been no sign of a coordinated response to address the gas glut.

“While the oil market has a broad, if fragile, alliance of producers to manage production and rescue prices, the gas market lacks a coordinated approach, allowing the current oversupply to drift unchecked,” the reports says.

Gas prices negative by August or September

The report also quoted a forecast by Nick Boyes, an LNG and gas analyst at Swiss trading company Axpo, that European gas prices are most likely to go negative in August or September when demand is at its lowest and storage inventories are at their highest.

So far as Australian exports are concerned, April saw LNG shipments to Japan and South Korea fall by 7.7% and 7.1% respectively.

That Japanese figure was the lowest since 2009, and then Japan’s imports of our LNG fell again in May by 20%.

The Gladstone LNG producers had a production surplus in May: 7.8 petajoules more than exports.