Credit Clear plans $15 million IPO and ASX listing to capitalise on pandemic-fuelled debt industry

Funds raised from the offer will fast-track development of Credit Clear’s digital billing and communication technology platform.

Melbourne-based fintech Credit Clear is pushing ahead with plans for a $15 million initial public offering (IPO) as the COVID-19 pandemic fuels demand for technologies that can speed the recovery of unpaid bills.

Chaired by former National Australia Bank (ASX: NAB) and Tyro Payments (ASX: TYR) executive Gerd Schenkel and backed by rich-listers Alex Waislitz and Paul Little, Credit Clear is asking investors to dig deep to fund the IPO and share market listing, which will value the company at about six times its historical revenue.

It is expecting to issue 42.8 million shares at an offer price of $0.35 per share, which would imply a $64 million enterprise value and $79 million market capitalisation.

The company recorded $11.2 million revenue in the 2020 financial year on a proforma basis – up from $10.3 million in the previous corresponding period.

It expects to clear $18 million revenue in calendar year 2020, backed by a surge in demand for its services after debt recovery call centres in southeast Asia closed amid the pandemic.

Funds raised from the IPO will allow Credit Clear to accelerate the development of its proprietary technology platform designed to collect receivables using digital billing and communication systems.

The debt recovery firm intends to hit the ASX boards later this month using the ticker ‘CCR’.

Pandemic struggles

Credit Clear founder Lewis Romano believes the timing is right for a market listing given the number of consumers worldwide who have struggled to meet their financial commitments since the pandemic took hold.

After debt recovery call centres in the Philippines closed earlier this year, companies have been seeking alternative ways of chasing customers for unpaid bills.

“It has had an instant effect on our business and in a positive way [and] there will be even greater focus on debt collection as we move into life post-COVID lockdown,” he said.

“The pandemic has not stalled, delayed or deferred our ambitions [and] we intend to be listed fairly soon.”

Unemployment impact

Mr Romano said unemployment rates can directly impact demand for debt recovery services, as people who lose their jobs or can’t find work realise they lack sufficient income to pay what they owe.

Australian Bureau of Statistics research shows the national unemployment rate at June 2020 sat at a 22-year high of 7.4%, with some 992,300 people out of work.

According to the government’s July economic and fiscal update, this rate is expected to increase until year end, with an anticipated peak of around 9.25% in the December quarter.

“A higher national unemployment rate generally signals weaker economic conditions, which can often contribute to increased debt, providing an opportunity for [our] industry to expand,” Mr Romano said.

Age-old issue

Credit Clear aims to address the age-old issue of built-up debts experienced by utilities, telco, financial companies and government agencies, and those companies providing services to consumers on a post-paid basis.

Launched in Australia and New Zealand three years ago, the company’s cloud-based platform claims to help organisations achieve “smarter, faster and more effective financial outcomes” by changing the way customers manage their payments.

The platform services a spread of clients from small-to-medium enterprises and large corporations, local councils and other government departments, and domestic businesses and subsidiaries of global organisations.

Companies currently on the books include AGL Energy (ASX: AGL), Prospa Group (ASX: PGL), Synergy, BMW Financial Services and Transurban Group (ASX: TCL).

Automating the process

Credit Clear automates the debt collection process and uses artificial intelligence to determine what time of day and through which method of communication – most often via Facebook Messenger, SMS or email – a customer prefers to be reached regarding payment of their overdue account.

Messages are sent via a mobile app and automatically translated into the default language on a customer’s device to offer four actionable options – pay now, make a partial payment, create a payment plan, or request a call back.

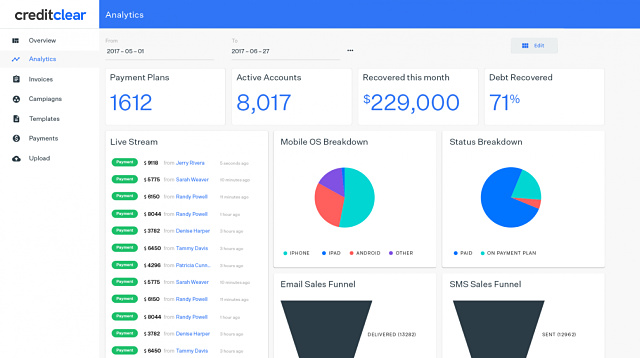

The Credit Clear dashboard.

Credit Clear earns part of its revenue by charging for each text message or email it sends to customers of its clients, instead of charging a commission of up to 30% on the debt recovered.

“We are currently replacing 10,000 phone calls a week with the Credit Clear app that is already achieving higher recovery rates,” Mr Romano said earlier this year.

Credit Solutions acquisition

In December 2019, Credit Clear acquired full-service debt recovery agency Credit Solutions, which had been utilising its platform to service debt collection contracts with a number of Top 50 Australian companies.

The acquisition was funded from a private $9 million capital raising and gives the merged group the ability to collect earliest-stage debts (less than 30 days) through to more delinquent debts (greater than 90 days).

Credit Solutions has more than 800 clients across state and local governments, utilities, telecommunications and consumer finance sectors, and according to Mr Romano, the acquisition rationale was clear.

“The complimentary client base presented us with the opportunity to accelerate product optimisation from an existing pool of clients, and to ‘sell’ the Credit Clear technology over time into a larger client base,” he said.

https://www.youtube.com/watch?v=0PatCXo-7mY