Emerging gold producer Empire Resources (ASX: ERL) is poised for ongoing cash flow after producing more than $2 million worth of gold from its maiden processing campaign at Penny’s Find gold mine in Western Australia’s Kalgoorlie-Boulder region.

In this first campaign, Empire Resources took 15 days to process 21,710 tonnes (t) of Penny’s Find ore at Golden Mile Milling’s nearby Lakewood Mill.

Preliminary figures from the campaign revealed about 1,500 ounces (oz) of gold were produced at a 94% recovery rate, including recouping 44% from the gravity circuit.

The calculated ore head grade was 2.38g/t gold from the initial operation. However, this is expected to be higher in upcoming campaigns as mining moves to the higher-grade part of the orebody.

With a further 16,000t currently being processed at the Burbanks mill south of Coolgardie, Empire Resources will be bringing in even more cash flow in the coming weeks.

In its first year of operation, the company expects Penny’s Find to generate $7.6 million in free cash flow based on a A$1,500 per ounce (/oz) gold price. However, this doesn’t include the approximate $2 million in additional revenue for every $100/oz over the $1,500/oz base.

Please note that their is no guarantee that the gold price will rise and could also fall, which would have the opposite affect for the company.

At today’s current spot gold price of A$1,642, Empire Resources stands to achieve quite a bit more than the original $2 million estimate for its maiden production.

“With a total average open pit grade of 4.62g/t gold to a depth of 80m, this project is providing an excellent production opportunity for Empire Resources, given the current sustained high gold price,” Empire Resources managing director David Sargeant said.

The company is also continually looking at ways to keep production costs down and is currently assessing different processing plants in the region.

With an approximate market capitalisation of $12 million, combined with the recently quashed 50% gold royalty hike that was proposed for WA miners, Empire Resources is well-placed to take advantage of the prevailing gold prices and establish itself as a reputed WA-based gold miner.

Penny’s Find gold mine

Mining kicked-off at Penny’s Find in May this year, with Empire Resources’ maiden gold pour announced in early October signalling the company’s first foray into gold production.

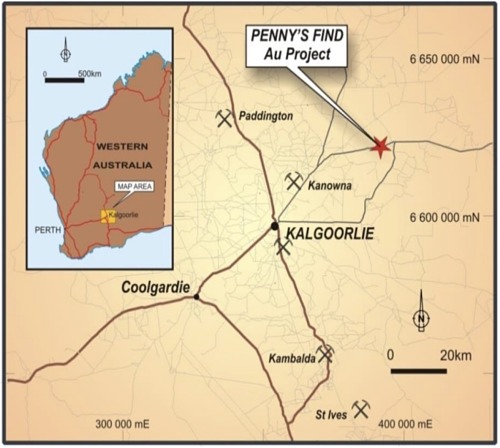

Located 50km from Kalgoorlie, Penny’s Find is situated in WA’s renowned Eastern Goldfields province.

The flagship operation is in proximity to multiple gold mines including one of the state’s largest and most famous mines: the Fimiston Open Pit (also referred to as the Kalgoorlie Super Pit). Currently owned via a joint venture between Newmont Mining (NYSE: NEM) and (TSX: ABX) Barrick Gold, the Super Pit produces about 850,000oz of gold a year.

Among the multitude of prospectors and gold miners in the region, some notable producers include Silver Lake Resources (ASX: SLR), Evolution Mining (ASX: EVN), Kidman Resources (ASX: KDR), Northern Star (ASX: NST), Saracen Mineral Holdings (ASX: SAR) and Ramelius Resources (ASX: RMS), with several companies starting out in similar circumstances to Empire Resources.

Empire Resources’ Penny’s Find project hosts more than 21,700oz in open pit reserves defined within indicated and inferred resources of 470,000t grading 4.42g/t gold for 66,800oz.

In its bankable feasibility study completed in mid-2016, the initial mine design was an 80m deep open pit, with production over an 11-month period and capital expenditure paid back within eight-months or earlier.

Concurrent to boosting open pit reserves and mining, an underground feasibility study is underway at Penny’s Find, with initial indicated and inferred resources of 170,000t at 5.40g/t gold identified directly under the open pit.

Operated under a joint venture, Empire owns a 60% stake in Penny’s Find, with partner Brimstone Resources Ltd retaining 40%.

Empire Resources also owns 100% of the Yuinmery copper-gold project’ in WA’s Murchison province.

Low cost production

As part of its strategy to maximise profit and dampen costs, Empire Resources has been actively assessing different toll treatment plants to manage transport and production expenditure.

Rather than potentially spending millions on building its own processing facility, the company has existing agreements to utilise the nearby Lakewood and Burbank processing plants.

The company also recently inked a memorandum of understanding with Poseidon Nickel (ASX: POS) to test Poseidon’s Black Swan plant which is less than 50km from Penny’s Find.

If the Black Swan trial proves successful, this would result in lower road haulage costs and make the facility a potentially cheaper processing option compared to the 63km trip to Lakewood and the 105km trip to Burbanks.

More gold pours on the way

Empire Resources has 16,000t of ore currently being processed at the Burbanks facility with further gold and revenue anticipated in coming weeks.

According to Mr Sargeant, mining at Penny’s Find is now accessing the higher-grade portion of the ore body, which has an overall average gold grade of 4.62g/t.

As more higher-grade ore is extracted, Empire Resources will be looking at increased ounces to sell into a strong spot market.

Assays to come from recent drilling

Mr Sargeant said the recently completed second round of grade control drilling had boosted the company’s confidence in the current geological model used for Penny’s Find.

In early September, the company reported assays from a 48-hole drilling campaign, with numerous high-grade intercepts returned ranging from 6 metres @ 5.13g/t to 4 metres @ 54.62g/t, including a 1m intersection grading a whopping 183g/t.

