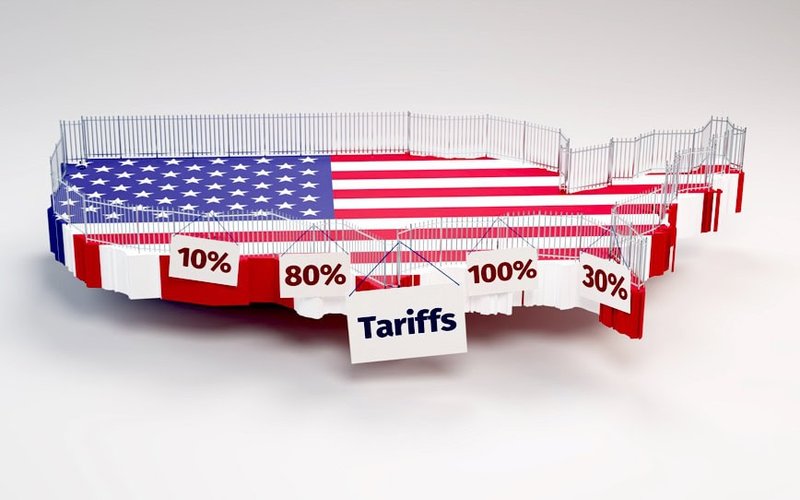

US president Donald Trump’s tariff wars have continued to cause chaos across global markets, particularly in countries expected to be worst hit by estimated impacts to their trading future.

The US decision to place a range of tariff levels against various nations across the globe has already seen some announce retaliatory responses.

While Australia hasn’t been spared from the panic that has stripped trillions from global stock market values, some are suggesting that areas of the nation’s resources sector may actually come out as winners.

China hits back

Analysts expect rare earth miners in particular to benefit from the response by China to place further export restrictions on rare earths and critical minerals.

China’s new restrictions follow two prior rounds of rare earth export rules that are slowly tightening the supply of these critical minerals, especially those used in several chipmaking applications.

Analysts are forecasting a big leap in both rare earths pricing and demand.

Minerals exemptions

Meanwhile, the Western Australia Chamber of Minerals and Energy (CME) is confident the state’s resource riches can overcome the impact of the tariff wars.

CME chief executive officer Rebecca Tomkinson said wide-ranging exemptions were in place for commodities such as iron ore, gold, LNG, bauxite, alumina and critical minerals including lithium and rare earths produced within the state.

Ms Tomkinson said the exemptions highlighted the ongoing significance of minerals and energy produced in WA to the world’s biggest economy.

“These exemptions are recognition that commodities like those we produce cannot simply be conjured out of thin air,” she said.

Ongoing supply

“WA is one of the world’s leading mining jurisdictions and remains well positioned to supply our trading partners – including the US – with minerals and energy central to our daily lives.”

While the WA resources sector appears to have escaped some direct US import duties, Ms Tomkinson cautioned the outlook remained uncertain.

“A return to protectionism and import tariffs is a concerning backwards step that threatens to slow global growth,” Ms Tomkinson said.

“Significant tariffs placed on many of WA’s key trading partners – including China, Japan and South Korea – may reduce economic output and result in lower demand for WA’s key commodity exports.”