China, which has dominated reserves and production in the global rare earths market for many years, now finds its number one position under attack from a number of directions.

Even China’s own regulations are expected to become a major hindrance to its current dominance, with the nation previously considered as almost having a monopoly.

Chinese authorities have reportedly released a list of new rare earth regulations aimed at protecting supplies in the name of national security, laying out rules on the mining, smelting and trade in the critical materials used to make products from magnets in electric vehicles (EVs) to consumer electronics.

Technology sales ban

The government will reportedly take control of the development of the industry around rare earths.

This follows China’s December 2023 decision to ban rare earth extraction and separation technologies.

China produces around 60% of the world’s rare earths, while nearly 90% of their processing is undertaken within its borders.

With rare earth elements (REE) considered critical for modern clean energy and defence technologies, those numbers have raised concerns with other nations—the US in particular.

The US responded with major public funding for the development of an REE supply chain, headed up by support for local exploration for the critical metal.

Major discovery

That government support looks to have already paid off with a recent 2 billion tonne discovery in Wyoming by an Australian miner being labelled the world’s largest new REE deposit.

It is already being estimated that American Rare Earths’ (ASX: ARR) Wyoming find could see the US overtake China in its rare earth mineral resource ownership.

Federal and state governments in the US are doing everything they can to help commercialise the Cowboy State mine at Halleck Creek.

Most recently, American Rare Earth received a $10.7 million grant from the state of Wyoming as part of a matching funds agreement to support further exploration drilling and bulk sampling, the construction of a pilot processing plant and pre-feasibility studies and economic assessments.

Australia playing its part

With its natural mineral riches and mining expertise, Australia’s rare earths potential is of particular interest to the US.

Australia, the world’s third-largest REE producer in 2022, generated an estimated 18,000 metric tonnes of rare earth oxide in 2023.

The nation has one of the richest REE deposits in the world at Lynas’ (ASX: LYC) Mount Weld project in Western Australia.

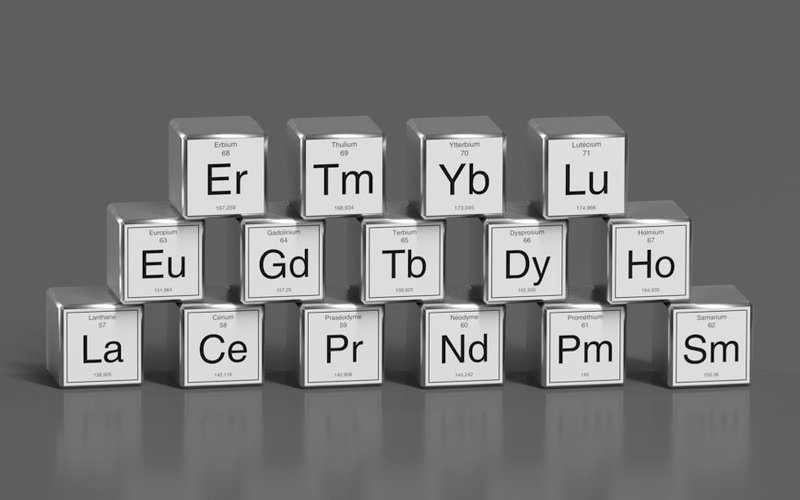

Mount Weld is attractive to international buyers due to its high concentrations of neodymium and praseodymium.

These two elements are critical to the production of the most efficient and durable types of magnets, sometimes called “supermagnets,” which help to transform mechanical inputs into electric energy (such as in wind turbines) and vice versa (for instance, in EVs), as well as for hard disks and medical devices.

The discovery of significant amounts of clay-hosted rare earths across Australia has led to a surge in exploration investment across the nation.

VHM’s Goschen a highlight

One new project of particular interest is VHM’s (ASX: VHM) giant Goschen REE and heavy minerals project in Victoria.

VHM recently signed a strategic memorandum of understanding with leading local mining services firm Yellow Iron Fleet, which will help it fast-track the development of the project.

Goschen is expected to be a relatively simple mining operation on a substantial rare earth deposit of 413,107t of total rare earth oxide with an accompanying world-class mineral sands resource.

The project has a current proved and probable ore reserve of 210Mt producing highly sought-after “critical minerals” integral to the green energy transition and other modern technology applications.

VHM also signed a binding offtake agreement earlier this year with a subsidiary of Asian trading house Shenghe.

The initial three-year term of that agreement covers 60% of the rare earth mineral concentrate and zircon-titania heavy mineral concentrate to be produced from Phase 1 of the project.

Subject to favourable government approvals outcomes in 2024, Goschen’s first production is planned for 2025.