A number of leading energy specialists are leaning towards nuclear power as one of the answers to the world achieving its net zero targets.

They have also suggested that new technologies and thinking need to be a significant part in creating a bigger role for nuclear power in the future energy equation.

Finland benefitting from new nuclear input

On the new thinking side, the International Energy Agency (IEA) says Finland’s decision to make nuclear power a key plank of its energy planning is already paying off.

According to the US-based energy agency, nuclear power now plays a key role in Finland’s energy sector and is central to the government’s goals to achieve carbon neutrality and reduce energy import dependence.

It found that nuclear power amounted to 33% of the country’s total electricity generation in 2021. This figure is expected to rise to more than 40% following the recent start of commercial operations at the Olkiluoto 3 reactor – the first new nuclear plant in Europe in 15 years.

Notably, Finland’s electricity prices have fallen dramatically since the recent start-up of the Olkiluoto 3 nuclear plant.

The IEA says nuclear energy is a good fit in Finland, where a relatively large heavy industry sector and the high heating demand from its cold climate are the main reasons for the high energy intensity of its economy and energy consumption per capita.

“This makes energy efficiency a key pillar of Finland’s strategy to hit its climate goals, reduce energy costs and boost energy security,” the IEA study said.

“Thanks to its fleet of nuclear plants and high shares of electricity generation from biomass, hydro and wind power, Finland already has a low reliance on fossil fuels.”

The IEA has welcomed Finland’s plans to achieve carbon neutrality by maintaining a high share of nuclear energy, increasing the role of renewables in power generation and heat production, improving energy efficiency, and electrifying sectors such as industry and transport.

“Finland’s ambitious targets to reach carbon neutrality by 2035 underscore the country’s leadership on climate and energy issues,” said IEA Executive Director Fatih Birol.

He added that Finland is well placed to reach its goals because of the hard work and investment it has already undertaken in nuclear plants and hydropower.

SMRs may speed up new nuclear delivery

A recent report from international energy analysts Wood Mackenzie suggested that lower cost technological developments such as small modular reactors (SMRs) may help speed up the introduction of new nuclear power plants.

Wood Mackenzie has stated a number of times that it believes nuclear should play a central role in decarbonisation for many countries.

“Under our base case, nuclear capacity expands 280 GW by 2050. Under our Global Pledges Scenario, consistent with a 2°C warming pathway, a tripling of nuclear capacity is required.”

However, the company added that for nuclear power to flourish, governments, developers and investors must work together to establish a new nuclear ecosystem, one that makes nuclear affordable.

“The challenge of reshaping the future of nuclear is vast, but so is the opportunity,” the company suggested.

According to one Wood Mackenzie report, ‘The nuclear option: Making new nuclear power viable in the energy transition’, despite policy support and market growth, cost is the biggest economic hurdle to the uptake of more nuclear power and the much-vaunted small modular reactors systems.

