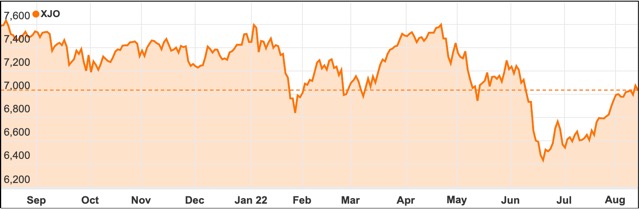

Weekly review: fourth straight week of gains for the market

WEEKLY MARKET REPORT

Despite ongoing uncertainty on the macro front, the ASX 200 inched higher again this week up 38.5 points or 0.24% to close at 7032.5 points.

Marking the fourth straight week of gains and closing above the psychologically important 7000 point level.

Meanwhile the broader All Ordinaries shaved 36.6 points or 0.5% to end the week lower at 7288.8.

Inflation cools but still high

In currency markets, the Aussie dollar hit an 8-week high getting above US$0.71. The rally underpinned by a softer than expected US inflation report that saw risk assets rally.

US inflation came in at 8.5% for July, while still high, it was a significant fall from the annual rate of 9.1% recorded in June.

Data from the Housing Industry Association (HIA) revealed that new home sales in Australia plunged 13.1% month-on-month in July, swinging from a 1.9% gain in June.

The Australian Bureau of Statistics data showed that nationwide household debt levels have increased, the average home loan size was $609,789 in June 2022, compared to $571,995 one year earlier.

With interest rates on the rise and the economy expected to take a hit as a result, the number of distressed homes currently at 6,000 could reach 8,000 by year end, warn industry experts.

Feeling the pinch at the household level, consumer confidence continues to decline, falling for the 9th straight month, down 22% from August last year.

Sending mixed signals however was business confidence bouncing in July to 7 points, up from its 2022 low of 1 point the previous month.

Gas market heats up

Beach Energy (ASX: BPT) announced it will sell 3.75 million tonnes of its LNG under a sale and purchase agreement executed this week with oil and gas giant BP’s subsidiary BP Singapore.

The Australian oil and gas company made the announcement Monday – saying it has agreed to sell 3.75Mt of LNG to BP, which brings it closer to a supplier of LNG to global markets.

Meanwhile Santos (ASX: STO) announced it has acquired Hunter Gas Pipeline in an effort to send gas from Queensland to Australia’s southern states to help aid the expected shortfalls in coming years.

The company received planning approval for a pipeline from the Wallumbilla Gas Hub in southern Queensland to Newcastle through Narrabri.

Miners making moves

OZ Minerals (ASX: OZL) rejected an $8.4 billion takeover bid by BHP (ASX: BHP), claiming the offer significantly undervalues the company.

In an effort to expand BHP’s copper portfolio, BHP made a conditional and non-binding indicative proposal of $25 per share for OZ Minerals.

Stanmore Resources (ASX: SMR) announced it will buy Mitsui & Co’s remaining 20% stake in BHP Mitsui Coal (now renamed Stanmore SMC) the company’s joint venture with BHP (ASX: BHP), for an estimated $380 million.

The Australia-based resources company plans to fund the purchase through internal resources, which comes after it agreed on 3 May 2022 to buy BHP’s 80% stake in the venture for $1.35 billion.

Medical progress

Biotechnology company Imugene (ASX: IMU) has revealed “positive signs” from its PD1-Vaxx trial in non-small cell lung cancer patients.

Imugene’s phase 1 study is evaluating its B-Cell immunotherapy candidate PD1-Vaxx to better understand its safety and tolerability when treating patients with non-small cell lung cancer.

ResMed (ASX: RMD) revealed fourth-quarter net income of US$195 million, the sleep apnoea device maker beating estimates of US$193.7 million, with revenue up 4% to US$914.7 million.

Small cap stock action

The Small Ords index rose 1.11% this week to close at 3050.4 points.

ASX 200 vs Small Ords

Small cap companies making headlines this week were:

iSelect (ASX: ISU)

The board of consumer services firm iSelect this week approved a proposed $72 million takeover bid from Innovation Holdings Australia, owner of comparison website Compare the Market.