The list below includes Empire’s assay results from the recent grade control campaign:

- 5m @ 14.31g/t Au from 28m depth in hole PGC098

- 4m @ 54.62g/t Au from 37m depth in hole PGC099

- Including 1m @ 183g/t

- 6m @ 15.92g/t Au from 17m depth in hole PGC102

- 4m @ 12.49g/t Au from 30m depth in hole PGC117

- 6m @ 5.13g/t Au from 39m depth in hole PGC118

- 5m @ 12.28g/t Au from 29m depth in hole PGC119

- 5m @ 14.39g/t Au from 34m depth in hole PGC122

- 4m @ 37.36g/t Au from 22m depth in hole PGC124

- 3m @ 7.35g/t Au from 29m depth in hole PGC129

- 2m @ 19.51g/t Au from 38m depth in hole PGC130

Given previous drill results, Empire is confident the deeper drilling will return similar, if not better, results as the focus is placed on targeting higher grade ore.

Open pit with underground potential

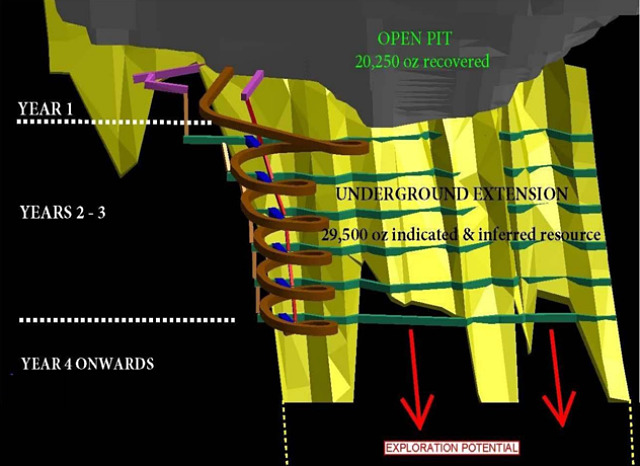

According to Empire Resources, its longer-term strategy is to develop its mine from an open pit operation to a fully-fledged underground mine with a minimum 10-year life.

With Penny’s Find mineralisation extending 250m below the surface and remaining open at depth, progressing to an underground mine is looking to be a viable option.

The underground resource is currently at 170,000t grading 5.40g/t gold directly beneath the open pit. A feasibility study is underway to upgrade this resource and investigate potential mine options.

Below, is a computer-generated model of Empire Resources’ exploration moving forward from Year one (open pit mining) to Year four-plus (underground mining and further resource expansion at depth):

“We believe there is substantial upside at Penny’s Find once a feasibility study into development of the underground resource has been completed,” Mr Sargeant said. “This, along with exploration potential at depth, bodes well for the long-term future of the project.”

Strong gold prices

Unlike many other commodities, gold is hoarded during economic and political volatility. Due to its global currency status, in times of uncertainty, investors flock to the metal to provide some form of financial security.

This is easily seen during the global financial crisis, which saw gold prices breaking the A$1,000/oz barrier and move towards it’s A$1,800/oz peak in mid-2011 and again in mid-2016.

Although going through peaks and troughs like the rest of the market, gold has consistently been growing with shorter cyclical dips. Please note that there is no certainty that this will continue and markets can be unpredictable.

In recent months, the price has remained strong with the precious metal hovering between A$1622/oz and A$1,658/oz in the last 30 days, alone.

According to Empire Resources’ bankable feasibility study, Penny’s Find is comfortably profitable when exposed to the A$1,500/oz gold price and this is considerably enhanced in the current market.

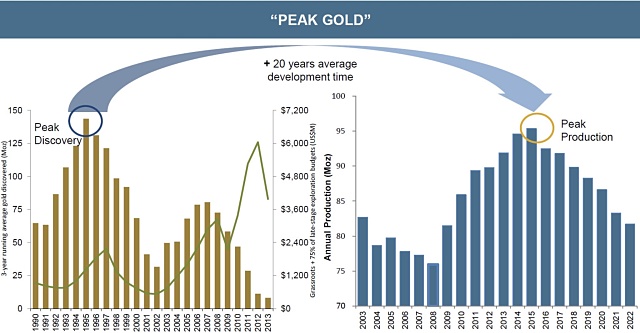

Peak gold discovery

As with other commodities, gold is exposed to the usual supply and demand dynamics.

Many analysts believe that global gold production peaked in 2015. The phenomenon is known as peak gold.

It is already evident in Australia, which is the world’s second largest gold producing country. The Minerals Council of Australia recently published a report claiming Australia is struggling to replace the gold it mines due to declining grade and size of its primary gold discoveries.

Other factors including falling exploration expenditure, rising costs, and harder to find ore bodies have also contributed to the situation.

On a global level, in the past decade, gold discoveries have plummeted 85%, with the world’s major gold miners slashing capital expenditure by more than 50%.

If global gold supplies continue to tighten, many experts predict the metal’s price will continue its upward journey.

Growing the Empire

Economically viable gold projects with substantial ore bodies and decent grades are increasingly hard to find.

Many of those that have been discovered often lie in politically risky provinces and require substantial infrastructure investment.

Empire Resources’ Penny’s Find is situated in a well-known gold region and close to multiple infrastructure options including three nearby processing facilities. This minimises capital expenditure and keeps production costs down – maximising its profit margins.

Combined with the potential peak gold situation and rising gold prices, Penny’s Find appears to be a solid project for the company – particularly with the opportunity to develop the current open pit operation into a higher-grade underground mine.

With a small market capitalisation of $12 million, expected upcoming cash flows in excess of $2 million, numerous more gold pours to come, Empire Resources is cementing itself as an emerging gold play to watch.