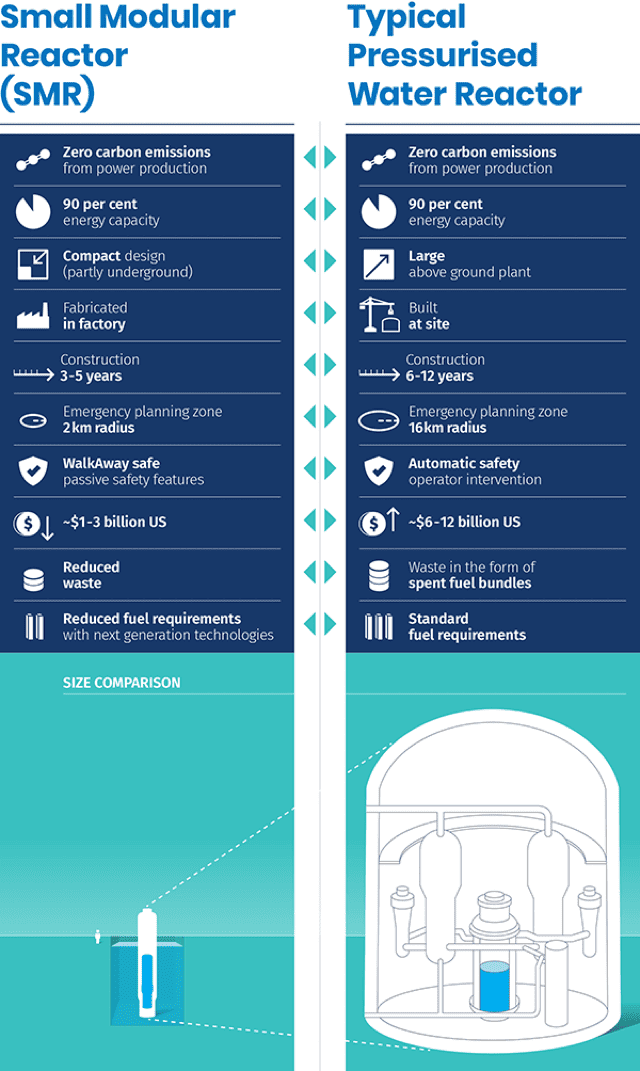

Wood Mackenzie says SMRs are designed to be modular, factory assembled and scalable. They are expected to be quicker to market, with a target construction time of three to five years compared with the ‘nameplate’ 10 years needed to build a large-pressurised water reactor (PWR).

“The nuclear industry will have to address the cost challenge with urgency if it is to participate in the huge growth opportunity that low-carbon power presents. At current levels, the cost gap is just too great for nuclear to grow rapidly,” said David Brown, a Director, Energy Transition Service at Wood Mackenzie, and lead author of the report.

Mr Brown said scaling up the SMR market will depend on how fast costs fall to a level that is competitive against other forms of low-carbon power generation.

According to Wood Mackenzie estimates, conventional nuclear power currently has a levelised cost of electricity (LCOE) of at least four times that of wind and solar.

The company’s modelling shows that if costs fall to US$120 per megawatt hour (MWh) by 2030, SMRs will be competitive with nuclear PWRs, gas and coal in some regions of the world.

It forecast that further price declines are expected between 2040 and 2050 as SMRs realise economies of scale and improve market economics.

CSIRO plays down SMR’s Australian potential

Australia’s leading science agency, the CSIRO, has also recently raised the cost issue with regard to the local introduction of new nuclear technology.

In a recent report, “The question of nuclear in Australia’s energy sector”, the CSIRO noted that there has been increased debate around the use of nuclear power in Australia.

It also identified small modular reactors (SMRs) as being a feature of those discussions regarding their potential to be used for low-emissions electricity generation in Australia.

However, the report suggested that at present, the numbers don’t stack up.

“… a review of the available evidence makes it clear that nuclear power does not currently provide an economically competitive solution in Australia – or that we have the relevant frameworks in place for its consideration and operation within the timeframe required,” the CSIRO report said.

“Without more real-world data for SMRs demonstrating that nuclear can be economically viable, the debate will likely continue to be dominated by opinion and conflicting social values rather than a discussion on the underlying assumptions.”

The report noted that only two SMRs are currently in operation, located in Russia and China, and both have experienced cost blowouts and delays.

Paul Graham, a CSIRO energy economist and lead author of the Australian Energy Market Operator’s (AEMO) GenCost report, says more data needs to be provided to support the push for nuclear power in Australia.

He said that with the use of a standard formula for levelised costs, plus the additional calculations specific to storage and transmission, wind and solar come in at a maximum of $83 per megawatt hour in 2030.

“In contrast, SMRs come in at $130 to $311 per megawatt hour.”

However, he did add that this range allows for nuclear SMR capital costs to halve from where the industry thinks they are at present.

New SMR model launched

One leading international nuclear technology manufacturer, Westinghouse Electric Company, recently launched what it believes could be an SMR game changer.

The AP300 is a small modular reactor has been designed as a scaled down version of Westinghouse’s advanced and proven AP1000 reactor.

Westinghouse says the AP300 is the only SMR truly based on an Nth-of-a-kind operating plant.

The AP300 SMR has been designed to take up an ultra-compact footprint, which Westinghouse says may lead directly to cost savings and reduced construction time.

It also features Westinghouse’s pioneered advanced passive safety system which automatically achieves safe shutdown without operator action and eliminates the need for backup power and cooling supply.

“The AP300 is the only small modular reactor offering available that is based on deployed, operating and advanced reactor technology,” said president and chief executive officer of Westinghouse, Patrick Fragman.

Floating nuclear plants

On the safety side, another nuclear technology developer, Core Power, believes putting nuclear reactors on water may be one answer.

The UK-company said reactors used in floating nuclear power plants offer several advantages over conventional reactors, being smaller, more efficient, safer and potentially less expensive to build.

According to Core, floating nuclear power plants can theoretically be placed anywhere at sea and because they float, they would not be affected by earthquakes. It has also been suggested they can also withstand tsunamis if placed offshore.

The electricity produced from these floating plants can be sent ashore and used to produce other energy fuels such as hydrogen and ammonia.