Weekly review: dovish Federal Reserve not enough to inspire Aussie market

WEEKLY MARKET REPORT

Not even the prospect of low US interest rates for years to come was enough to spark some life into the Australian share market, which once again slumped its way into the weekend.

The ASX 200 dropped by 52.4 points or 0.9% to 6073.8 points after US stocks provided a strong lead in by hailing the Fed decision to allow higher inflation and lower unemployment.

Asian stocks also strengthened on the Fed moves but Australia headed in the opposite direction, along with the Japanese Nikkei stock market which was reacting to surprise news that Japan’s Prime Minister Shinzo Abe will resign for health reasons.

That brought up the ASX 200’s second weekly loss of 0.6% as weakening commodity prices and falling growth stock prices sent the market down.

Gold and iron ore miners were big losers for the day and investors continued to switch out of the strong technology and health stocks and into the beaten down banks.

It was the first time the index has closed below 6100 points in nine sessions and came just three days after the market briefly touched a high of 6199.2 points.

Aussie dollar riding high with the Yen

The shock news that Shinzo Abe would resign despite expectations that he would serve out his term which is due to finish in September 2021 sent the Japanese Yen soaring and the Nikkei in the opposite direction.

Political uncertainty may cause Japanese investors to sell out of offshore investments and convert their cash back to Yen, with the Australian dollar riding higher along with the Yen to reach an 18-month peak of US73.02c.

Technology stocks did not have a good day, with Afterpay (ASX: APT) down 2.8% to $88.75 while Appen (ASX: APX) had a second terrible day, shedding 10.4% to $34.65.

The switch is on

There was some evidence of a switch out of tech and into banks with Commonwealth Bank (ASX: CBA) flat at $69.09, Westpac (ASX: WBC) up 0.9% to $17.56, NAB (ASX: NAB) up 0.7% to $17.93 and ANZ (ASX: ANZ) up 0.4% to $18.40.

The fall in commodity prices was instantly reflected in the share prices of the big listed miners with BHP (ASX: BHP) down 1.9% to $37.73, Rio Tinto (ASX: RIO) falling into double figures with a 2.2% slump to $97.88 and Fortescue Metals (ASX: FMG) down to 2.2% to $18.87.

Newcrest (ASX: NCM) dropped 2.5% to $31.37 as the gold price lost 0.35% for the week and the US Fed changes saw investors exiting gold positions.

One of the more interesting profit reports was retailer Harvey Norman (ASX: HVN), with founder Gerry Harvey saying the past financial year was one of the best he’s seen in more than 60 years of retailing.

The electronics and furniture retailer delivered record sales and profit figures, with a 7.6% rise in total revenue to $8.23 billion and a 19.4% jump in net profit to $480.5 million.

“It’s an enormous result, and in all the time I’ve been in retail…I’ve never been in a time like this,” the 80-year-old businessman said.

Still, not even that sort of result was enough to guarantee a rise, with Harvey Norman shares closing down 7c or 1.62% to $4.24 after the result was announced, with investors buying the rumour and selling the fact.

Other reporting companies included fruit grower, Costa Group (ASX: CGC) which rallied 11.8% on a strong FY21 outlook, Shine Justice (ASX: SHJ) up 7.4%, Resolute Mining (ASX: RSG) down 1.8% and Boral Ltd (ASX: BLD) up 2.3%.

Bookmaker PointsBet (ASX: PBH) at one stage more than doubled its share price to $16.40 after announcing a partnership deal with US sports broadcast giant NBC.

It closed up 86.7% higher at $14.

In general, blue chip stocks were weaker with CSL (ASX: CSL) down 1.3% to $289.89 and Woolworths (ASX: WOW), Wesfarmers (ASX: WES), Macquarie Group (ASX: MQG), Transurban (ASX: TCL), ResMed (ASX: RMD), Telstra (ASX: TLS) and many others all closing down.

