Coming year will be crucial for Australia’s telecommunications sector

2019 is setting up to be a evolutionary year in Australia’s telecommunications market, with dominant players such as Telstra and Optus set to face increased competition and 5G technology offering consumers more mobile solutions.

Australia’s telecommunication market is in for a crucial year as a number of situations that will define the sector play out.

Central among them will be the proposed merger between TPG and Vodafone Hutchison Australia, which is now in doubt after the competition regulator expressed deep competition concerns.

The Australian Competition and Consumer Commission (ACCC), has indicated that it may block the deal, given that customers could end up “paying higher prices” for “less innovative” mobile and fixed broadband plans if the companies are allowed to merge.

It is expected to release a final decision by the end of March 2019.

TPG a strong competitor if independent

“TPG is currently on track to become the fourth mobile network operator in Australia, and as such it’s likely to be an aggressive competitor,” ACCC chairman Rod Sims said in the interim decision.

“If TPG remains separate from Vodafone, it appears likely to need to continue to adopt an aggressive pricing strategy, offering cheap mobile plans with large data allowances.”

“Our preliminary view is the merged TPG-Vodafone would not have the incentive to operate in the same way, and competition in the market would be reduced as a result.”

“The ACCC considers that without the merger, TPG would likely adopt an aggressive pricing strategy, offering cheap plans with large data allowances,” the ACCC’s statement of issues said.

The ACCC said that other potential deleterious effects from the merger could include decreasing competition in the retail fixed broadband market and the wholesale mobile services market.

Shares plunge

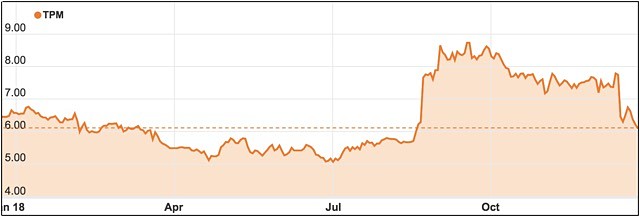

That mid-December decision led to plunging share prices for TPG (ASX: TPM) and Hutchison Telecommunications (ASX: HTA) – the listed half of the Vodafone Hutchison joint venture.

TPG’s share price tumbled on 13 December 2018 due to merger concerns from the ACCC.

However, smaller telco players, which are members of the Telecommunications coalition Commpete, congratulated the ACCC on the interim decision, saying it would enhance competition and wholesale access for smaller players.

Commpete said the decision was “in line with those of regulators around the world, which have either rejected or placed very strict conditions on (proposed) mergers that would reduce the number of mobile network owners in their national markets from four to three.”

It said competition in Australia had decreased after the Vodafone and Hutchison merger in 2009.

“By contrast, the entry of TPG into mobile services, backed by its investment in building its own network, has already pushed prices down dramatically,” Commpete said.

“The ACCC has learned the lesson from its decision to allow the Vodafone-Hutchison merger, and heeded international evidence in requiring more time to consider the present proposed deal.”

Commpete, whose members include Amaysim, InABox, Macquarie Telecom, MNF Group, MyRepublic, Southern Phones, TasmaNet and Vocus, said that in some offshore cases where four to three mergers have gone ahead, “they have required the merged entity to make available network capacity to stimulate wholesale markets” and said the ACCC should investigate the idea.

Whether the ACCC would consider a conditional merger or ban it altogether is yet to be seen but it represents a large part of what 2019 holds for all of the Australian telco players.

Market liked the original merger

Unlike the smaller companies, the share market had always welcomed the merger of the number three and four players in the telco sector, given the large market shares of the two biggest players Telstra (ASX: TLS) and Optus.

The two companies fitted together nicely, with TPG a strong price competitor in the fixed broadband market while Vodafone owns and operates its own mobile network.

TPG had planned to also launch its own $600 million mobile network in the major Australian cities, so the merger was seen as a way it could preserve capital and still get access to a mobile network.

The merger was seen as a great way to generate greater scale and an ability to bundle and cross-sell mobile and fixed services.

Vodafone Hutchison Australia is a joint venture between the Britain-based Vodafone Group and ASX-listed Hutchison Telecommunications.

The regulator said it was factoring in the longer term impact of the TPG-Vodafone deal — particularly given that it expects consumers to increasingly opt for mobile broadband services after the rollout of the 5G network, instead of fixed home broadband.

The competition chief said the ACCC is “continuing to consider whether operators will need to offer both mobile and fixed broadband services in the longer term to remain competitive, meaning that TPG and Vodafone will necessarily be closer competitors in the future.”

Complicated sector

The preliminary decision by the ACCC is a blow to both TPG and Vodafone Hutchison because of the very large amounts of capital needed to install mobile networks and to upgrade them to 5G, which is seen increasingly as a competitor to the NBN’s fixed broadband internet network.

The sector is rapidly changing as Telstra’s legacy phone network is subsumed into the NBN and Telstra moves from being a wholesale phone and fixed internet provider into a fixed network reseller.

Telstra and Optus still dominant

However, Telstra’s strong position in mobiles, with a 44% market share, puts it in a great position to be a wireless competitor with the NBN’s fixed broadband offering, given the much faster internet speeds possible once the 5G network is installed.

In the rest of the mobile sector Optus has a 29% market share, Vodafone a 19% share and TPG 3% by re-selling Vodafone capacity.

In the fixed broadband market, which is quickly becoming the re-selling of NBN services, Telstra has a 51% share, TPG 22%, Optus 17% and Vocus 6%.

So the combination of TPG and Vodafone Hutchison would not have disturbed the market leading position of Telstra and Optus in mobiles or fixed broadband.

Instead, the ACCC seems to be basing its decision on what it sees happening down the track as the sector continues to quickly evolve.

It wants to maximise the number of smaller but still capable and efficient competitors to the dominance of Telstra and Optus and keep infrastructure in as many hands as possible.

The ACCC decision isn’t final but given Australia’s penchant for dominant duopolies in major sectors, the ACCC seems to be hoping that an independent TPG and Vodafone Hutchison will be able to thrive and grow on their own.