Deutsche Bank to cut 18,000 jobs and exit Australian equities

Deutsche Bank’s downsizing plan to improve profitability involves exiting its global equities business and scaling back on its investment bank.

Germany’s biggest lender Deutsche Bank has revealed a €7.4 billion (A$11.9 billion) restructure that will see 18,000 jobs axed and its global equities business shut down.

Once a global trading powerhouse, the bank has struggled to compete with Wall Street top guns such as JPMorgan Chase & Co and Goldman Sachs.

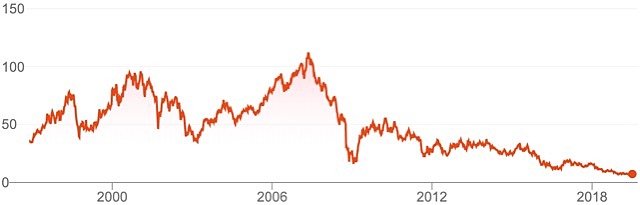

It has been in the red for most of the last five years and its securities slumped to a record low last month of €5.81 per share.

Deutsche Bank’ share price has been struggling.

The bank is now expected to post a net loss of €2.8 billion (A$4.5 billion) for the 2019 second quarter.

The announced plan also comes two days after Deutsche investment bank chief Garth Ritchie stepped down by “mutual agreement”.

In the major overhaul, the bank will scrap its global equities business, which will involve a retreat from Australian financial markets among others. It also plans to scale back on its investment bank and cut some of its fixed income operations.

Deutsche will then set up a new “bad bank” to wind-down its unwanted assets, valued at an estimated €74 billion (A$119 billion).

In addition, it will create a corporate bank to streamline its offered services, which Deutsche chief executive officer Christian Sewing described as a “core strength”.

Mr Sewing has labelled the overhaul as a “restart”, which will focus on the bank’s more stable revenue streams.

“We are creating a bank that will be more profitable, leaner, more innovative and more resilient,” he said.

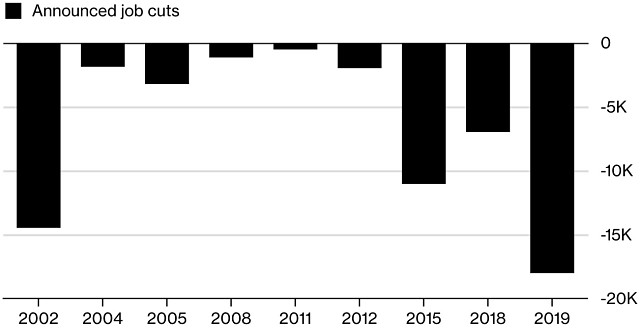

Jobs slashed

Deutsche’s overhaul represents some of the biggest job cuts announced from an investment bank since HSBC axed 30,000 jobs in 2011 following the global financial crisis.

Mr Sewing began the job-cutting process not long after being appointed as chief executive officer last year.

His aim to reduce staffing to “well below 90,000” has now been slashed further, with ambitions to cutback to 74,000 by 2022.

Deutsche Bank has been cutting its workforce in recent years.

Deutsche has not specified the geographic regions for the job cuts, although the equities business it is planning to dump largely operates in London and New York.

The bank is also one of Australia’s biggest equities market participants, ranking as number five in cash equities market share for the 2019 financial year.

It has operated in the country since the 1970s with offices in Sydney, Melbourne and Perth.

According to news reports, Deutsche is holding meetings with its Australian staff on Monday to discuss how its plan will impact local operations.

The restructure is expected to slice a quarter off the bank’s current cost base, or €6 billion (A$9.64 billion), by 2022.

Investment bank chief steps down

Two days earlier, Deutsche’s investment bank boss Garth Ritchie agreed to resign in a move that signalled the division’s diminishing significance.

This is despite Mr Ritchie being Deutsche’s highest paid board member (earning €8.6 million) last year and his contract being extended in September for another four years.

Mr Sewing, who warned of “tough cutbacks” to the investment bank in May following Deutsche’s failed merger talks with rival Commerzbank, will now represent the division on the board.

Two other management board members, head of regulation Sylvie Matherat and head of retail Frank Strauss, are expected to leave the bank in the restructure, while some newcomers will be added to the board.

Mr Sewing said this restructure would be the “most fundamental transformation of Deutsche Bank in decades”.