Small cap stock action

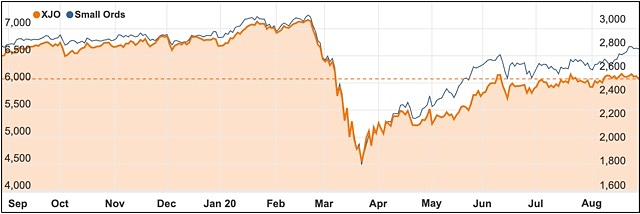

The Small Ords index rose 0.89% for the week to close on 2801.3 points.

ASX 200 vs Small Ords

Small cap companies making headlines this week were:

Respiri (ASX: RSH)

Developer of the wheezo device and asthma monitoring technology Respiri has partnered with Carlton Football Club’s women’s team which is part of nation’s AFLW league, which has over 4.1 million fans.

The deal involves Carlton promoting Respiri’s wheezo device to raise the importance of asthma management.

Respiri anticipates this promotion will result in boosted sales and brand recognition.

“Wheezo is about improving health management for people living with asthma and the company’s philosophy perfectly aligns with the Carlton Football Club and our AFLW program,” Carlton chief executive officer Cain Liddle said.

“We look forward to having wheezo as a significant partner for our football club moving forward as we work to grow women’s football,” he added.

Respiri plans to officially launch its wheezo device before the end of the year.

Incannex (ASX: IHL)

Preliminary in vitro results using Incannex’s lead drug IHL-675A against sepsis-associated acute respiratory distress syndrome (SAARDS) have been positive.

SAARDS is the leading cause of mortality in COVID-19.

Incannex noted the in vitro trial using IHL-675A’s constituents cannabidiol (CBD) and hydroxychloroquine (HCQ) had resulted in completely inhibiting the inflammation biomarker – cytokines – in human cells.

Incannex chief scientific officer Dr Mark Bleackley said the positive results were encouraging for developing IHL-675A in preventing and treating SAARDS.

“Identifying the optimal combination of CBD and HCQ will contribute to the design of an IHL-675A fixed dose combination product whereby lower doses of drugs can achieve the same level of efficacy,” he added.

Incannex plans to continue advancing the drug with further in vitro assessments and a stage two in vivo study.

PharmAust (ASX: PAA)

Another drug development small cap with a promising candidate against COVID-19 is PharmAust, with its lead candidates monepantel and monepantel sulfone.

Melbourne’s Walter and Eliza Hall Institute of Medical Research used the drugs on human respiratory cells with severe acute respiratory syndrome coronavirus-2 (SARS-CoV-2).

The research found that when both drugs were used virus particle counts of SARS-CoV-2 were suppressed by between 90% and 95%.

PharmAust noted preliminary research, using both drugs, has now demonstrated reduced SARS-CoV-2 infectivity in two independent cell lines – one non-human primate kidney and one human lung.

“Further preliminary confirmation of the activities of monepantel and monepantel sulfone against SARS-CoV-2 in alternative, and especially human, cellular models is an encouraging step,” PharmAust chief scientific officer Dr Richard Mollard said.

“These data will fuel further development of the effects of monepantel administration upon SARS-CoV-2 for clinical application,” he added.

The company cautioned the preliminary results required repetition and robust verification prior to clinical stage studies.

Freehill Mining (ASX: FHS)

While advancing its flagship Yerbas Buenas magnetite project in Chile, Freehill has uncovered high-grade iron, copper and gold in rock chip samples within the adjacent recently acquired El Dorado asset.

A five-day mapping and sampling program at El Dorado was completed last month with assays revealing 9.93% and 4.02% copper, 22.1g/t and 13g/t gold, and 36% and 29% iron.

Freehill chief executive officer Peter Hinner described the results as “undoubtedly encouraging”.

“These assay results from this sampling program confirm that El Dorado is another richly endowed mineralised area that will potentially add to our magnetite resource at Yerbas Buenas,” he added.

El Dorado comprises eight tenements spanning 7.5sq km and adjoins Yerbas Buenas’ northern boundary.

