In contrast to many floundering businesses rocked by COVID-19, social media commerce company Crowd Media (ASX: CM8) has come on in leaps and bounds in the last year as the online retail market continues to thrive throughout the pandemic.

The Millennial-focused business sells a variety of products and services via social media influencer channels, recently launching direct-to-consumer (D2C) brands including London Labs (haircare), KINN-Living (eco-friendly cleaning products), I am Kamu (watches and accessories) and Vital Innovations (healthcare and family products).

The company claims it is the “only listed company in the world with an influencer social commerce market focus”, having collaborated with more than 10,000 influencers over the last five years across 30 countries and more than 10 languages.

Following a business restructure in late 2019, Crowd Media has been successfully executing a new three-stage growth strategy and has six D2C brands in the pipeline to launch over the next year.

Online retail thrives during pandemic

As many businesses across the globe shutdown brick-and-mortar stores in light of the pandemic, online retail sales have surged.

According to global spending data, the United States saw a 17.7% increase in retail sales through May while Australian consumer spending rose 16.3%.

In addition, much of the world has been working from home or paused study and schooling arrangements, leaving Millennials with more time to do they love – scroll social media.

The combination of these two factors create an ideal scenario for a business in which its model is based on selling products online through influencer channels.

How does influencer marketing work?

Crowd Media’s target market is Millennial and Gen Z consumers, the largest demographic in the world and estimated to comprise more than 4.9 billion people in 2020.

According to the company, the average Millennial or Gen Z spends more than five hours a day on social media and their purchasing power is rapidly increasing as they enter the workforce.

For this reason, an important driver of sales in this demographic is influencer marketing, a booming industry currently worth about US$20 billion (A$29 billion) and growing rapidly.

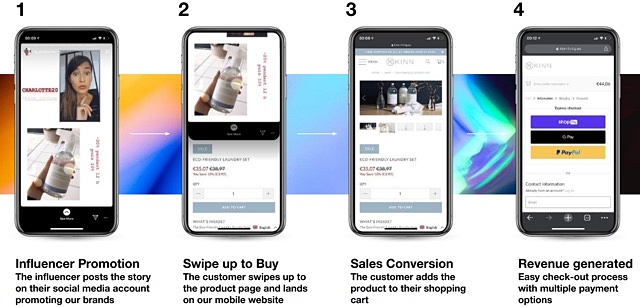

At a basic level, influencer marketing involves an ‘influencer’ posting a story on their social media account (such as Instagram) promoting one of Crowd Media’s brands. They might be demonstrating the application of a cosmetic product or describing the benefits of a skincare range, as some examples.

Interested followers can ‘swipe up’ to buy the product. This action directs the customer to Crowd Media’s brand’s website, where they can add the product to their shopping cart and ‘check out’ using multiple payment options.

Crowd Media said it has acquired more 5 million Millennial customers in the last five years of operations.

With offices in Australia and Amsterdam in the Netherlands, Crowd Media primarily targets European markets where a recorded 96% of Millennials own a smartphone and more than 280 million Millennials use the internet daily.

Growth strategies

Crowd Media’s business model is based on three key growth strategies. It is currently executing the first strategy, Horizon 1, which focuses on capturing a larger slice of the retail spend via D2C sales.

In this phase, Crowd is selling products and services it either owns, part-owns, or is strategically aligned with.

The company has lined up six D2C brands to launch in the 2021 financial year across mobile, web and Amazon retail platforms.

Next year, Crowd Media anticipates moving up to Horizon 2, its strategy of selling products via collaborations, partnerships, or strategic alliances.

The company said these connections will initially be in the travel insurance and fintech space. It is currently in the process of acquiring appropriate licences for the insuretech sector.

The third strategy in Crowd Media’s growth model, Horizon 3, involves strengthening and developing current alliances as well as exploring some innovative technological ideas.

The company describes the objective here as finding the “Holy Grail” of influencer marketing.

“By linking Crowd’s existing Q&A chatbot technology with the digital visual technology of our co-development partner, we will create an entertaining ‘conversational commerce’ experience between consumer and influencer…imagine learning about the Battle of Trafalgar by Facetiming with Napolean,” it said.

This final strategy is slated for the 2022 calendar year.

New board drives financial turnaround

Crowd Media first listed on the ASX in 2015 under the name Crowd Mobile and has undergone a significant transformation in the last year.

After recording substantial losses for the previous two financial years including a net loss of $4.7 million in FY2019, the company welcomed a $2.7 million investment by a group of European investors known collectively as the European Consortium (EC) in September 2019.

As part of the deal, Crowd Media appointed EC principals Steven Schapera and Robert Quandt as chairman and non-executive director (respectively) to its board.

Mr Schapera is an experienced executive in the health and beauty space, having co-founded and served as global chief executive officer of the BECCA cosmetic brand before selling it to Estee Lauder in 2016 for $300 million.

Mr Quandt comes from a corporate consultancy background and most recently served as board director and chief operating officer of Invincible Brands GmbH, a Berlin-based influencer-led brand builder.

Since its restructure, Crowd Media has achieved a significant turnaround, reporting a near-breakeven operational position for the first half of FY2020 with $8.5 million in revenue.

Underlying earnings before interest, tax, depreciation and amortisation (EBITDA) also trimmed down to a loss of $36,000, compared to the $1.3 million loss reported in the FY2019 first half.

The company attributed the turnaround to the company’s new board, which “scrutinised the quality of revenue” derived from its Q&A and subscription verticals to extract further profitability from the streams.

By May, it had posted $13.6 million in revenue and a small profit of $100,000 in underlying EBITDA.

It also claimed it was on track to achieve at least a breakeven operational position for the full financial year, which would compare favourably to FY2019’s underlying EBITDA loss of $2.6 million.

In addition, Crowd Media successfully raised $1.5 million through a share placement last month to “strengthen its balance sheet, accelerate scale up and bolster sales”.

The raising is also intended to reduce a revolving facility it secured last year with fintech lender Billfront by up to A$500,000.