Chinese investment in Australia takes a 36% dive, mining sector hit hardest

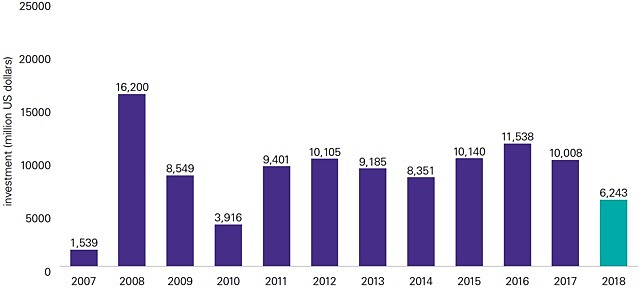

Chinese investment in Australia fell by almost $5 billion last year, hitting its lowest level in eight years.

Chinese investment in Australia fell more than 36% in 2018, to its second lowest level since the mining and gas driven investment boom of 2008.

According to new research by the University of Sydney and professional auditing firm KPMG, Chinese investment in the country only reached A$8.2 billion last year, compared to A$13 billion in 2017.

This figure just beats the US$3.9 billion (A$5.1 billion) of Chinese investment recorded in 2010, following the Global Financial Crisis.

Chinese outbound direct investment into Australia has taken a hit.

Furthermore, this decline is despite China boosting its foreign investment on a global-scale, with the report showing a 4.2% growth in 2018 to US$129.8 billion (A$183 billion).

The University of Sydney and KPMG’s jointly produced report Demystifying Chinese Investment in Australia analysed Chinese overseas direct investment (ODI) into Australia in the 2018 calendar year and incorporated a survey that gathered insights from Chinese investors into the perceptions of the Australian investment climate.

One of the report co-authors, University of Sydney Chinese Business and Management Professor Hans Hendrischke, described the investment decline as a “significant withdrawal” particularly by Chinese state-owned enterprises, which has been influenced by Chinese capital controls, diplomatic relations and security concerns about Chinese investments in Australia.

The investment landscape

Private companies dominated the investment landscape in 2018, accounting for 87% of deal value and more than 92% of deal volume, with an overall trend towards smaller sized deals (85% were below the A$100 million mark).

The report also saw a 28% drop in the number of Australian transactions for the first time since 2011, from 102 in 2017 to 74 transactions in 2018.

Geographic distribution of Chinese investment in 2018 by state.

The majority of investment (80%) was focused on New South Wales and Victoria, with the other states trailing behind at 8% and under, and the Northern Territory not attracting any Chinese capital at all in 2018.

Mining and resources

After a big year in 2017, Chinese investment in mining fell sharply by 90% to A$464 million with just five deals made in 2018.

This effectively brings investment in the sector back to 2016 levels after a peak in 2017, bolstered by Yancoal’s A$3.4 billion acquisition of Rio Tinto’s (ASX: RIO) thermal coal assets.

The report also suggested this reduction in the traditional mining sector reflected a correction in supply and demand imbalances.

However, it said an interest in lithium mining was being driven by strong market demand in China, with this trend predicted to continue thanks to Australia’s status as the major global lithium supplier.

Energy

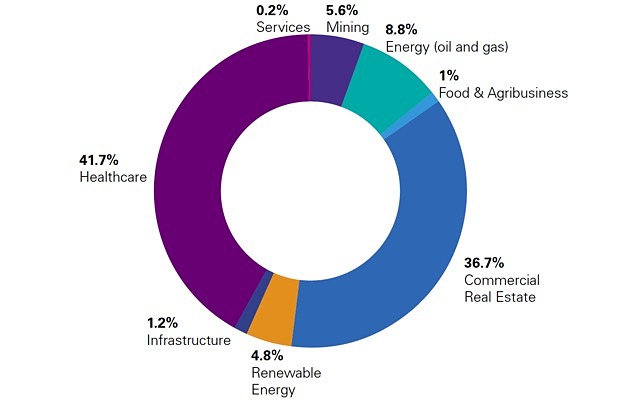

On the other hand, oil and gas almost tripled to A$726 million, now making up 9% of 2018’s total Chinese ODI.

However, this was primarily due to ENN’s A$619 million acquisition of additional Santos (ASX: STO) shares, with only two other smaller scale investments made in Queensland and Western Australia.

This is a far cry from the mining and gas investment peak of 2008, which boosted total Chinese ODI that year to US$16.2 billion (A$21 billion).

Healthcare

Meanwhile, Chinese investment in healthcare more than doubled, surpassing real estate to top the charts as the most popular sector.

In 2018, Chinese investment in the industry was worth A$3.4 billion (up 111% from 2017) and accounted for 41.7% of total ODI.

Healthcare was the largest area of Chinese investment in Australia by sector in 2018.

