Cobalt Blue and Broken Hill Prospecting secure battery-charged $US6m binding deal with LG

Development company Cobalt Blue (ASX: COB) and its partner Broken Hill Prospecting (ASX: BPL) have charged up their plan to produce battery-grade cobalt sulphate at Thackaringa with a US$6 million deal with major battery manufacturer LG.

The joint venture partners’ strategic First Mover partnership for their Thackaringa project in Broken Hill, New South Wales is with LG International.

The LG subsidiary is LG Corporation’s resources investment arm, with the partners’ technical assistance deal to also involve the multinational group’s LG Chem outfit.

LG Chem is one of the leading electric vehicle manufacturers in the world and one of the largest lithium ion battery makers across the globe.

Cobalt Blue’s chief executive officer Joe Kaderavek welcomed the joint venture partners’ coup.

“COB is excited to find a high-quality partner in LG and assist them in sourcing long-term supply of battery-ready cobalt,” he said.

“The technical competence of LG business is world class and this partnership will add significantly to our project.”

Thackaringa project

The 60-square-kilometre-Thackaringa tenement 20km from Broken Hill hosts 61,000 tonnes of contained cobalt — a 23 per cent upgrade the mineral resource, announced to the Australian market on Monday.

Thackaringa’s upgraded resource is now 72 million tonnes grading 0.08% cobalt, 9.3% sulphur and 10% iron.

Cobalt Blue has been farming into a 100 per cent holding into Thackaringa from Broken Hill Prospecting.

Broken Hill Prospecting managing director Trangie Johnston highlighted the importance of the investment and assistance deal to developing the resource.

“The strategic alliance with LGI is a major win for the Thackaringa cobalt project and our board welcomes LGI’s partnership. The LG group brings valuable expertise in product development and other disciplines to the joint venture and is a significant milestone along the road to developing this world-class cobalt resource,” he said.

“BPL’s commercial interest in the Thackaringa cobalt project is significantly advanced by the involvement of LGI and we look forward to working with both of our partners to deliver the project as expeditiously as possible.”

Cobalt Blue chairman Rob Biancardi said the investment was an important event for the company and its shareholders.

“It demonstrates that the Thackaringa project is unique and is one the most advanced Cobalt projects of its type in the world,” he said.

LG deal details

Cobalt Blue’s binding term sheet with the LG investment arm will allow the Australian developer to raise US$6 million (A$7.8 million) by 16 April.

The junior will issue shares in its company to the investor at a face value of A$1.10 each — a 15% premium to the 30-day volume-weighted average price of 95.4c — for the number of shares equivalent to the US and Australian dollar conversion on the day it receives the funds in its bank account.

A maximum of 14 million shares may be issued, as approved by company members on 25 January.

LG has agreed to provide capital and technical assistance for the Thackaringa joint venture as part of the deal to help it move to making high-purity battery-grade cobalt sulphate at the site.

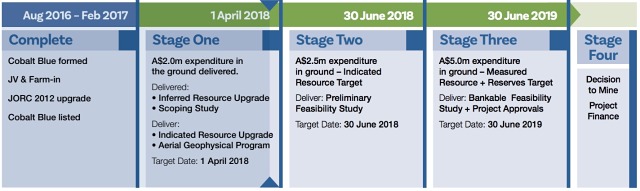

Thackaringa Cobalt Project timeline.

Cobalt Blue has previously indicated a pre-feasibility study is due in June, with a A$5 million exploration spending program also aiming to further upgrade the Broken Hill resource to measured and reserve status.

The developer has previously set its sights on delivering a bankable feasibility study by June next year.

Cobalt Blue’s securities were up 11c or 8.8% up to $1.36 by lunchtime today. Whilst shares in Broken Hill Prospecting were up 20% to 12c.