IHA currently has 26% equity in iSelect and will assume ownership of the remaining 74% via a scheme of arrangement.

iSelect shareholders stand to receive a cash consideration of $0.30 per share for the transfer to IHA.

Lotus Resources (ASX: LOT)

Lotus Resources released a much-anticipated definitive feasibility study into the restart of the Kayelekera uranium mine in Malawi.

Among other findings, the study showed the mine could become one of the lowest capital cost uranium developments in the world and could be operational in as little as 15 months after the final investment decision.

Other standout features include attractive operating costs, which take into consideration the current high inflation environment while ensuring Lotus can significantly reduce its carbon footprint.

Lotus managing director Keith Bowes said the study would sit well with investors, who chase projects with low technical risk and restart capital.

Kazia Therapeutics (ASX: KZA)

Oncology-focused drug developer Kazia Therapeutics has presented new data from an ongoing phase 1 clinical trial of paxalisib in combination with radiotherapy for the treatment of brain metastases.

The company reported all nine patients evaluated in the trial experienced complete or partial response to treatment – representing an overall response rate of 100%.

Recruitment of another 12 patients for the second stage of the study is underway and Kazia anticipates preliminary data in 2023.

Lithium Plus Minerals (ASX: LPM)

Junior explorer Lithium Plus Minerals intersected a wide pegmatite at the Lei prospect within the Bynoe lithium project in the Northern Territory.

A maiden drill hole hit 43m of pegmatite down hole from 191.9m to 234.9m, which included 3m of wall rock from 211.6m.

It is believed to indicate an extension of the pegmatite system at depth beneath a historical discovery hole drilled by Kingston Resources in 2017, which returned 12m at 1.43% lithium oxide and 16m at 0.69% lithium oxide.

The completed hole is the first of up to nine holes in a two phase 1,800m diamond drilling program at Lei.

Results from three phase one holes will provide detailed characterisation and key structural information to support further drill planning and targeting.

Stage two will include up to six holes over 1,200m targeting further definition of lithium-bearing pegmatites at Lei.

Pure Hydrogen (ASX: PH2) and Botala Energy (ASX: BTE)

Australian clean energy company Pure Hydrogen Corporation confirmed that two wells are scheduled to be drilled on the Serowe coal-bed methane gas project in Botswana next month.

The Serowe-6 and Serowe-7 appraisal wells will be completed by local contractor Kalahari Gas Corporation, and Serowe-3 will be flow tested.

Botala Energy is operator of the Serowe project with a 70% equity, while Pure Hydrogen has a 30% free carried interest in the project and a 19.9% interest in Botala.

Following completion of the first three wells, Botala is planning to drill an additional four pilot wells in preparation for a commercial pilot flow testing program.

Botala was admitted to the ASX in July after raising $5 million in an initial public offering.

Magnis Energy Technologies (ASX: MNS)

Magnis Energy Technologies and its joint venture partner Charge have announced commercial production has begun at the Imperium3 New York lithium-ion battery manufacturing plant in Endicott.

The batteries are manufactured using Charge’s technology and possess one of the highest voltages of any lithium-ion batteries available. Additionally, these batteries do not contain nickel or cobalt.

It is expected that several thousand batteries will be produced at the 22,000sq m plant in the first month, which will be evaluated for quality assurance.

Once this has been confirmed, annual production will increase to 1GWh by the end of 2023 and into 38GWh by the end of the decade.

At 1.8GWh capacity, around 15,000 battery cells will be produced daily.

The Imperium3 plant is currently the only pure home-grown battery plant in North America.

The week ahead

Unemployment numbers are the main data point to watch next week in the local market, with the unemployment rate expected to hold steady at around 3.5%.

The Reserve Bank of Australia meeting minutes will be release on Tuesday and be scoured for clues as to what the central bank may do next. With further, but not as sharp, rate rises forecast.

Over in the US data points to look out for will be retail sales for July and housing start numbers.

In China, industrial production numbers will be released with expectations it will fall short of the 5% forecast.