Copper price heads up on easing trade tensions and eroding inventories

The ongoing trade standoff between the US and China has been blamed for keeping base metal prices subdued despite rising demand and diminishing inventories.

As a trade resolution between China and the US finally becomes a possibility, eroding copper stockpiles have begun to bump the metal’s price back up.

Earlier this week, US President Donald Trump announced the March deadline for his tariff threat on billions of dollars-worth of Chinese imports had been postponed after having what he described as “very productive talks” in recent weeks with China’s President Xi Jinping, with both leaders agreeing to a summit to officially conclude an agreement.

A potential end to the trade conflict has eased market jitters, somewhat, and allowed underlying market fundamentals to rise to the fore – particularly with copper.

At the height of the tensions, the copper price plunged on global uncertainty – along with other base metals.

Copper price on the rise in 2019.

As the trade war gained traction, copper toppled from US$7,261 per tonne in July last year to a low of US$5,838/t in early January.

Since then, the commodity’s price has staged a steady come back – reaching US$6,545/t on Monday.

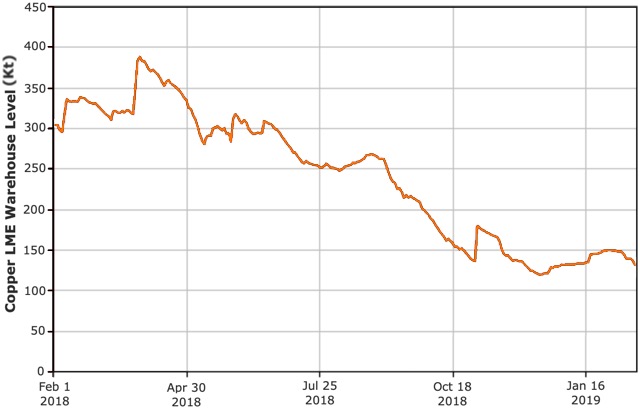

Underpinning the rise are rapidly eroding copper stockpiles, which have plummeted to 132,450t on the London Metals Exchange – the lowest in over five years and a world away from the almost 400,000t in the first half of 2018.

Copper comeback on the cards

Despite the metal’s languishing price during the second half of last year, copper bulls have been predicting a comeback.

The bullish outlook gained legs after mining majors BHP (ASX: BHP) and Rio Tinto (ASX: RIO) both publicly stated they were focusing exploration efforts on the commodity.

Late last year, copper fever sparked as rumours abounded regarding Rio’s potential major copper discovery in Western Australia’s Paterson Province, which was confirmed yesterday.

BHP added fuel to the copper fire a few weeks after Rio’s initial announcement with its widely publicised find on the other side of the country in South Australia’s Olympic Province, which is known to host iron-oxide, copper, gold-style mineralisation.

Industry stakeholders and investors were left in awe after the mining giant revealed it had pulled out of the ground a 425.7m wide intersection grading 3.04% copper, 0.59 grams per tonne gold, 346 parts per million uranium and 6.03g/t silver.

Underlying fundamentals remain

Both mining majors are focusing on the commodity due to its underlying market fundamentals, with the metal staring down a future of rising consumption and a dry project pipeline.

Speaking with Small Caps copper explorer Argonaut Resources’ (ASX: ARE) chief executive officer Lindsay Owler said copper market fundamentals were stronger than ever.

“As copper market fundamentals overwhelm speculative risk, investors will turn their attention to tier one copper exploration assets,” he added.

“BHP’s Oak Dam West discovery in 2018 has shown the market that the Eastern Gawler Carton area around Olympic Dam has a huge copper endowment making it an international exploration hot spot.”

Copper stockpile levels continue to plunge at the LME.

As it firms up its Oak Dam West discovery, BHP anticipates the copper market will enter a structural deficit in the first half of the next decade, which will sustain further price increases.

Meanwhile, CRU Group principal analyst Robert Edwards also takes the view that the copper market will slip into a shortfall spurred by falling production and increased consumption in electric vehicles.

Mr Edwards anticipates the metal will command “commensurately higher prices” by the end of the next decade.