Credit Intelligence posts strong half-yearly report, responds to ASX query on share price rise

Credit Intelligence expects the group’s half yearly result to show a 335% profit increase from the comparable half year prior.

Debt restructuring and personal insolvency management services company Credit Intelligence (ASX: CI1) has announced an unaudited revenue of $5.3 million and a $1.2 million profit after tax for the half year to December 2019.

The profit represents a 335% jump on the previous corresponding period and was underpinned by an ongoing strong performance from the company’s Hong Kong bankruptcy business.

Credit Intelligence has more than 10,000 bankruptcy cases under personal insolvency management in Hong Kong, managed by purpose-built software to process the large quantity of data involved in case management which would otherwise be done manually.

The system can automatically calculate distributions to be paid to creditors and produce reports for each debtor, creditor and court, thereby saving time, effort and money.

The company said its core business of bankruptcy and individual voluntary arrangement continues to trade well amid the current environment of social and political unrest in Hong Kong.

Singapore business

Credit Intelligence said contributions to its half-yearly results from two recently-acquired Singapore finance businesses are on track to exceed their profit guarantee for the period to 30 June.

In July, the company acquired a 60% majority shareholding in ICS Funding Pte Ltd as part of its regional expansion efforts.

Founded in 2015, ICS assists local small-to-medium enterprises to access business funding as an alternative source to conventional banking platforms.

ICS has a background in the Singapore credit funding industry and a network of consultants to provide comprehensive solutions for business owners.

In October, Credit Intelligence purchased 60% of Hup Hoe Credit Pte Ltd, a registered moneylender in Singapore established in 2014 to provide personal loans to local and foreign residents.

“(ICS and HHC) are well managed and are investigating plans to grow their respective businesses,” the company said.

“These acquisitions will allow [us] to further expand our operations into the Asian market with businesses which are synergistic to our current business model and will help further establish our Australian operations as needed.”

ICS contributed $1.1 million in revenue for the half year and a profit after tax of $500,000 while Hup Hoe raked in a $700,000 revenue and $300,000 profit.

ASX query on price move

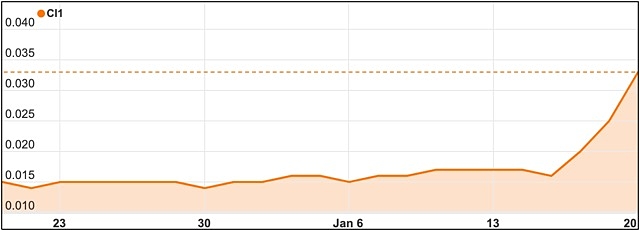

On Friday, Credit Intelligence was the subject of an Australian Stock Exchange query after its share price increased on larger than normal volume off no news.

The company’s price prior to the release of its half-yearly results doubled from $0.016 per share recorded on Wednesday.

In its response to the ASX, Credit Intelligence maintained a string of good news stories worldwide contributed to a “bullish sentiment” in the market for the period in question.

These included the signing of a new trade treaty between the US and China; the easing of tensions between the US and Iran; and news that the Australian recovery from the bushfire emergencies of $5 billion would provide significant stimulus to the Australian economy.