As the world moves towards a zero-carbon future, Global Energy Ventures (ASX: GEV) is poised to take advantage with its “world first” innovative compressed shipping solution for green hydrogen.

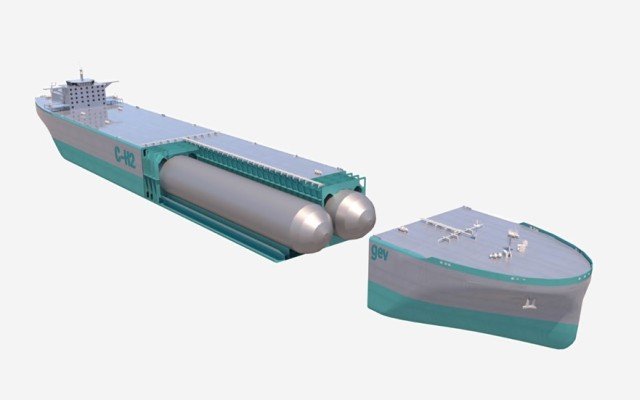

The company has designed a “world first” ship capable of transporting 2,000 tonnes of compressed hydrogen (C-H2), with a US patent already filed. It has also devised requisite infrastructure for the entire C-H2 export supply chain to be emission free.

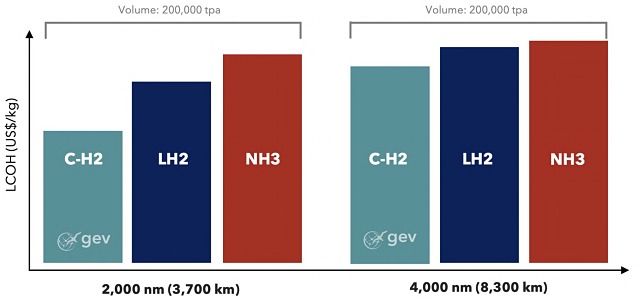

Results from a scoping study on this supply chain have shown it is economically competitive compared to shipping liquefied hydrogen or ammonia.

Global Energy Ventures executive director Martin Carolan said the company was “delighted” with the scoping study results, saying the company’s C-H2 supply chain technology was a “game changing” solution.

Global hydrogen market to be worth trillions

Hydrogen is set to become one of the green energies replacing fossil fuels as the world attempts to move to a carbon neutral future.

Analysts now predict the global market for the energy will grow more than 10 times in the years through to 2050.

It is estimated hydrogen will account for about 20% of primary energy consumption with this addressable market valued at around US$2.5 trillion (A$3.22 trillion).

To stimulate hydrogen adoption, many countries including the US, France, Germany, China, South Korea, Japan and Australia have committed more than US$300 billion (A$387 billion) to develop a hydrogen economy.

The impact of investment at this scale will also drive down the cost of production which is also key for adoption.

To shore up this massive growth will be a need for scalable hydrogen storage and transport solutions.

Unlike natural gas, where the shipping market is already established, the hydrogen industry is at a development stage that is fully embracing new transport ideas.

“Global Energy Ventures’ view is the market scale will be so material that multiple shipping alternatives will be developed,” Mr Carolan told Small Caps.

“Support for C-H2 has been evident through a recent memorandum of understanding with Ballard Power Systems, a global leader in fuel cell systems, which shows willingness to get on board with Global Energy Ventures while still the early stage of development,” he added.

Scoping study outcome

Looking to provide critical transport solutions to facilitate this forecast growth, Global Energy Ventures developed its emission free transport solution to export green hydrogen from Australia to South East Asia.

To evaluate whether this is commercially feasible, Global Energy Ventures’ scoping study set out to provide a “levelised cost analysis” based on exporting compressed green hydrogen to these markets.

Specific volumes evaluated were 50,000t per annum, 200,000tpa and 400,000tpa. These were then investigated at market distances of 2,000, 4,000 and 6,000 nautical miles.

The capital and operating costs from these estimates were then compared to the same costs of transporting liquefied hydrogen and ammonia (which can be converted into hydrogen).

According to Global Energy Ventures, the levelised cost of hydrogen for the compressed hydrogen supply chain was found to be “very competitive” as a marine transport solution for distances of 2,000 nautical miles (3,700km) and remained competitive at 4,500 nautical miles (8,300km).

