One of China’s largest gold jewellery manufacturers, Wuhan-based and NASDAQ-listed Kingold Jewelry, is being accused of depositing fake gold bars as collateral to obtain loans from 14 Chinese financial institutions.

The 83 tonnes of gold were purportedly valued at 20.6 billion yuan (A$4.2 billion) but many of them have turned out to be gilded copper, according to reports from Beijing.

Two New York law firms have already begun investigations into securities fraud on behalf of investors in Kingold Jewelry Inc (NASDAQ: KGJI).

The story broke after a Beijing-based website investigated complaints and then posted the news under the headline: “The mystery of [US]$2 billion of loans backed by fake gold”.

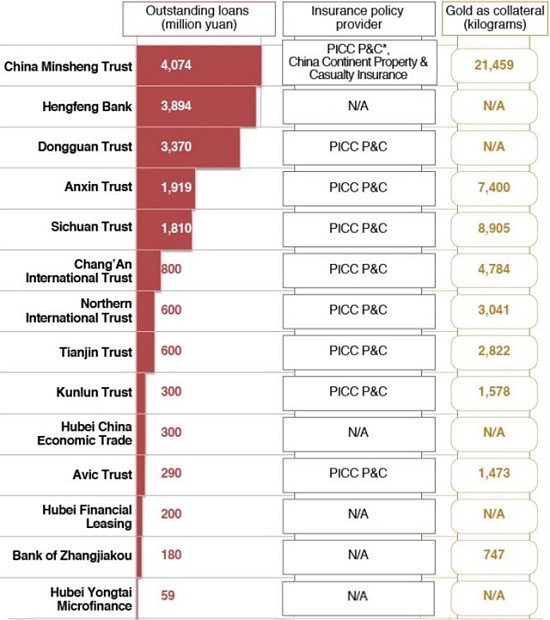

Kingold is denying it lodged fake bars with Chinese lenders such as China Minsheng Trust, Hengfeng Bank, Dongguan Trust and Bank of Zhangjiakou. The trust companies involved are largely what are known as “shadow banks”.

Fake gold used as collateral after loan defaults

The alleged scam came to light earlier this year when Kingold defaulted on loans to Dongguan Trust. The gold bars pledged as collateral turned out to be gilded copper alloy. Minsheng Trust’s “gold” bars have also turned out to be copper alloy under the gilded surface.

Much of the money borrowed was reportedly used to invest in China’s housing bubble, some of which investments obviously went sour.

Kingold bought a company called Tri-Ring that owned blocks of land in Wuhan and Shenzhen with some of the borrowed money.

Military backing helped Kingold raise money

Kingold’s controlling shareholder is Jia Zhihong, described as “an intimidating ex-military man”.

Mr Jia, who has served in the military in Wuhan and Guangzhou, once managed gold mines for the People’s Liberation Army. Kingold was originally a gold factory in Wuhan affiliated with the People’s Bank of China.

Commentaries on this breaking story argue that Mr Jia’s connections with China’s powerful army meant he could do anything he wanted, no questions asked.

In fact, a state-owned insurer covered some of the loans — but with the beneficiary being Kingold, not the lenders.

Wuhan Kingold is the largest gold processor in Hubei province.

Questions are already being raised as to whether more of China’s “hard assets” of gold simply do not exist.

This is not the first scandal of its kind: in 2016 “gold” bars issued as collateral to 19 lenders in the Shaanxi province also turned out to be adulterated – in that case, the core of the bars consisted of tungsten.

Fears are that other Chinese gold producers and jewellery makers may also be involved in similar frauds.

It is reported that the Shanghai Gold Exchange has cancelled Kingold’s membership.

Shares in Kingold fell 23.77% overnight on the news to US$0.85.