The world’s major economies and their overarching financial systems could be in line for a shock that wipes off around 50% from a number of asset classes: primarily stocks and fixed income markets.

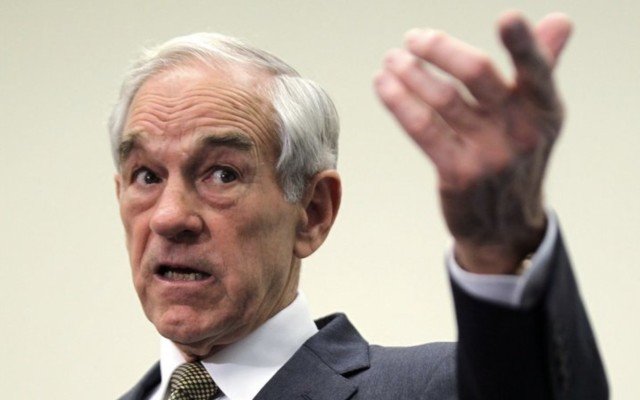

That’s the verdict from former US Congressman Dr Ron Paul who appeared on CNBC’s ‘Futures Now’ programme to express his views relating to current events in the financial sector.

Dr Paul is an outspoken critic of the current Keynesian economic management the US is enforcing, including extremely loose monetary policy from the Federal Reserve and ineffective fiscal policy from Congress.

G20 equity markets are currently flying high and breaking new records, with Australia’s market also nearing its pre-GFC levels of around 6,800 points, currently at 6,265.

In the US, the benchmark Dow Jones index is trading at around 25,000 points, within touching distance of its all-time high of 26,600 set in January this year. The tech-focused Nasdaq index is also pushing into all-time record territory approaching 8,000 points with pre-GFC levels firmly in the rear-view mirror.

Market high flyer

The reasons for such high-flying US stock markets are rather numerous – ranging from renewed business cycles, a strong US dollar, kickstarted industrial production and the creation of new industries altogether. Also Donald Trump’s US$1.5 trillion package of tax cuts have helped US firms.

Dr Paul contends that the strong economic recovery experienced by most major economies such as the US, Canada, UK, Europe, Japan and China has been established on “shaky foundations”.

This market is in the “biggest bubble in the history of mankind,” and when it bursts, it could cut the stock market in half, Dr Paul explains.

“Some of our problems originate there [Washington DC] because they are the ones that undermine the market,” referring to the strong level of political influence that continues to play a huge role in setting US economic policy.

Dr Paul referenced excessive Congress spending, exaggerated debt accumulation and a current account that’s in “bad shape”. He also had scorn for the upper echelons of policy-making by saying that Federal Reserve manipulation of monetary policy and interest rates has had detrimental effects on the US economy.

The primary reasons cited for the perceived market health in the form of stock market highs has been margin debt and government spending – two rather ineffective solutions to the problem of runaway debt, balance sheet debasement, growing sovereign debt and misdirected government spending.

The story of Ron Paul

Dr Paul is a staunch Libertarian Party supporter – a line of government policy that advocates constrained government spending and control. He sees federal spending and monetary policy as dual forces inflating a market bubble.

The Texan is known for his mix of conservative and libertarian views and as a doctor has delivered over 4,000 babies into the world.

He ran for president in 2008 and 2012 on the republican ticket, riding a wave of populist support to “audit the Federal Reserve” and even had an entire movement dubbed in his honour in accordance with his political stance: “Blue Republican”.

Blue Republicans were thought to be US voters who considered themselves “liberal” or “progressive” (generally those that support the Democratic Party in the US) but intended to register as Republicans and vote in the US 2012 Republican presidential primaries for Dr Paul.

Dr Paul’s attempts to gain political status and secure a presidential or cabinet seat petered out although many of his methods, observations and analysis remain profoundly significant – especially in the financial arena.

After leaving Congress in January 2013, the veteran politician founded the Ron Paul Institute for Peace and Prosperity, an organisation that promotes “peaceful foreign policy and the protection of civil liberties at home”.

Federal Reserve to blame

One of the big problems highlighted by Dr Paul is “the Congress spending and the Federal Reserve manipulation of monetary policy and interest rates — debt is too big, the current account is in bad shape, foreign debt is bad and it’s not going to change.”

In an economic outlook assessment earlier this year, the US Congressional Budget Office estimated that federal deficits will average US$1.2 trillion a year from 2019 to 2028.

The agency has adjusted its estimates on several occasions in the past, as a further sign that government costs are quickly ballooning to unprecedented levels while tax receipts continue to dwindle amidst sluggish growth figures of around 2% in the US in 2017.

During the CNBC interview, Dr Paul said “the [Federal Reserve] will keep inflating, and that distorts things. Now they’re trying to unwind their balance sheet. I don’t think they’re going to get real far on that.”

As a solution, the former Congressman offered his view by saying that “you have to liquidate the debt and the malinvestment.”

Wind up and unwind

One of the huge challenges now facing central banks – including its volume leader, the US Federal Reserve – is how to adequately remove the trillions of added liquidity and capital extensions provided to millions of businesses, both large and small since the GFC.

The US, as a country, and its banking system, as an entity, amassed huge debts originating from a defunct housing market – leading to significant balance sheet write-downs and losses. The gaps were plugged with emergency loans and central bank liquidity taps including the lowest interest-rate period in modern history since 2009.

With the time approaching for US interest rates to rise, this could throw dozens of developing countries into precarious macroeconomic positions given their reliance on a cheap dollar and cheap interest rates to service hefty debt schedules.

As US interest rates rise and the dollar strengthens, the cost burden to emerging countries goes up in direct proportion.

Emerging markets in trouble

Emerging market debt is typically US dollar-based, soaring from US$21 trillion in 2007 to US$63.4 trillion last year, according to the Institute of International Finance.

If US interest rates rise, millions of loans become more difficult to service. The net amount of those loans has risen significantly over the past decade fuelled by ultra-low interest rates and a weak US dollar.

Not only have emerging market currencies such as the Mexican peso and Indian rupee dropped 8.8% against the US dollar in Q2 2018, the MSCI’s 24-country emerging market index is down 17% from its year high.

Large sections of US corporate debt were effectively moved over into the sovereign purse via huge funding and quantitative easing programs that still need “unwinding” – with a serious problem that there is a rather meagre capacity to do so.

Meanwhile, quantitative easing programs continue to this day to various degrees around the world. As just a few examples: the EU, the UK and Japan are countries currently set to entirely different wavelengths to the US when it comes to monetary policy implementation.

Market bears getting it wrong, for now

Dr Paul often provides dire assessments of world markets but getting the timing right behind calling a 50% downturn is rather tricky.

Many analysts would agree that several developed economies are in line for a correction given the overwhelming evidence to suggest that largesse and band-aid solutions are gradually running out. An adjustment seems more and more likely with each company earnings season and central bank policy meeting, but the timing is the most difficult part to call.

Dr Paul has provided his views on CNBC on several occasions over the past five years with his views continuing to critique the establishment-held status-quo and call for more transparency and accountability within the highest policy-making elites in the US.

One of these days, his predictions could come true and markets could shed 50% in rapid-fire fashion.

However, many market recovery naysayers and market bears have been warning of such calamities since central bank influence began to escalate, and yet markets continue to enjoy their bandwagon of record-breaking market highs.