Douugh raises $6 million ahead of ASX debut

Douugh will list on the ASX via a reverse takeover of Australian telco ZipTel.

Next-generation neobank Douugh plans to list on the ASX this month to scale up its customer base in the United States and ahead of launching its money management app in Australia.

The company will list via a reverse takeover of Australian telco ZipTel (ASX: ZIP).

Douugh has developed an artificial intelligence (AI) powered app that effectively manages a user’s money in accordance with their budget and savings plans.

Douugh’s prospectus was offering up to 200 million shares at $0.03 each and ZipTel told the market last week the offer had closed after raising the maximum $6 million, with the bookbuild “multiple times” in excess of the limit.

The company is expected to relist on the ASX under the new ticker code ‘DOU’ on 17 September with an estimated undiluted market capitalisation of about $18 million.

What is a neobank?

Neobanks are digital banks that generally interact with consumers through smartphone apps.

In 2018, Australia followed other countries including the United Kingdom and Germany in changing legislation to effectively lower competition barriers and encourage this new breed of challenger to traditional banks.

Competitors in the neobank sphere in Australia include Raiz Invest (ASX: RZI), Spaceship, Up, Xinja and Revolut.

Douugh’s core banking services are provided by a partner bank via an operating model known as Banking-as-a-Service (BaaS).

The company acts as an agent of the partner bank’s licence, which means it doesn’t need to take on the high cost structure, business model and risks associated with becoming a licensed bank in each country it operates.

In a promotional video, Douugh founder and chief executive officer Andy Taylor said this makes the company stand out from its competitors as it is “very much a capital-light fintech business”.

“We believe the future of banking is platform-based and AI driven and in that vein, we’re building a fully autonomous money and management assistant that will really help customers spend less, save more and build wealth over the long term,” he added.

Partnerships key to business model

Douugh’s operations are reliant on its continued partnerships with key stakeholders including partner banks, Choice Bank in the United States and Regional Australia Bank (RAB) in Australia.

In addition, Douugh has formed a global partnership with Mastercard that will see the companies collaborate on a number of digital payment initiatives.

Mastercard will also support Douugh’s scale-up in the US, Australia and other international markets over the next 10 years, Mr Taylor said.

“Mastercard are very much at the forefront of digital payments and a lot of that innovation is driven out of Sydney so we are very fortunate to be working very closely with them,” he added.

The Douugh platform

Mr Taylor said Douugh aims to become the “Tesla of banking” and lead the way for customers to automate money management using its AI-based app.

“The problem we saw early on was that traditional personal financial management (PFM) tools and banking apps didn’t really help customers better manage their money and help them achieve their financial goals,” he said.

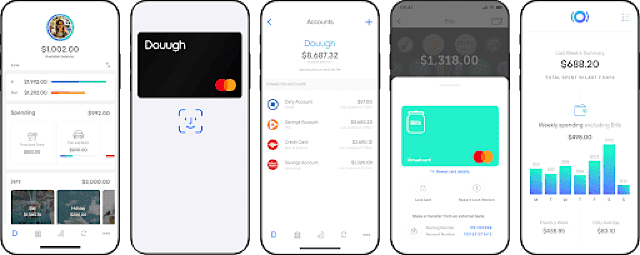

The Douugh app.

“We are building full automation in the money management process, so when you pay your salary into Douugh, we will automate your money management practices – that’s paying your bills, making sure you can cover them, putting money towards your savings goals and investing that money, and always holding you accountable through a budget so you’re living within your means.”

Customer and revenue expansion

The Douugh app is currently live in the US to an invitation-only test group of 1,000 users and is set for a major US launch soon after listing.

It has already started to generate revenue from these active users via interchange, paid by Mastercard and deposits held by Choice Bank.

Mr Taylor said the purpose of the $6 million capital raising is to invest in scaling up the US customer base, introduce investment management services which the company calls Douugh Wealth, as well as version one of an ‘autopilot’ feature which lays the foundation for the company to introduce a monthly subscription.

He said introduction of this monthly subscription fee is also expected to drive monthly recurring revenue.

“We are also going to begin work on the launch of the MVP of the Australian business, which we hope to take to market early next year,” Mr Taylor added.

Experienced board

Douugh has an experienced management team led Mr Taylor, who also previously co-founded and headed the peer-to-peer lending platform, SocietyOne, as well as digital marketing and technology agency, Unity ID.

He will be joined by non-executive chairman Steve Bellotti, who was most recently the managing director of Global Markets and Institutional Loans at ANZ Bank (ASX: ANZ), and non-executive director Patrick Tuttle, the current non-executive chairman of Buy Now Pay Later minnow Openpay Group (ASX: OPY).

Bert Mondello is the only ZipTel director who will stay on as a non-executive director for Douugh. He is also the current chairman for fellow ASX-listed techs Vection Technologies (ASX: VR1), Emerge Gaming (ASX: EM1) and SineTech (ASX: STC).

Mr Taylor is a major shareholder of Douugh through his associated entity, The Digital Bakery Limited, which is expected to hold a 37.8% stake (on a fully diluted basis) on completion of the public offer.