The People’s Bank of China (PBOC) has filed 84 patents and is hastening plans to launch a digital currency electronic payments (DCEP) system.

The filed patents focus on “designing protocols” that will control the issuance and supply of digital renminbi, as well as frameworks for performing interbank settlements and integration of the central bank digital currency (CBDC) with China’s existing retail banking infrastructure.

In addition to various protocols, the PBOC also intends to develop a digital token that will presumably be swappable with actual Yuan currency.

Other patent filings refer to the creation of a middle-layer entity that allows customers to deposit fiat currency and withdraw the digitised renminbi. Similar patents also mention the creation of digital wallets or chip cards for retail holders of the CBDC.

Global digital currency race

Much like the arms race between the US and the Soviet Union in the 1960s, today’s global hegemony is being fought out in financial markets and amongst digital innovators.

China’s progress towards digitising its domestic currency has caused a stir in Russia, Europe and the US, given the potential ramifications that growing Chinese influence could bring to global markets.

US and European central bankers are being hurried into adopting their own digital currencies simply to look the part on the world stage, but also, to be able to compete as Chinese commerce sweeps up new market opportunities as they appear around the world.

Speaking at a congressional hearing last week, Jerome Powell, the chairman of the US Federal Reserve, revealed that developments like Facebook’s Libra and China’s CBDC plans have brought CBDCs to the forefront.

The same pressure is evident in Japan where lawmakers are pushing the country’s central bank to create a digitised yen in response to China’s CBDC plans.

A think tank of central bankers from Canada, Sweden, Switzerland, Japan, as well as the ECB will hold a key meeting in April where digital currencies are expected to be a headline discussion topic.

How Western nations respond to China’s expediency is not yet known.

Chinese danger

In the same vein that the Huawei scandal has rocked the tech sector, suspicions of Chinese companies flexing their muscle in Western countries are also lingering in fintech.

China has been looking into building its own, centrally controlled cryptocurrency since 2014.

A digital currency enables China’s central bank to record every single transaction in real-time and thereby obtain a full spectrum live view of the entire financial landscape.

China’s mobile payments companies already capture vast troves of data including most consumer spending, given that nearly 2 billion accounts are registered between the country’s two major platforms: Alibaba’s Alipay and Tencent’s WeChat Pay.

Furthermore, a CBDC would cement China’s dominance in financial technology with state backing adding more momentum to the growing trend.

With pioneering tech companies such as Facebook leading the way in digital innovation, China’s central bank intends to capture a slice of the action, beginning with avid consumers and the digital boom.

Having worked on a digital currency for the last six years, Chinese authorities are keen to beat Facebook’s plans for its own Libra crypto coin announced last year.

The news added even more heat to an already hot arms race and makes a cryptocurrency with global reach a near certainty in the foreseeable future.

Facebook hopes to roll out Libra sometime this year but has met severe criticism from US authorities and the public for its litany of mishaps including privacy issues, policy mistakes and technical problems.

Libra currently stands as the most significant competition to China’s cryptocurrency ambitions. The US social media company has 2.5 billion users, more than twice the amount commanded by WeChat which gives Facebook an immediate leg up in the race for a global cryptocurrency.

Bitcoin impact

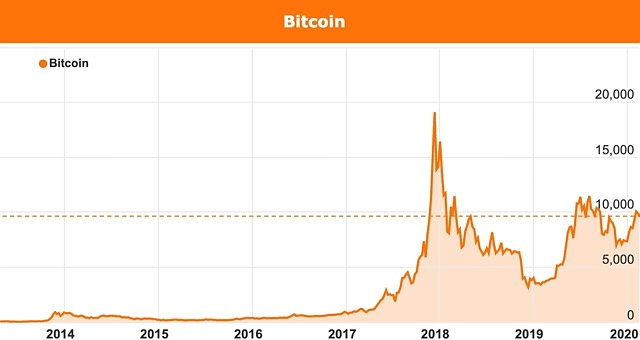

The headline indicator for the cryptocurrency revolution, the Bitcoin price, has risen around 30% in the past three months and is trading mid-way to its all-time high of close to $20,000.

News of China’s haste in developing its own crypto coin is fanning Bitcoin values, although it’s rather hard to attribute exact factors to price fluctuations, especially in a crypto market that’s fuelled by speculation.

Another factor that crypto aficionados are looking forward to is Bitcoin’s upcoming halving, which is slated to happen sometime in May 2020.

According to Clem Chambers, chief executive officer of ADVFN, the Bitcoin halving could produce a “very clear bull market” for prices while noting that the existing uptrend could serve as an ideal supplementary factor to aid prices.

Serial venture capitalist Mike Novogratz shares the same view, going on record as saying that Bitcoin has the potential to reach and even surpass its all-time highs of $20,000 by May’s block reward halving.

In a televised interview last week, Novogratz called Bitcoin “the best brand of the past 11 years” and predicted 2020 will be the year the cryptocurrency surpasses $20,000.

With Bitcoin prices potentially setting up for yet another bull run and China hastening its plans to create a state-backed cryptocurrency, the future for crypto investors has never been rosier.