China’s GDP collapse caps off a week of bad Australian economic news

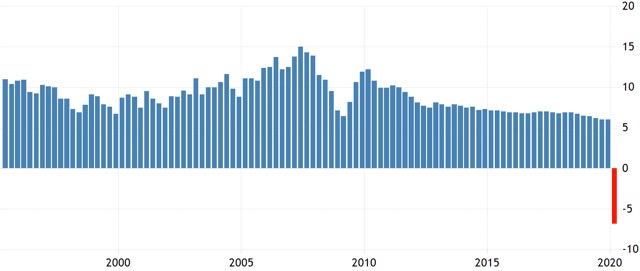

China’s economy contracted 6.8% in the March quarter.

China has been reporting quarterly GDP figures for 28 years and there has never been a contraction — until the March quarter just ended and the contraction came in at 6.8% on Friday.

That sent a shock wave around the world. It ended a surge of Chinese economic growth that dates back to 1976.

It will be an especially hard jolt to Australia with its heavy reliance on China as an export market.

Even before the Chinese data was released on Friday, Australian Prime Minister Scott Morrison earlier in the day was warning Australians that the economic impact of the COVID-19 virus will hit this economy “like a truck”.

China’s GDP contraction is the first recorded since records began in 1992.

Figures out this week on consumer spending, credit card use and unemployment gave Australians a solid hint as to what is to come.

Only retail figures are missing this month.

Two weeks ago, the Australian Bureau of Statistics suspended its trends series surveys of retail spending due to volatility caused by the COVID-19 virus.

With so many stores closed, the preliminary estimate numbers for March retail trade due on April 22 will likely come in low. With final data for March to be released on May 6.

However you can see the retail downturn with your own eyes in any shopping strip.

Even in upmarket Double Bay, one of Sydney’s richest suburbs, eight stores have shuttered in one short street.

Only the jobs number was better than expected — but commentators have generally said along the lines of “wait until next month, then you’ll see how bad it is”.

That survey was conducted in the first two weeks of March before the onerous and widespread lockdown and social distancing policies were applied to Australian life.

House price expectations also collapsed to levels last seen during the 2008-09 global financial crisis.

Business confidence plunges to record low

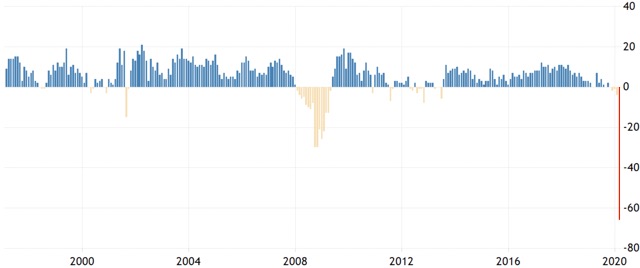

Waning economic sentiment due to COVID-19 was clearly reflected in the National Australia Bank’s index of business confidence, which plunged to a record low.

Having fallen 21 points in February, the business confidence index fell to -66 in March.

Business confidence in Australia is at a record low -66.

A decline in sales and profits due to the lockdown being the key factors, along with unemployment rising meaning there is less demand in the market for products and services.

Without a clear light at the end of the tunnel we may see the index held under water for some time yet.

Being Australia’s two most lucrative sectors, tourism and education have felt the brunt of the government imposed lockdown.

“While almost everyone expects a fairly rapid bound back in activity once the spread of the coronavirus is contained and social distancing rules are relaxed, the immediate worry for the business sector is the impact on cash flows,” said NAB Group chief economist, Alan Oster.

“For now more businesses expect it to get worse before it gets better.”

Largest drop in consumer sentiment in 47 years

Australian consumer sentiment in April dropped by 16.3 points to 75.6.

This was the largest monthly decline in the 47-year history of the survey, and sentiment fell below that recorded during the GFC.

This Westpac/Melbourne Institute consumer survey also contained questions about employment.

The accommodation, café and restaurant sector is worst off with 47.5% of workers reportedly laid off or stood down without pay.

The only section unscathed (so far) was wholesale. The construction industry sentiment fell by just three points.

Consumers are being hit by several forces, according to Kristina Clifton, senior economist at the Commonwealth Bank.

“The job losses, shut downs and restrictions and fears about the potential health impacts of COVID-19 are clearly having an impact on sentiment,” she said.

The survey showed that sentiment toward the housing market has changed abruptly.

The “time to buy a dwelling” index fell deeply into negative territory.

Massive fall in card spending

The Commonwealth Bank has released figures showing total debit and credit card spending to be down 20% on a year ago.

The figures cover the week ending 10 April. While that day was Good Friday this year, numbers from previous years show that spending usually lifts in the days leading up to Easter, more than offsetting the quieter Good Friday.

The biggest drop over 2019 was in personal care (down 61%), while clothing spending declined 58%, transport was 44% lower, and recreation spending fell 37%.

Even alcohol sales using debit or credit cards were hit.

The spike in bottle store sales was not enough to offset the unprecedented drop in spending at pubs, hotels and bars.

Gareth Aird, head of Australian economics at CBA, said the card data paints a “very sobering” picture of household spending.

“We do not expect to see a rebound in our spending data for the foreseeable future,” he added.

Full jobs impact to come in April numbers

The unemployment rate rose from 5.1% to 5.2% in March. Underemployment came in at 8.8%, making 14% of the country’s labour force either jobless or underutilised.

The Treasury has forecast unemployment will increase to 10% in the June quarter.

ABS chief economist Bruce Hockman said after releasing the March figures that they reflected only the early part of that month.

“Any impact from the major COVID-19 related actions will be evident in the April data,” he added.

The ABS has also indicated that there will be deterioration in hours worked for people employed on a part-time basis.

The labour markets in NSW and Victoria held up best, but unemployment fell sharply in South Australia.

In Victoria, the unemployment rate in March actually fell slightly, from 5.3% in February to 5.2% in March.

Another Australian export market in trouble

Capital Economics in London reports that economic activity in India — Australia’s sixth largest export market— took an enormous hit from the nationwide lockdown in March.

Trade data show that both imports and exports slumped by more than 30% year on year (y/y).

“This was far worse than the trade numbers for many other Asian economies,” said Capital’s senior India economist Shilan Shah.

New vehicle sales plunged 51% y/y.

Electricity consumption dropped by more than 25% on 2019 figures.

“What’s more, worse is yet to come,” said Mr Shah.

The lockdown is not scheduled to end until 3 May.

Mr Shah expects economic growth in 2020 to be the lowest in 40 years.

Even with the lifting of the lockdown, manufacturing, construction, transport, retail and recreation sectors have been badly damaged.

India’s virus response, in terms of food and cash handouts, has been very small compared to the fiscal response in other countries, he added.