What a difference a day makes – in the case of Friday it wiped out an entire week’s gain.

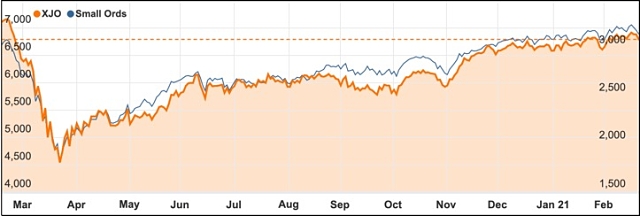

There was nothing in particular to point to but that didn’t stop the ASX 200 index from dropping 1.34% to 6793 points, 13 points below where the index began on Monday morning.

It could have been worse, though, a slight recovery in the afternoon led to a tepid rebound from the 6770 mark.

However, this is the first time there have been consecutive weekly losses for more than four months.

It was difficult to pin down a cause for the lull other than a general feeling that it was time to take some profits or that the US market was set to take a breather.

Profit reports remain on track

Fortunately, there was nothing in the string of Australian profit reports that would suggest any cause for a fall, although some weakness in our retail sales numbers and similar weakness on the US market might have soured the atmosphere – along with plenty of volatility in iron ore prices which were jumping up and down like a puppy all week.

Whatever the reason, a range of ASX majors led the market lower, including all of the big banks and dominant miners and blood products giant CSL (ASX: CSL).

The fast-running energy and industrial sectors also took a rest as investors locked in those profits.

A few companies swim against the tide

Swimming against the receding tide were some of the profit reporting companies, including hearing implant maker, Cochlear (ASX: COH), which rose 8.4% as falls in revenue and underlying profit from the previous year were more modest than expected.

Cochlear was also cheered investors by declaring an interim dividend after cancelling the final dividend six months ago and by predicting continuing improvement in the rest of the year.

Another reporting company – chicken group Inghams (ASX: ING) – saw its shares jump 3.6% on the back of higher first half revenue which fed into a 35% profit jump to $35.3 million.

QBE shares recover

Shares in QBE Insurance (ASX: QBE) were also up 3.1% after spending the morning in the red after its previously flagged significant net loss for the 2020 financial year came in at US$1.52 billion after tax – a significant turnaround from last year’s US$550 million profit but perhaps not as bad as investors were expecting.

Needless to say, there won’t be any final dividend from QBE but perhaps a profit recovery is now on the way.

There were also some improvements in the buy-now pay-later (BNPL) stocks, with ZipCo (Z1P) faring the best out of them, adding 6.4% and leading the charge while the embattled casino group Crown Resorts (ASX: CWN) also improved 5.3% on the back of some positive broker reports.

Small cap stock action

The Small Ords index fell 0.79% for the week to close on 3146.8 points.

Small cap companies making headlines this week were:

Investigator Resources (ASX: IVR)

Investigator Resources’ exploration success at Australia’s highest grade primary silver project has continued with more high-grade intercepts revealed.

This week Investigator received initial assays from 20,500m of infill drilling completed last year at the wholly-owned Paris silver project.

The assays continue to confirm Investigator’s belief in the project’s very high-grade nature with highlight results of 3m at 718g/t silver from 28m; 1m at 783g/t silver from 28m; and 10m at 178g/t silver from 38m, including 7m at 299g/t silver from 38m.

K-TIG (ASX: KTG)

Disruptive welding technology developer K-TIG has adapted its process enabling it to work with A516 Grade 70 carbon steel – paving the way for it to enter the US$800 billion global carbon steel market.

After applying its technology to the steel material, the American Society of Mechanical Enengineers independently verified and certified its suitability.

K-TIG managing director Adrian Smith said this achievement was an “exciting milestone” that further expands the commercial opportunity for the company’s welding technology.

Oar Resources (ASX: OAR)

Rare high-grade halloysite along with kaolinite minerals have been confirmed at Oar Resources Gibraltar project in South Australia.

Gibraltar adjoins Andromeda Metals’ advance Mount Hope project in the region.

The minerals were intercepted during a maiden aircore drilling program with 24 out 59 holes containing halloysite, and kaolinite present all 59.

Notable intercepts were 13m at 5% halloysite and 84% kaolinite from 13m; 3m at 20% halloysite and 42% kaolinite from 26m; and 3m at 10% halloysite and 46% kaolinite from 11m.

Incannex Healthcare (ASX: IHL)

After more successful in vivo research, Incannex Healthcare has shown its IHL-675A drug candidate could potentially “clinically relevant” in treating a “large variety” of conditions including inflammatory bowel disease.

Comprising cannabidiol and hydroxychloroquine, IHL-675A was found to have benefit in a mouse model of ulcerative colitis greater than cannabidiol or hydroxychloroquine alone.

“This indicates IHL-675A has potential for treating inflammatory bowel disease in humans,” Incannex managing director Joel Latham said.

Impact Minerals (ASX: IPT)

Impact Minerals is poised to carry out a 3,000m reverse circulation drilling program at the Aspley prospect within its Commonwealth project.

The imminent drill program comes after an IP survey over Aspley identified numerous targets with the potential to host a major porphyry discovery.

Data has been likened to a textbook example of a zinc doughnut, with the core chargeable anomaly surrounded by a zinc-lead-manganese halo.

Impact is targeting the copper-gold “jam” within the doughnut.

Fatfish Group (ASX: FFG)

Fatfish Group’s foray into the buy now pay later space has officially begun with subsidiary Smartfunding’s platform launch on Thursday.

The Singapore central bank licenced platform will be pushed as a financing alternative for small to medium businesses in the South East Asia region.

Due to what Fatfish sees as huge growth potential, the company said it was focusing on the BNPL space and related fintech services moving forward.

In other news for Fatfish, its indirect subsidiary Stockholm-based RightBridge has agreed to acquire iCandy Interactive’s wholly-owned esports entity iCandy Digital.

Caravel Minerals (ASX: CVV)

As the copper price continues its positive momentum, Caravel Resources has started the pre-feasibility study for its namesake project in WA’s Yilgarn Craton.

The project has a current resource of 662Mt at 0.28% copper for 1.86Mt of contained metal.

The study is due to be completed at the end of the year and will focus on evaluating the potential of a low-cost, open pit, bulk mining operation.

Boosting the project’s potential is the ore being amenable to standard processing to generate a clean and readily marketable concentrate. The project is also close to grid power, sealed roads and nearby towns and ports.

The week ahead

Once again company profit reports will be central to the coming week’s market performance.

Some of the larger companies reporting include LendLease, BlueScope Steel, Alumina, Worley, SEEK, Woolworths, Nine Entertainment, Sydney Airport, Medibank Private, Mayne Pharma, Blackmores, Scentre, IOOF, McMillan Shakespeare, Flight Centre, Iluka Resources, Qantas, Qube Holdings, Ardent Leisure, A2 Milk, Zip Co, Stockland, Ramsay Health Care, BWX and Austal.

There will also be some clues revealed about Australian economic growth with the release of construction and business investment.

It is a busy week for US data with home prices, consumer confidence, home sales, economic growth and international trade numbers released.

In China, the loan prime rates decision and new home prices data are out on Monday and Tuesday respectively.