Among the significant healthcare investments recorded in 2018 were three mega deals worth more than A$500 million each: CDH Investment and China Grand Pharm into medical device company Sirtex Medical; By-Health into Australian probiotics manufacturer Life-Space Group; and Jianyin’s Investment into vitamins company Nature’s Care.

According to the report, healthcare investment was driven partly by “the attractiveness of the Australia package: the combination of transferable management know-how, high-level care service experience, state-of-the-art technology, the ‘clean, green and healthy’ image of Australian products, and the attraction of Australia for Chinese health tourism”.

Interestingly, all 2018 healthcare investors were new to this sector in Australia, with only one having had a minority stake in an Australian food business back in 2011.

Real Estate

Commercial real estate fell 31% to second place after healthcare at A$3 billion and accounting for 37% of total ODI.

Yuhu Group’s A$1.1 billion acquisition of Dalian Wanda’s assets – including the One Circular Quay development in Sydney and the Jewel Resort on the Gold Coast – accounted for 37% of total investment in the sector, while investment in offices made up 31%.

Aside from a few large deals, real estate investment tended to comprise smaller acquisitions, with two-thirds of transactions coming in under A$49 million.

According to the report findings, this shift towards smaller deals partly reflected the ongoing impact of measures to limit capital outflows from China.

China tightens its belt

Despite investment slowing, the research found Chinese attitudes towards Australia remained positive, with investors perceiving it as a relatively attractive place to invest with an improving political climate.

However, investors also confirmed they are finding it hard to move money out of China.

“While Australia remains a preferred investment destination relative to other countries, Chinese executives are finding it harder to get investment approvals and capital out of China,” KPMG Australia head of Asia and International Markets and report co-author Doug Ferguson said.

In addition, he said surveyed investors were concerned about the cost of doing business in Australia and noted challenges including “obtaining finance, low profitability, government approvals, finding qualified staff and building relationships with local Australian management”.

According to the report findings, policy changes in China appear to be a main driver of Chinese foreign investment levels.

Since early 2017, the Chinese Government has been cracking down on overseas investments in an effort to reduce financial risks. It implemented several measures to ensure Chinese firms fully understood the major potential risks of their investments, that these investments were not speculative and were consistent with both the company’s strategy and China’s socio-economic development goals.

These implemented measures included categorising overseas investments that were to be encouraged, restricted or prohibited.

Encouraged investments include: participation in the exploration and development of mining and energy resources; mutually beneficial cooperation in agriculture, forestry and fishery sectors; cooperation with foreign high-tech and advanced manufacturing enterprises; business and trade investments; and infrastructure investment that would facilitate China’s ‘Belt and Road’ construction initiative.

In addition, Australia has recently tightened its conditions on foreign ownership of property, including the introduction of a 50% cap on foreign buyers in new developments and capital gains tax changes for foreign residents in the 2017-2018 Federal Budget.

However, China isn’t just tightening its belt in Australia, with the report showing that investment in the United States and Canada fell even more, by 83% and 47%, respectively.

In contrast, major European countries continued to attract investment from China, including Sweden (up 186% to US$4.1 billion), Germany (up 34% to US$2.5 billion) and France (up 86% to US$1.8 billion).

Growing global investment

Meanwhile, Chinese global outbound direct investment – that is, the total amount it invested in foreign countries around the world – actually grew by 4.2% in 2018 to reach US$129.8 billion (A$183 billion).

According to Professor Hendrischke, this increased demand has focused on “high value-added sectors to bring back expertise and high-quality brands and products that can support China’s industrial upgrading and meet the evolving demands of Chinese middle-class consumers”.

“As part of this trend, large strategic investments in resources, energy and infrastructure have given way to smaller investments, into projects that are tactical and directly linked to Chinese consumer market demand,” he said.

Good or bad?

China is among the US and the United Kingdom as one of Australia’s largest sources of foreign investment.

There is much to be debated about foreign ownership but at the core, it is essential to the nation’s economic prosperity. Foreign investment creates jobs, strengthens trade relationships and increases export opportunities.

Chinese investment into the EU and US, has outpaced that flowing into Australia.

Mr Ferguson said the report findings did not necessarily define a trend of lower Chinese investment in Australia into the future but instead, should serve as a warning.

“The recent decline in Chinese investment in Australia provides an opportunity to reflect on the role that future Chinese investment should play in Australia’s long-term domestic economy and our economic integration into the Asian region,” he said.

Mr Ferguson said many great opportunities still lay ahead for Chinese companies to contribute towards the development and internationalisation of Australian industries in the coming years.

“Australian companies seeking further investment must continue to explore and present unique opportunities that appeal to the key value drivers of targeted Chinese investors,” he said.