A ground magnetic geophysics survey is currently underway across the tenements with exploration to continue until the end of the quarter.

Kalamazoo Resources (ASX: KZR)

Kalamazoo Resources’ Pilbara assets are looking promising with the company revealing on Friday it had firmed up several gold targets at its The Sisters gold project, which is along strike of De Grey Mining’s major Hemi discovery.

A wide soil geochemical survey across the project identified anomaly zones containing up to 70ppb gold.

Kalamazoo noted this was consistent with magnetic features seen in recently completed low-level aeromagnetic and radiometric surveys.

The company is planning a reverse circulation program to test the anomalies later this year.

Friday’s news followed Kalamazoo announcing earlier in the week it had locked-in the acquisition of the Ashburton gold project from Northern Star Resources.

Kalamazoo has described this acquisition as “transformational” for the company, with the asset hosting a historic mine that produced 350,000oz gold at 3.3g/t.

The project also has a JORC resource of 20.8Mt at 2.5g/t gold for 1.65Moz.

Trigg Mining (ASX: TMG)

Sulphate of potash explorer Trigg Mining has identified a large scale palaeovalley beneath its Lake Throssell SOP project in WA.

Trigg claims the structure has the potential to host “significant” potassium-rich brines.

The structure was identified via a gravity survey, and has been modelled to 120m depth.

According to Trigg, the survey also revealed the structure is potentially up to 6km wide and extends for about 46km under its granted tenement.

Trigg believes the deepest part of the structure is most likely to host sand-rich aquifers that contain potassium in brine.

The company is finalising drill targets with a campaign to begin next month and a maiden resource anticipated in the December quarter.

Galan Lithium (ASX: GLN)

In an unsurprising move, Galan Lithium has officially directed its attention to focus on the high-grade Hombre Muerto West lithium brine project in Argentina.

The redirection of priority arises from “excellent” conceptual modelling results.

Modelling showed HMW has “exceptional potential” with lithium concentration grades of 4.8% – or 25.6% lithium carbonate equivalent.

Although the company will focus on HMW, it noted that both HMW and the Candelas lithium brine project had “excellent capabilities” for economic production.

Galan claims modelling indicated HMW may have smaller pond and processing plant footprints making its capital expenditure and estimated operating costs more competitive.

“Our efforts are now fully focused on developing an economic and competitive project at HMW,” Galan managing director JP Vargas de la Vega said.

Mr Vargas de la Vega said the company was on tract to deliver a preliminary economic assessment/scoping study in the December quarter.

Buddy Technologies (ASX: BUD)

It was a big news week for IoT and smart light technology company Buddy which posted its first EBITDA positive month in July, followed by unveiling the world’s first antibacterial smart light.

In July, Buddy posted EBITDA of $36,000 – reversing a loss of $266,999 in June and another loss of $647,000 in July 2019.

The company also demonstrated a 90% month-on-month revenue increase to $4.9 million, which is also 80% higher than July 2019 which generated $2.7 million.

Buddy closed out the week with news it developed an antibacterial smart light which will be available for purchase via LIFX.com and in retail locations in the December quarter.

Known as LIFX Clean the smart light is expected to retail for $99.99 and is capable of safely disinfecting surfaces and surrounding air.

“LIFX Clean is a ground-breaking product that we believe will help create a whole new category of smart lighting, one that we intend to lead with a combination of innovation and relentless pace,” LIFX chief executive officer David McLauchlan said.

The week ahead

We have a very busy week ahead with a rush of statistical releases to greet the arrival of Spring.

The biggest of those is the release of the national accounts on Wednesday which will provide a window into what looks set to be negative economic growth for the June quarter.

Some of the other things to watch out for include measures of private sector credit, company profits, inventories, home values, building approvals, balance of payments, manufacturing, retail trade and international trade balance.

Tuesday’s Reserve Bank meeting is almost certain to leave interest rates at the current low of 0.25%.

Internationally, there are US measures on manufacturing, construction, factory orders, employment and international trade and Chinese data on purchasing, manufacturing and services.