The scoping study assumes green hydrogen was sourced from a third party at a delivered price of US$2 per kg (A$2.58/kg) and at a 20 bar pressure. It also assumes additional power requirements will be sourced from renewable energy for the loading and unloading stages.

The study concluded C-H2 was a “simple and efficient” supply chain with “minimal technical barriers” to commercialisation in the next five years and meet demand and timelines of Australian export projects.

“When compared to liquefaction and ammonia, we have demonstrated C-H2 is the simplest, with minimal technical barriers to achieve commercialisation in timelines for large-scale projects seeking a transport solution,” Mr Carolan noted.

How the proposed C-H2 supply chain works

Global Energy Ventures started development of its C-H2 supply chain solution last year – kicking it off with the engineering design for its proposed C-H2 vessel and associated infrastructure.

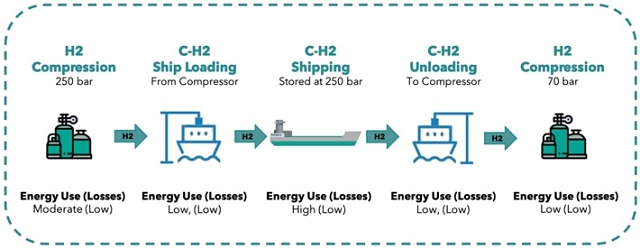

The first step in the proposed chain is to compress and load the hydrogen from 20 bar to 250 bar, with 250 bar being Global Energy Ventures’ ship operating pressure.

Compressors will be powered by renewable energy.

The patented ship will then transport up to 2,000t of C-H2. The ship will be powered by onboard hydrogen fuel cells developed under a memorandum of understanding with Ballard Power Systems. Ballard’s designed cells will run on the compressed hydrogen cargo.

At the unloading/decompression stage, gaseous hydrogen will be supplied to the customer at 70 bar pressure.

Ship fuel cells are expected to power the scavenging compressors that bring the pressure back to 70 bar using hydrogen cargo.

“The C-H2 supply chain eliminates the requirement for on-site storage, as the C-H2 ship is itself the storage,” Global Energy Ventures noted.

Minimal C-H2 supply chain barriers

To make the C-H2 supply chain work, infrastructure that’s required comprises compressors, pipe work, loading infrastructure and a C-H2 fleet.

Global Energy Ventures pointed out hydrogen compressors up to 700 bar pressure have been operated for decades along with associated piping and loading equipment.

The scoping study identified the only material barrier to commercialising Global Energy Ventures’s C-H2 supply chain is achieving American Bureau of Shipping (ABS) approvals for the patented ship.

However, Global Energy Ventures is anticipating Approval in Principle from ABS before the end of June – a major de-risking milestone on the way to Final Class Approval targeted for 2022.

Hydrogen sources and export markets

Global Energy Ventures’ strategy is to export the hydrogen from Australian sources to international markets within the 4,000-4,500 nautical mile range – primarily South East Asia.

There have been several green hydrogen export projects announced to-date in Australia through the development of renewable energy projects such as wind, solar, and hydro.

Global Energy Ventures’ aim is to offer a long-term transport solution for these projects to markets seeking long-term “sufficient security” hydrogen supply.

“Therefore, key supplier hubs such as Australia will meet this demand more effectively by supplying large volumes of green hydrogen rather than producing it locally,” Global Energy Ventures explained.

The idea is that the C-H2 supply chain will be commercially available before the alternative proposals of large-scale liquefaction or ammonia.

The company’s scoping study has shown its C-H2 supply chain to be a “very competitive” marine transport solution for green hydrogen markets 2,000 nautical miles to 4,500 nautical miles away.

Global Energy Ventures will focus on export locations from Western Australia’s mid-west and across to Gladstone in Queensland.

From these locations, C-H2 will be shipped to international markets potentially including Singapore, Japan, China and South Korea.

These markets are believed to face “significant” infrastructure, natural resources and development constraints and will likely need to import hydrogen to meet their requirements.

“Global Energy Ventures will now accelerate its plans to address key markets for green hydrogen, alongside advancing the C-H2 ship approvals from American Bureau of Shipping expected in H1 2021, and define our own green hydrogen export project in Australia to support the construction of a pilot scale C-H2 ship,” Mr Carolan said.